Cut your debt down to size

Lesson 3

Managing multiple debts can feel daunting and uncertain, often leaving people unsure of the best strategy to reduce their financial burden. Debts typically come with three main features: principal amount, repayment time, and interest rate. Generally, the larger the debt, the longer it takes to pay off. But it’s the interest rate, combined with the time it takes to repay, that significantly impacts the total amount paid back.

As interest accrues over time, the debts with higher rates become the most expensive, resulting in larger payments over the course of repayment.

Given these factors, it becomes crucial to adopt an effective repayment strategy. When managing multiple debts, prioritising the repayment of those with the highest interest rates can lead to significant savings over time, as this strategy minimises the total interest paid and accelerates the path to becoming debt-free.

Despite this, many people opt to pay off debts with the smallest balances first, regardless of their interest rates, in an effort to decrease the number of accounts they manage. This strategy may create a sense of both simplicity and progress, as closing smaller accounts can feel effective. However, it can ultimately be more costly and lead to greater financial strain, as it delays the journey to becoming debt-free.

We often find ourselves prioritising smaller debts due to two key psychological tendencies: cognitive ease and a sense of accomplishment.

1) Cognitive Ease Through Debt Simplification:

When facing multiple debts, many people gravitate towards paying off smaller accounts first, regardless of their interest. This choice stems from the perception that smaller debts are more manageable and can be settled quickly, creating the illusion of progress towards being debt-free. This quick-fix mentality not only provides an immediate sense of control by reducing the number of debts to track but also fosters the illusion of control and better financial management. However, this approach often creates a deceptive sense of progress; while fewer outstanding accounts might suggest advancement, the reality is that the total financial burden is significantly influenced by the interest rates attached to those debts. Paying off smaller accounts may temporarily lighten the mental load associated with juggling multiple debts, but it ultimately detracts from a more effective strategy. Focusing on high-interest debts is essential for genuinely reducing overall debt and achieving long-term financial health.

2) Sense of Accomplishment to Prevent Fear of Multiple Debts.

Repaying debt can often feel discouraging, as it may seem like hard-earned money is merely going towards covering previous obligations rather than building a brighter financial future. To combat this frustration, some individuals opt to pay off smaller debts first, as doing so provides immediate psychological gratification and a sense of accomplishment. Successfully eliminating even a minor debt can evoke the exhilarating feeling of crossing a finish line, akin to achieving a sub-goal within a larger task. This "quick win" offers not only a temporary boost in morale but also a tangible sense of progress, reinforcing positive emotions and the belief that they are actively managing their finances. While this approach can create a satisfying sense of achievement, it does not necessarily expedite the journey to becoming debt-free. Ultimately, although the satisfaction from small wins is valuable, the most effective long-term strategy lies in prioritising high-interest debts.

In summary, people often tend to focus on reducing the number of open debt accounts instead of adopting the strategy of the total amount owed by targeting high-interest debts.

While reducing the number of accounts can make finances seem more manageable and give a sense of accomplishment, focusing on the total amount owed—by tackling the debts with the highest interest rates first—proves to be a better strategy for achieving financial freedom sooner. When unable to pay off all debt in full, the best approach is to first make minimum payments on each debt to avoid additional fees. After meeting these minimums, focus on paying down the debt with the highest interest rate as quickly as possible. Once that debt is cleared, move on to the next highest interest rate, and so forth. This strategy can be broken down into three steps.

