Being a better budgeter

Lesson 2

We often start with the best intentions when creating a budget to control spending, but sticking to it can be challenging. Small slip-ups—like occasional overspending or unexpected expenses—can slowly undermine our efforts. Over time, these minor lapses build up, leading to financial stress and a sense of failure. Each overspend feels like a setback, until it seems like the entire budget has been derailed.

A single mistake can trigger a downward spiral, where instead of correcting course, you abandon financial discipline altogether. This mindset of "I’ve already messed up, so I might as well continue" leads to even more reckless spending. As a result, the budget you once set becomes irrelevant, and financial well-being takes a hit, with overspending snowballing into debt or reduced savings.

This cycle not only derails your immediate financial goals but also undermines long-term stability. The sense of failure and guilt from repeated overspending creates emotional stress, making it even harder to regain control and get back on track. Ultimately, this cycle harms both your financial health and your overall sense of well-being, as it perpetuates bad habits and deepens financial insecurity.

This downward spiral stems from a combination of depleted willpower, guilt, and the misguided belief that one failure means the goal is completely lost. It’s a psychological response to self-control failure that often leads to even more detrimental behavior.

Self-control is challenging to maintain, especially when faced with numerous temptations—much like trying to resist dessert or sweet treats while on a diet. Once we break our commitment to stick to our plan of losing weight, we gradually lose motivation. Similarly, when we set goals, such as sticking to a budget, it requires ongoing self-control to resist temptations, like buying those expensive shoes we’ve been dreaming of. Each small failure, such as overspending, chips away at our willpower. These lapses make us feel as though we are losing control, and over time, the mental effort required to resist becomes increasingly difficult. Eventually, we become less motivated to keep trying.

When we act against our goals, such as through overspending, we experience cognitive dissonance—the psychological discomfort that arises from holding conflicting behaviors and beliefs. For instance, if you believe in saving money but then make an unnecessary purchase, this conflict generates guilt. Instead of confronting and correcting the behavior, people sometimes try to escape this guilt by rationalizing further poor decisions, thinking, "I've already slipped, so it doesn't matter now."

Once a person feels they’ve "failed" their initial goal, it’s common to experience a complete loss of motivation. The goal starts to feel more difficult to achieve, and as the perception of failure grows, the motivation to continue diminishes. People often adopt an "all-or-nothing" mindset, which leads them to give up entirely rather than view the lapse as a minor setback.

When under pressure to meet goals, small failures can trigger feelings of guilt, frustration, and stress. Abandoning the strict discipline offers temporary emotional relief. Once people let go of their goal, they no longer feel the burden of trying to control themselves, even though this relief is short-lived and worsens their situation in the long run.

