Cognitive psychology holds key to understanding risks to your business

Global risksArticleJanuary 12, 20178 min read

What does a famous psychology experiment teach business leaders about managing global risks?

In the 1970s, renowned psychologist Ulric Neisser devised a clever experiment to understand human perception. He made a video of two superimposed groups of three players each passing basketballs; one group of players wore white shirts and the other wore black shirts. Then Neisser superimposed another video of a woman with an umbrella walking through the center of the frame. He showed this video to a group of his students and asked them to count how many times the players in white shirts passed the basketball. The result: 79 percent of his subjects did not notice the woman with the umbrella.

Neisser is known as the father of cognitive psychology, and his experiment holds a lesson for business executives reading The Global Risks Report (GRR) 2017, as the global risks landscape is shifting. The GRR is an annual study published by the World Economic Forum in collaboration with leading institutions such as Zurich Insurance Group.

In 2007, four of the five top risks were economic risks, with clear business implications. In 2017, none of the top five risks are economic. Instead, the coming year will be dominated by a focus on geopolitical risks, along with the rise in nationalism and populism that threatens existing institutions of international cooperation.

For business leaders, the challenge of The GRR 2017 is to not focus so much on the geopolitical risks that they miss the direct risks to their business - in the same way that Neisser’s study subjects focused so much on the basketballs that they never saw the woman with the umbrella.

Political Risks Have Business Impact

Virtually all of the risks identified as high-likelihood and high-impact in The GRR 2017 are geopolitical, societal and environmental in nature, and many of them have their roots in the fiscal remedies for the 2008 financial crisis.

These remedies - loose monetary policies, but also austerity budgets - have had a tremendous impact in many countries, and contribute to underlying economic risks such as unemployment and underemployment, fiscal crises and asset bubbles. Today these risks are intersecting with trends like the increasing polarization of societies, growing income and wealth disparities and increased longevity, and that creates political risk and business challenges, such as changes in trade policy.

When the dominant risks are geopolitical rather than economic, the tendency is to see these risks as less consequential to businesses. That’s a mistake, says John Scott, Chief Risk Officer, Commercial Insurance, Zurich Insurance Group.

“Political risks really do have business impact,” says Scott. “We can see that in the way they interact with other risks. We also see it in our political risk insurance business, with political violence, forced abandonment, expropriation and sovereign default claims on the rise for firms exposed to developing countries.”

Risk, and global risk, is really a C-suite issue.

Unwelcome surprises can happen when the business impact of these interconnected risks is felt locally and globally. That means C-suite executives need to look beyond the screaming geopolitical headlines to see the hidden triggers, trends and scenarios that will affect their bottom lines, and then take steps to mitigate the impact of these risks.

“Risk, and global risk, is really a C-suite issue,” Scott says. “What it comes down to, is how to build these risks into your strategy holistically. How can you create a more competitive business that’s sustainable in the face of these global risks, and take advantage of the opportunities they bring?”

What Does the Fourth Industrial Revolution Mean for Your Business?

