Zurich increases its commitment to impact investments and introduces impact targets

- Zurich expands impact investment portfolio commitment to USD 5 billion

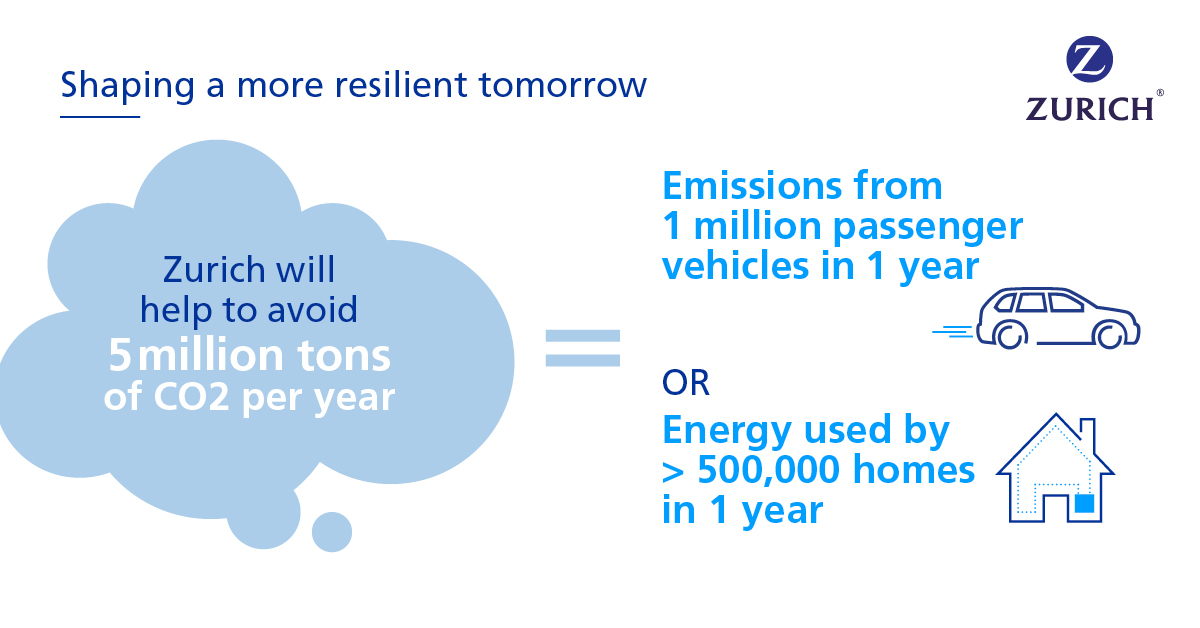

- Commitment to investment volume is coupled with innovative impact targets, including the avoidance of 5 million metric tons of CO2 equivalent emissions and improving lives of 5 million people per year

- Zurich believes it is the first private-sector investor to introduce impact targets for its investment portfolio

Zurich Insurance Group (Zurich) announced today that it will build on its successes in responsible investment by more than doubling the amount of its impact investments and it will also set innovative new impact targets.

Earlier this year, Zurich announced that it had achieved its multi-year goal of investing USD 2 billion in green bonds, part of its impact investing portfolio. Going forward, it will target USD 5 billion for the entire portfolio of impact investments, more than double the original commitment of USD 2 billion. To achieve this, Zurich will invest in different types of impact investments in various asset classes and around the globe. In addition, it will establish a measurement framework to track the impact of these investments, with the goal of avoiding five million tons of CO2 equivalent emissions annually and improving the lives of five million people per year.

“Zurich has been delivering on our responsible investment strategy since 2012, and was one of the first in the market to identify green bonds as an effective tool to support more sustainable growth without jeopardizing returns,” said Urban Angehrn, Group Chief Investment Officer and member of Zurich Insurance Group’s Executive Committee. “Today we are once again leading the industry by significantly increasing our commitment to responsible investment and introducing ambitious impact targets. While we recognize the novelty of this approach and expect a learning curve, we are very excited about the opportunity to play an active role in shaping a more resilient world for tomorrow.”

