Fossil fuels

Zurich has implemented positions for its investment and underwriting portfolios to restrict support of new fossil fuel developments

Coal, oil sands and oil shales

Overall progress towards the Paris Agreement goals is slow and all pathways analyzed in the IPCC’s 1.5 degrees report published in October 20181 and the International Energy Agency (IEA) Net Zero by 20502 (NZE2050) scenario require a “steep reduction” in the use of fossil fuels. Limiting average temperature increases to 1.5°C rather than 2°C will result in “robust differences” in terms of fewer and less intense severe weather events such as droughts, floods and wildfires. It will also reduce impacts on sea level rise, species loss and extinction, public health and livelihoods, water and food security and economic growth.3 These are all important impacts, not only for society, but for insurers as we support our customers’ and society to manage climate risks.

The most carbon-intense fossil fuels (coal, oils sands and oil shales) create a particular challenge for global greenhouse gas emissions and that is why Zurich has focused on reducing our exposure to these fossil fuels in particular.

Given this situation, where permissible by law or regulation, Zurich will not insure or invest in companies that:

- generate more than 30% of their revenue from mining thermal coal, or produce more than 20 million tons of thermal coal per year;

- generate more than 30% of their electricity from coal;

- are in the process of developing any new thermal coal mining, power or transportation infrastructure; Zurich will also not underwrite any new metallurgical coal mining*

- generate at least 30% of their revenue directly from the extraction of oil from oil sands;

- are purpose-built (or “dedicated”) transportation infrastructure operators for thermal coal or oil sands products, including pipelines and railway transportation;

- generate more than 30% of their revenue from mining oil shale, or generate more than 30% of their electricity from oil shale.

* Enhancement to existing position, which is in the course of being fully embedded within our underwriting process.

While the implementation of the policy for our existing portfolio is completed, we continue to screen new clients and investee companies and will only consider companies that are already below those limits or have near-term commitments in place to bring them below the limits, with annual reviews of progress. If in the course of these dialogues the company does not show credible progress in their transition from thermal coal, oil sands or oil shale, Zurich will, as permissible by law or regulation, reduce exposure, divest from equity holdings, stop investing in new debt and run-off existing holdings.

These positions do not apply to workers’ compensation, other employee protections, or considerations, which have a positive impact on human health and the environment. It also does not affect green bonds that support the transition.

On thermal coal, in our investment management activities, we also engage with companies on the phase out of thermal coal production and use in Organisation for Economic Co-operation and Development (OECD) countries and EU 27 by 2030 and rest of world by 2040.4 Where permissible by law or regulation, Zurich will phase out insurance for companies that mine or transport thermal coal, or generate electricity from thermal coal by 2030 for OECD and EU27 countries and 2040 for the rest of the world.

Oil & Gas

Whilst Zurich recognizes the present role of fossil fuels, our support is prioritized for companies actively transitioning to low carbon business models. Zurich does not believe that further exploration and development of new fossil fuel projects, beyond those already operating or with approved licenses already in place, is required for the transition. Hence, Zurich has implemented positions for its investment and underwriting portfolios to restrict support of new fossil fuel developments.

For insurance, to the extent permissible under law or regulation, we exclude the following from our activities:

- New single-site P&C insurance policies for new (upstream) oil and gas exploration and development projects, for sites where licenses were approved after 31 December 2022.

- Oil and gas drilling and production projects and infrastructure (up and mid-stream*) in the Arctic5

Within our insurance offering, we also expect oil and gas producers to have a “zero routine flaring by 2030” commitments and have credible transition plans aligned to achieving net-zero by 2050, with interim targets and clear measurable commitments.* Those transition plans should be in place by 2030. As a last resort, where permissible by law or regulation, we will then exit customers where transition risks are not sufficiently managed. These positions do not apply to workers’ compensation, other employee protections, or considerations, which have a positive impact on human health and the environment.

* Enhancement to existing position, which is in the course of being fully embedded within our underwriting process.

