Zurich sees world failing to meet climate goals, takes further steps to accelerate climate change transition

- Zurich joins UN Net-Zero Asset Owner Alliance as a founding member, as well as Insurance Development Forum and other platforms tackling climate change

- Zurich publishes updated climate change guidance for businesses to assess and manage their exposures

- The Zurich Flood Resilience Alliance commits to scaling up its work in climate action, to help make 2 million people more resilient to flooding

- Zurich actions over past year earn company a leading spot on 2019 Dow Jones Sustainability Index, outperforming 99% of insurance sector

Zurich Insurance Group (Zurich) is taking new steps to address climate change after its latest assessment shows the world is still not on course to meet the targets of the Paris Agreement.

As a founding member of the UN Net-Zero Asset Owner Alliance launched yesterday, Zurich is committing to a zero-emission portfolio of investments by 2050. It also plans a new service to help businesses better manage rapidly evolving risks.

Mario Greco, Group CEO, Zurich Insurance Group, said: “Business has a critical role to play in transforming the global economy to tackle climate change. At Zurich, we are determined to play our part. The recent Dow Jones Sustainability Index shows Zurich is already ahead of 99% of its peers, but we want to go further. In June we were the first insurance company to sign the Business Ambition for 1.5°C Pledge and we continue to seek partners focused on driving meaningful impact. It makes sense economically, strategically and above all, it’s just the right thing to do.”

UN Net Zero Asset Owner Alliance

True to its responsible investment commitment, Zurich is a founding signatory of the UN Net-Zero Asset Owner Alliance. This is an important milestone on its journey to becoming a 1.5 degree compliant business.

Urban Angehrn, Group Chief Investment Officer, Zurich Insurance Group, said: “Our customers across the globe are facing the challenges associated with climate change already today. That is why we strongly believe that asset owners like Zurich must act now to tackle those challenges, in particular – by leveraging capital markets to fund solutions to the pressing environmental issues of our time. After signing earlier this year the UN Global Compact Business Ambition for 1.5°C pledge, we are delighted to join the Asset Owner Alliance, which is an important step in transitioning towards a low-carbon economy.”