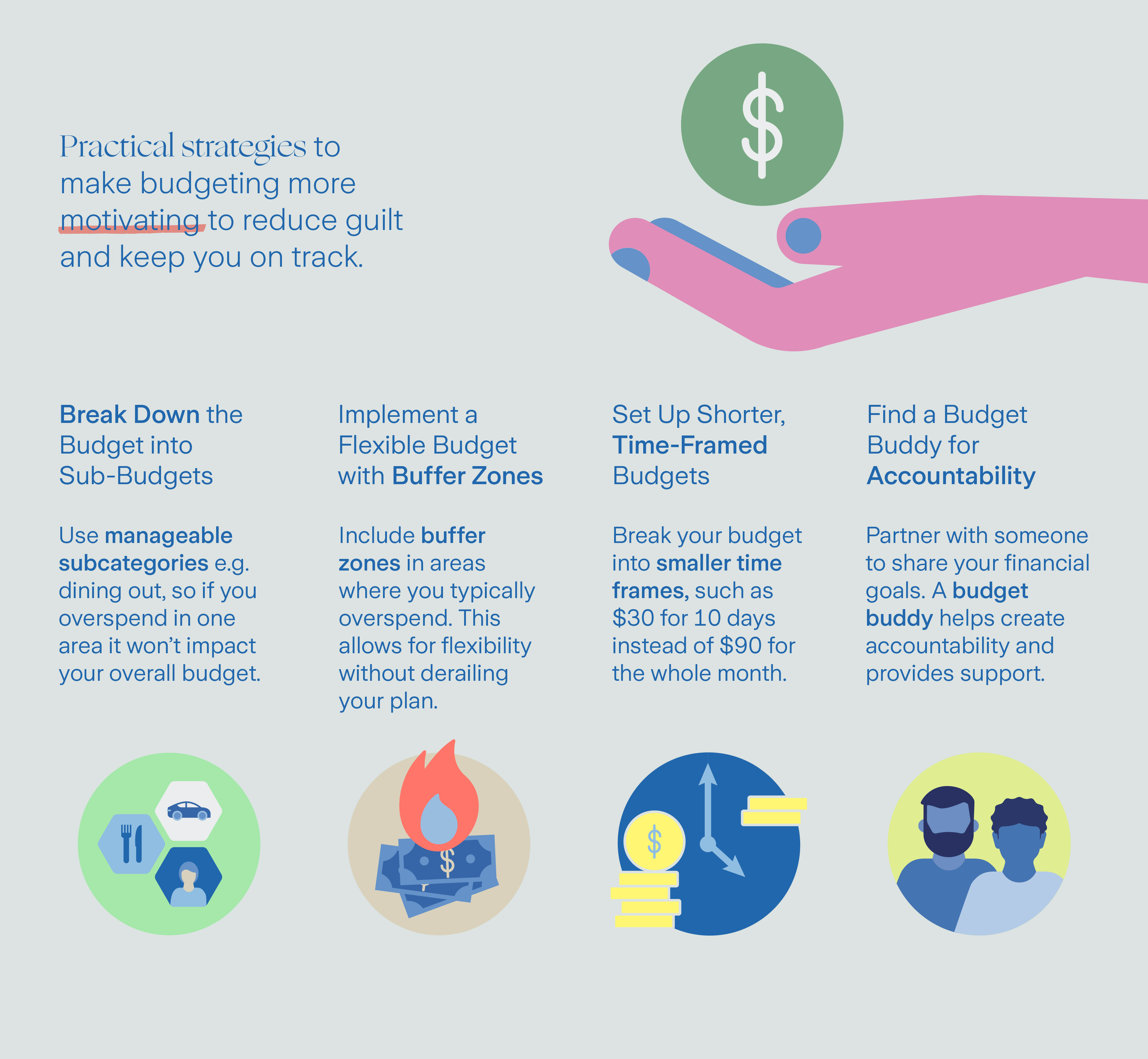

To improve adherence to budgets, we need strategies that make sticking to a budget more positive and motivating, along with tools to set realistic budgets.

1) Break Down the Entire Budget into Sub-Budgets

Instead of focusing solely on one budget or saving goal, break it down into smaller, more manageable subcategories. Design a spending budget that comprises several sub-budgets for different categories: (for example, dining out, coffee and snacks, movies and events, hobbies, clothing). If you happen to overspend in one category, it won’t affect your overall budget too much, reducing feelings of failure or guilt. This approach makes it easier to stay on track and provides a sense of accomplishment.

2) Implement a Flexible Budget with Buffer Zones

Create a budget that includes buffer zones in areas where you tend to overspend, such as food or entertainment. For example, allocate an extra $20 for dining out if that’s where you’re likely to exceed your budget. Allocating a fair amount for overspending adds the flexibility needed to manage small spending errors without derailing your overall financial plan, ensuring you stay on track even when minor slip-ups occur.

3) Set Up Shorter, Time-Framed Budgets

Instead of planning your budget for an entire month, break it into smaller time frames, such as $30 for 10 days rather than $90 for the whole month. With monthly budgets, if you slip up halfway through, you may still have two weeks left, during which you might feel discouraged and start overspending, leading to even greater expenditures. Shorter time frames provide more frequent opportunities to start fresh, helping you avoid the discouragement that can result from setbacks in a longer budgeting period. This fresh start—both financially and psychologically—keeps you motivated and allows you to reset your financial plan more often, maintaining focus on your goals.

4) Find a Budget Buddy for Accountability

Partner with a friend or family member to share your financial goals and progress. This creates mutual accountability and motivation, as you’ll have someone to check in with regularly. By supporting each other, you can stay on track and celebrate milestones together. Having a budget buddy makes the journey more engaging and increases your chances of sticking to your budget.

Follow these simple steps, and rather than experiencing a downward spiral when you overspend, you'll find yourself marveling at your improved budgeting skills.