Zurich is a not just a signatory to the principles for sustainable insurance developed by the UN Environment Finance Initiative, but is also turning that into action. This is the kind of leadership and broader trend we need to see in the financial sector.

Erik Solheim, head of UN Environment, under-secretary-general of the United Nations

Erik Solheim, head of UN Environment, under-secretary-general of the United Nations said: "Zurich is a not just a signatory to the principles for sustainable insurance developed by the UN Environment Finance Initiative, but is also turning that into action. Through steps like introducing innovative impact targets for its investment portfolio, disengaging from coal-intensive businesses in its insurance and investment activities, and enhancing community flood resilience, Zurich is already making a positive impact. This is the kind of leadership and broader trend we need to see in the financial sector, and I'm convinced such commitments to sustainable practice will become commonplace. After all, a resilient, low-carbon, sustainable and inclusive economy is also perfectly aligned with sound business practice."

As part of the next phase of its ambitious plan, Zurich will work more closely with policymakers and market participants to drive the sustainable finance agenda forward. It will also broaden the scope of its ESG (environmental, social and governance) integration practices.

While continuing to make systematic use of ESG data in portfolio management, Zurich will look at a variety of ways to grow its impact investing portfolios around the globe. The Group will focus on the following asset classes when executing on its commitment to grow its impact investment portfolio:

- Green bonds: The green bond market has shown impressive growth over the past several years. Accordingly, the Group expects its green bond portfolio to continue growing beyond the USD 2 billion mark – the milestone Zurich reached earlier this year.

- Social/sustainability bonds: With the recent introduction of the Social Bond Principles (SBP) and the Sustainability Bond Guidelines, the Group also expects further opportunities in the social and sustainability bond space beyond the USD 350 million already invested.

- Private equity: Zurich will keep working toward its 10-percent impact target in private equity (currently USD 116 million committed to four funds).

- A variety of new possibilities across asset classes will be evaluated to both broaden the approach and increase the impact investment volume.

A majority of green bond issuers have made considerable progress in reporting positive climate impact. And some of the other impact investment instruments (e.g., impact private equity funds, social bonds) have started to systematically report on the number of people who benefit from the projects these investments finance. Zurich will develop a methodology to measure the CO2 emissions avoided and people reached in a consistent way across its impact investment portfolio. This will be an important part of ensuring we can make real headway in reaching these new targets.

Further information

Read more here about Zurich’s responsible investment philosophy and approach.

Zurich’s corporate responsibility strategy aims to create value for Zurich and society as a whole. Through making use of Zurich’s core skills in risk and investment management, it is opening the door to a more resilient future for individuals and communities. In line with Zurich’s commitment to the UN Global Compact and its own corporate governance standards, it is integrating environmental, social and governance (ESG) criteria into its insurance and investment processes, allowing it to take a responsible and ethical approach to business. Zurich participates in the Dow Jones Sustainability Index (DJSI), FTSE4Good, CDP and MSCI, and has been a signatory of the UN Global Compact since 2011, Principles for Responsible Investment (PRI) since 2012 and UNEP FI Principles for Sustainable Insurance (PSI) since 2017.

Downloads

Contacts

- Media Relations

Zurich Insurance Group (Zurich) is a leading multi-line insurer that serves its customers in global and local markets. With about 54,000 employees, it provides a wide range of property and casualty, and life insurance products and services in more than 210 countries and territories. Zurich’s customers include individuals, small businesses, and mid-sized and large companies, as well as multinational corporations. The Group is headquartered in Zurich, Switzerland, where it was founded in 1872. The holding company, Zurich Insurance Group Ltd (ZURN), is listed on the SIX Swiss Exchange and has a level I American Depositary Receipt (ZURVY) program, which is traded over-the-counter on OTCQX. Further information about Zurich is available at www.zurich.com.