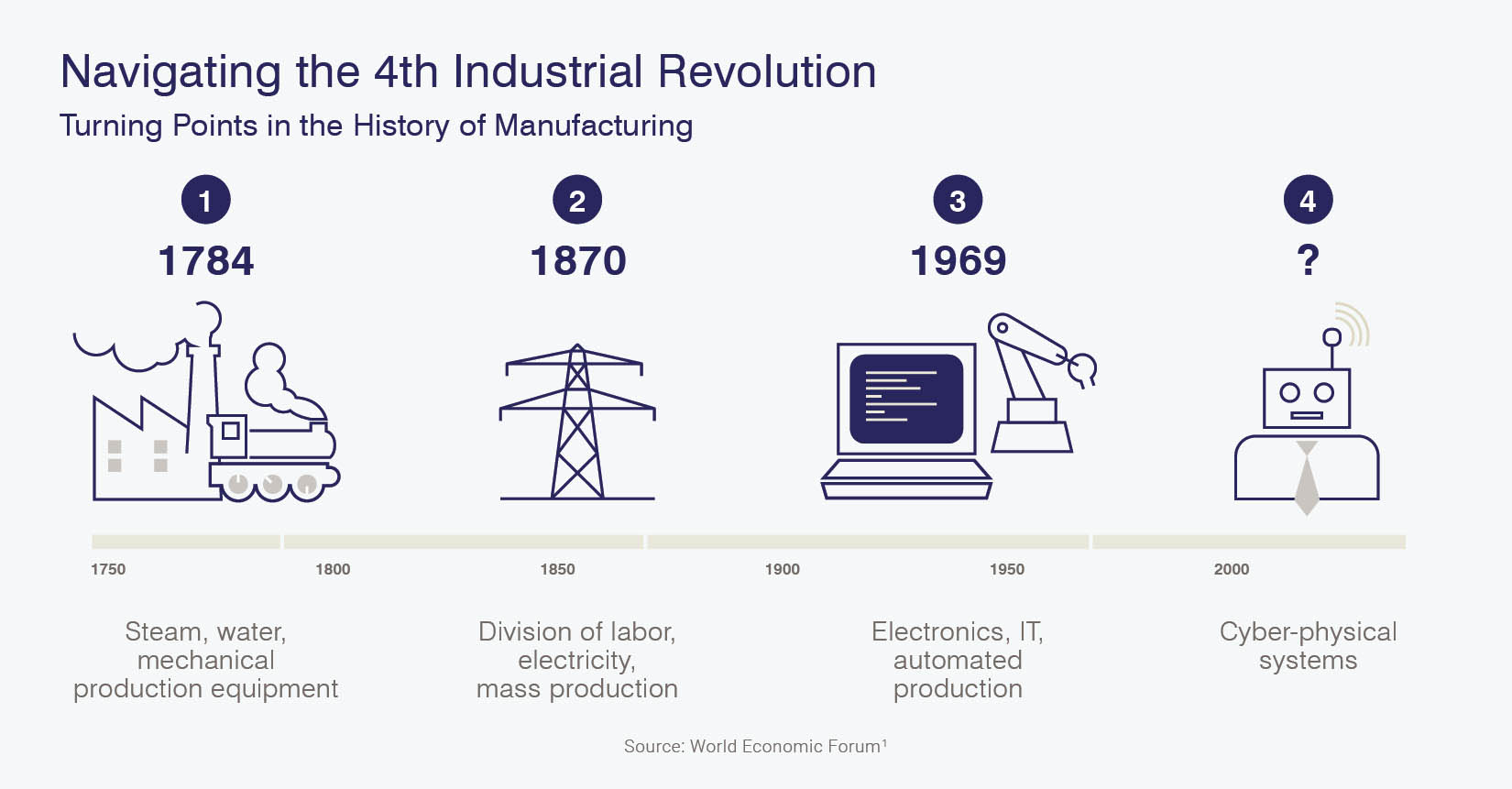

The link between business opportunity and geopolitical and societal risks is seen most clearly in the realm of technology, especially in today’s Fourth Industrial Revolution (4IR) that is driven by artificial intelligence (AI), robotics, the Internet of Things, autonomous vehicles and biotechnologies, and enabled by billions of people connected with mobile devices.

The consequences of this revolution are far-reaching, with the potential to address many global risks, while also triggering new risks. There’s a perception problem here, as well, because many people focus so much on geopolitical and societal issues that they don’t understand the enormous effect technological change has on their lives.

“We often see people blaming what goes on in their own economy or own society on global trade or globalization,” Scott says. “But when we look at the data, technology is a much bigger driver of that kind of disenfranchisement, and shifting jobs. We should expect to see more of that, and it is a real challenge because it links to the global risk of unemployment and underemployment.”

Business leaders can prepare for the 4IR. According to Scott, the risks and opportunities for the C-suite center on two areas: how physical infrastructure networks for transportation, energy, digital communications, water and waste will become increasingly connected, with huge opportunities for innovation, along with complex risks; and the impact of AI and robotics.

On the AI side, the most troubling risks are the threats of computer systems operated by AI applications that might perform in ways that create unexpected consequences - the “Flash crash” behavior of automated trading systems, for example, or self-driving vehicles that can’t distinguish between snow or a white-painted wall, or automated defense systems that might determine if it's ethical to win a battle with massive collateral damage.

Scott says strong AI, or superintelligence, is still a long way off, but as AI applications take over many tasks previously thought to require human intelligence - like stock trading, sports writing and even driving—the governance of AI, whether weak or strong, is an important topic for technologists, business leaders and policy makers.

Collaboration is essential to take full advantage of the opportunities AI creates, while addressing unemployment and underemployment, and other interconnected risks, says Scott. That means not hindering AI with so many regulations that it never develops, but agreeing to ethical guidelines for the use of AI.

“Technologists are taking the lead, but it’s in the interests of business leaders and policy makers to create the right regulations to be successful,” Scott says. “It’s a little bit like playing a sport: It’s great to go out and kick a ball in the park, but if you have some rules and sometimes even a referee, that makes the sport a lot more fun.”

Seeing Global Risks in Context

Scott has seen a sea change in the global risks landscape highlighted in The GRR since the first report in 2007. In the early years, macroeconomic risks were a main concern, all the way through the financial crisis and its aftermath. In the last five or six years, however, societal, geopolitical and environmental risks have overshadowed economic concerns.

“The trends that we’ve seen over time have manifested themselves as crystallizing political risks, particularly in 2016,” Scott says. “In a time of change, this creates risks and opportunities for both public policy makers and businesses.”

That’s why understanding the dynamics of cognitive psychology is crucial. Just as the subjects of Professor Neisser’s experiment had to focus intently on the basketball passes, C-suite executives must often be hyper-focused to successfully manage a company. But when it comes to risks, leaders need to step back and take a holistic view, or they might miss changes in the global risks landscape that signify huge opportunities.

“Geopolitical risks are really interesting, especially when we see big events like major elections or referenda,” Scott says. “Sometimes those events reflect changes in the fabric of the societies in which we operate. We need to reflect that in our business models.”

Key Takeaways:

- The top global risks have shifted over the last 10 years from primarily economic risks to primarily geopolitical and environmental risks.

- C-suite executives must view geopolitical and environmental risks holistically to see the interconnected business threats and opportunities.

- Political risks have business impact through interconnected risks and trends like unemployment and underemployment, increasing polarization of societies, growing income and wealth disparities and increased longevity. These risks also impact firms exposed to the emerging markets with insurable events like political violence, forced abandonment, expropriation and sovereign default.

- The 4IR has the potential to address many global risks, while also triggering new ones.

- The two areas of the 4IR with the most opportunity for businesses are the increasing connectivity of physical infrastructure, and AI.

- The changing global risks landscape means collaboration between C-suite executives and public policy makers is essential, because these global risks are interconnected and too large for a single company or even country to manage.

- Business leaders who have a holistic view of managing risks while maximizing the benefits will build more successful and sustainable companies.