Helping businesses to manage climate change risks

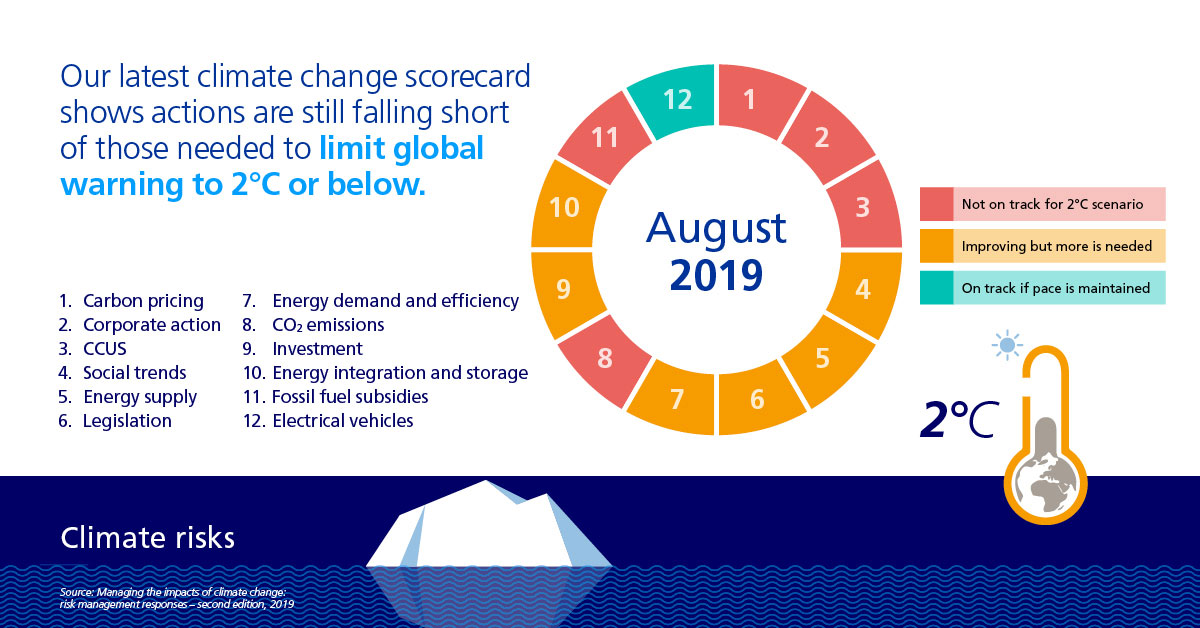

Climate change-related risks are a more critical and urgent challenge than ever for businesses. Zurich has updated its climate change white paper “ Mitigating the impacts of climate change: risk management responses ” that helps businesses better understand the evolution and status of their climate change-related risks. It also provides guidance on how to assess their exposures, vulnerabilities and hazards, and offers advice on how to manage them. It includes Zurich’s climate change scorecard, which since 2017 measures progress and developments in a range of climate change-related areas.

Climate change whitepaper

Planning the future in the face of climate change

Zurich’s analysis shows that business actions are still falling short of what is needed to meet the long-term goal of keeping the increase in global average temperature to well below 2°C above pre-industrial levels.

At the same time, there is growing demand among Zurich’s business customers for risk management tools that measure the impact of climate change. In response, Zurich will be launching a new Climate Risk Advisory Service during its next strategic cycle.

Building partnerships to combat climate change

Zurich is engaging with the World Economic Forum on several climate related projects, and has provided initial support to the newly established Adrienne Arsht/Rockefeller Foundation Resilience Center. Zurich has also recently joined the Insurance Development Forum, a public-private-partnership bringing together the United Nations Development Program, the German Federal Ministry for Economic Cooperation and Development, the UK’s Department for International Development, and other public and private sector entities to increase insurance protection in climate-exposed countries.

The scale and complexity of the changes needed are too much for any one company, sector or country to tackle alone. Public-private collaboration must be at the center of addressing climate change. These must be further developed and scaled to achieve transitions in the short, mid and long term. That is why the Zurich Flood Resilience Alliance, now entering its seventh year, commits to scaling up its work in climate action by bringing to 2 million the number of people more resilient to flooding. It will elevate community voices and research findings with international donors and all levels of government. The Alliance has already developed an award-winning Post Event Review Capability (PERC) methodology to provide practical post-disaster recommendations to communities.

Further information

Zurich began instituting environmental, social and governance (ESG) considerations into its core business practices in 2012. The company became carbon neutral in 2014. Earlier this year, Zurich signed up to UN business pledge to limit global temperature rise and announced it will use only renewable energy by 2022.

The Zurich Flood Resilience Alliance is a multi-sector partnership focusing on finding practical ways to help communities strengthen their resilience to floods globally – and save lives. The Alliance is working with the civil society and humanitarian organizations Concern Worldwide, the International Federation of the Red Cross and Red Crescent Societies (IFRC), Mercy Corps, Plan International and Practical Action as well as research partners the International Institute for Applied Systems and Analysis (IIASA), the London School of Economics (LSE) and the Institute for Social and Environmental Transition-International (ISET).

Downloads

Contacts

- Media Relations

Zurich Insurance Group (Zurich) is a leading multi-line insurer that serves its customers in global and local markets. With about 54,000 employees, it provides a wide range of property and casualty, and life insurance products and services in more than 210 countries and territories. Zurich’s customers include individuals, small businesses, and mid-sized and large companies, as well as multinational corporations. The Group is headquartered in Zurich, Switzerland, where it was founded in 1872. The holding company, Zurich Insurance Group Ltd (ZURN), is listed on the SIX Swiss Exchange and has a level I American Depositary Receipt (ZURVY) program, which is traded over-the-counter on OTCQX. Further information about Zurich is available at www.zurich.com.