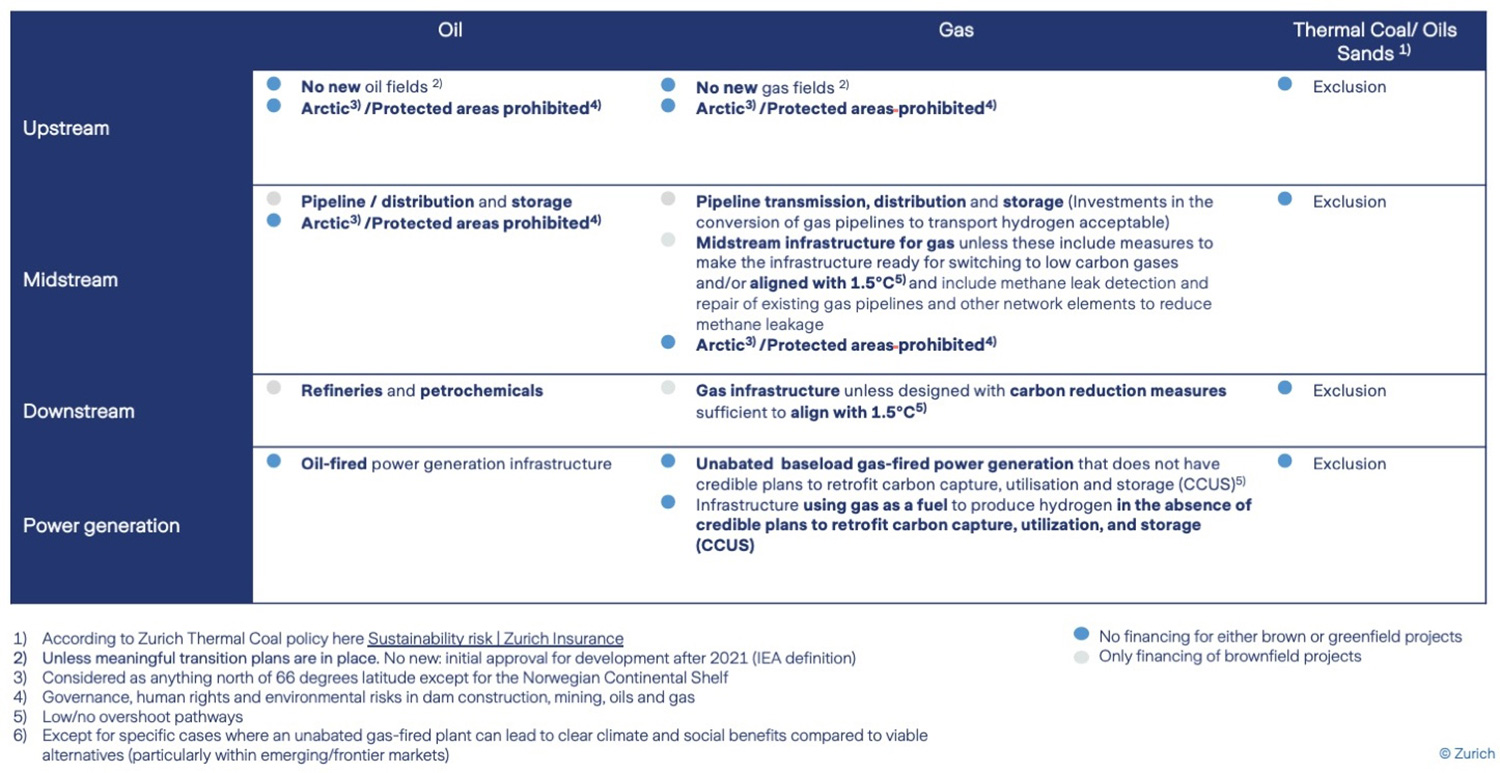

For Zurich’s investments in private debt6, we have dedicated fossil fuel guidelines agreed with our asset managers. In line with the group wide guidelines, Zurich excludes any thermal coal related assets in these portfolios. Further, these portfolios will not finance oil and gas assets which are not aligned with science-based or government-issued regional/ national 1.5°C pathways.

Zurich’s fossil fuel guidelines for private debt investments

1 https://www.ipcc.ch/sr15/

2 https://www.iea.org/reports/net-zero-by-2050?utm_campaign=IEA%20newsletters&utm_source=SendGrid&utm_medium=Email

3 UNEP Emissions Gap Report 2022 https://www.unep.org/resources/emissions-gap-report-2022

4 For more information, please see https://climateanalytics.org/media/report_coal_phase_out_2019.pdf

5 Considered as anything north of 66 degrees latitude with the exception of the Norwegian Continental Shelf

6 Excluding CLOs and Real Estate