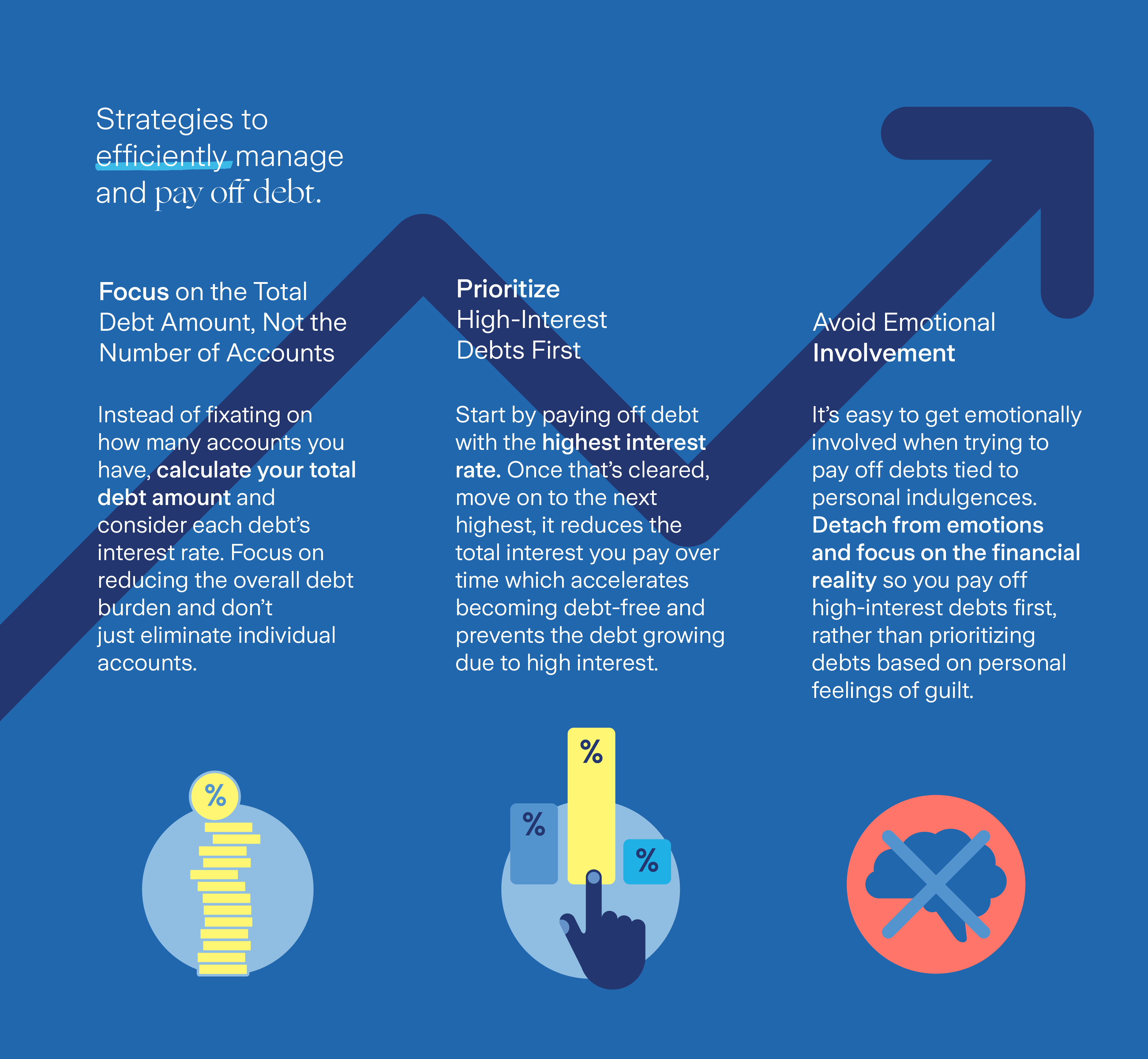

1) Focus on the total debt amount, not the number of accounts

To become debt-free more efficiently, start by calculating your total debt, factoring in each debt’s interest rate to get a clear picture of the true financial burden. Rather than counting the number of open accounts, focus on the overall debt balance, which will simplify your goal: reducing the total amount owed rather than merely the number of debts. This mindset generates cognitive ease by emphasising the management of total debt rather than fixating on individual accounts, thus ensuring all efforts go toward reducing the principal debt amount.

2) Prioritise high-interest debts first

Identify accounts with the highest interest rates and prioritise these for repayment. Begin by focusing on the debt with the highest interest rate, then move to the next highest once the first is cleared. By concentrating on the monetary value of your debt rather than on the number of accounts, you’ll avoid the false sense of progress that can arise from paying off smaller, lower-interest debts. Instead, you’ll see meaningful progress in reducing your debt balance and the overall amount of interest paid. A strategy that targets high-interest debt first accelerates your journey to becoming debt-free by lowering the growing cost of interest, which otherwise prolongs repayment significantly.

3) Avoid emotional involvement.

Emotional factors often cloud our judgement when it comes to prioritising debt repayment. We may feel inclined to repay debts associated with past indulgences, such as a holiday, driven by feelings of guilt or regret for having spent that money. This emotional involvement can lead us to overlook higher-interest debts that require immediate attention. Instead, it’s crucial to detach personal feelings from your repayment strategy and avoid letting the type or duration of a debt dictate your priorities. By maintaining objectivity, you ensure that your focus remains on the most financially prudent choices, enabling you to concentrate on paying off high-interest debts first.