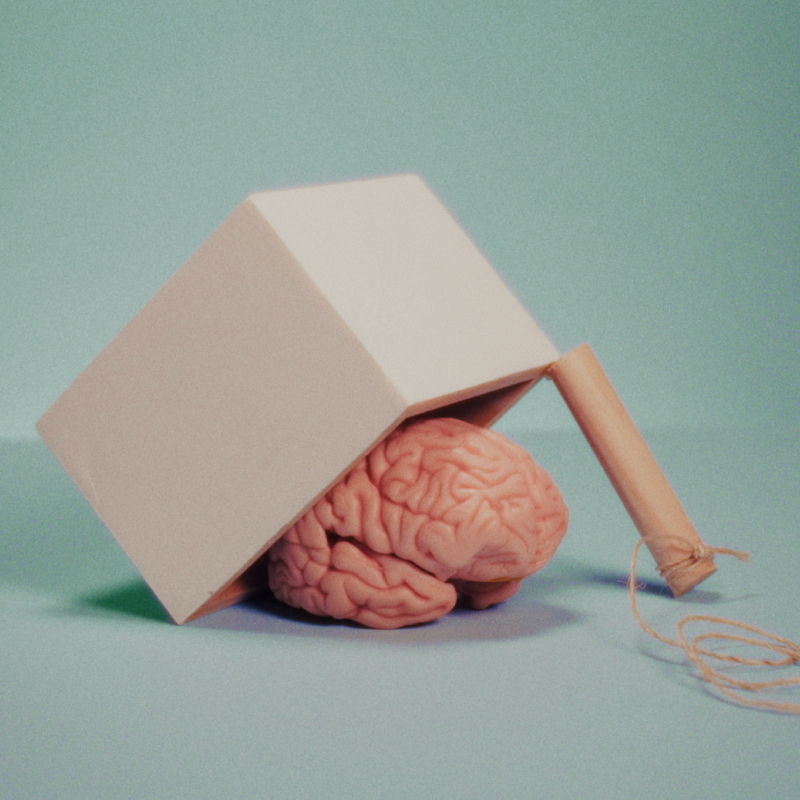

Impulse spending

Lesson 5

We all face challenges when it comes to making wise spending choices. Whether it’s the latest tech, a must-have outfit, or an upgrade we’ve had our eye on, these temptations pull us in, making it hard to resist the lure of a new purchase. Even when we know that spending beyond our budget isn’t in our best interest, the allure of “treating ourselves” can often win out in the moment. The result? We may find ourselves surprised – and stressed – when we realise that we’ve overspent for the month.

Impulse spending—whether unplanned or compulsive— creates a cycle that not only drains our savings but also causes a ripple effect of financial and emotional stress. Over time, these unchecked spending habits leave us less prepared for the future and can put us off-track for achieving key life goals.

There are two psychological factors that play a crucial role in impulse spending. The first diminishes self-control before a purchase, making spending irresistible, while the second creates an internal conflict after the purchase.

1) Delay Discounting:

From a financial perspective, when facing a choice of receiving money now or later, the right option is the one that maximises our gains. However, we often prefer smaller, immediate rewards over larger and delayed ones, a tendency known as delay discounting.

For example, many of us would rather prefer to receive $£250 immediately than wait a month to receive $£280. The satisfaction of an instant reward feels more real and certain, whereas waiting feels risky and intangible. This tendency makes it harder to put off purchases, even if doing so would yield greater financial benefits.

2) Cognitive Dissonance:

Cognitive dissonance refers to the discomfort we feel when our actions conflict with our values or goals. In spending, this happens when we buy something on impulse that contradicts our intention to save or budget wisely. We may feel excited in the moment, but afterwards, we often feel guilty for going against our financial goals. This internal conflict can create stress, as we wrestle with the opposing feelings of satisfaction from the purchase and guilt over spending.

For instance, if you impulsively purchase a new pair of shoes despite your goal of saving for a larger expense – like a family holiday or a home renovation – you might enjoy the thrill of the new purchase but simultaneously feel the discomfort of having stepped off track. This repeated internal conflict – cognitive dissonance – leads to frustration and financial regret, as we realise that these impulse buys undermine our financial goals.

To help curb impulsive spending, consider a simple yet effective tool: the 24-hour rule. This technique involves waiting a full day before making any unplanned purchase. By introducing a 24-hour “reflective pause”, you give yourself time to step back from the impulse and calmly think through the purchase, weighing its impact on your financial wellbeing.

Imagine you’re tempted to buy an expensive gadget on a whim. Taking a 24-hour pause provides the opportunity to reflect on whether this purchase is truly necessary and how it aligns with your financial goals. This reflective pause works in stages. First, it reduces the immediate urge to spend, which can often feel irresistible. As you cool down, you’re better able to weigh other options like saving the money more objectively. Later, you have the mental space to consider the long-term financial impact of the purchase, enabling you to make a more thoughtful decision about whether to proceed.

The 24-hour rule helps counteract delay discounting by shifting the decision to spend $£250 from “right now” to “tomorrow.” Since the option to spend is no longer immediate and doesn’t provide instant satisfaction, the impulse loses some of its power, making it easier to resist. This delay places the decision in the future, where the urge for instant gratification is diminished. You’re then in a better position to consider the benefits of saving versus spending.

Additionally, the 24-hour rule reduces cognitive dissonance by creating a “cooling-off” period that allows you to reassess your motivations. By pausing, you give yourself a buffer to consider whether the purchase truly aligns with your long-term values and goals, rather than giving in to a fleeting urge. Such pause brings your spending behaviour back in line with your saving goals and values, reducing the stress that comes from feeling like you’re compromising your priorities.

Ultimately, the 24-hour rule builds effective impulse control, helping you distinguish between genuine needs and passing wants. This approach supports financial decisions that align with your goals and values, putting the brakes on impulsive spending.