Retirement is the world's top financial concern, even among many young workers

Future of workArticleOctober 15, 2019

The world's greatest financial worry is retirement: 44% of respondents said it was their greatest concern in a startling new survey.

Since the 2008 global financial crisis, the top financial worry of workers has tended to be a short-term focus on monthly bills. But that sentiment has turned to concern about long-term security, according to the People Protection: Insights on Empowering an Agile Workforce report, published by Zurich Insurance Group and Smith School of Enterprise and the Environment at University of Oxford, which surveyed 18,000 working-age respondents in 16 countries.

Having enough money for retirement was the primary concern for 44% of workers, with paying monthly bills a distant second at 27%. Retirement emerged as the foremost worry in 14 of the 16 countries studied (only Brazil and Romania had monthly bills ranked higher). In Japan and Germany, retirement is more important than all other options combined.

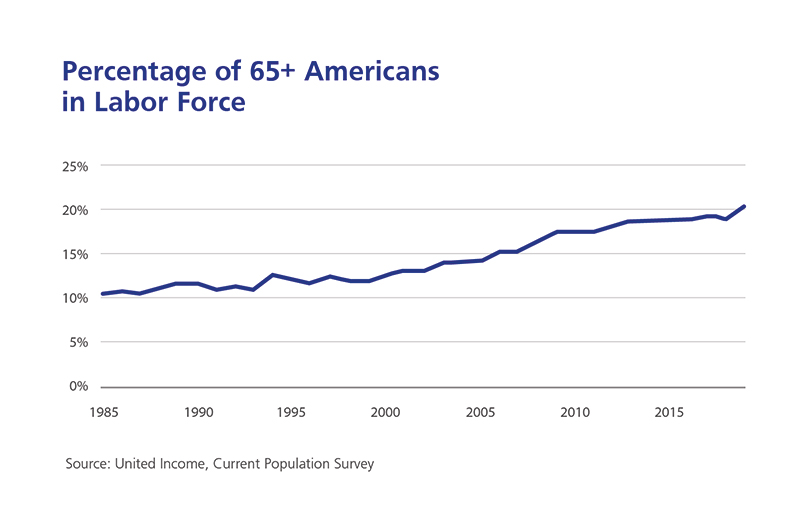

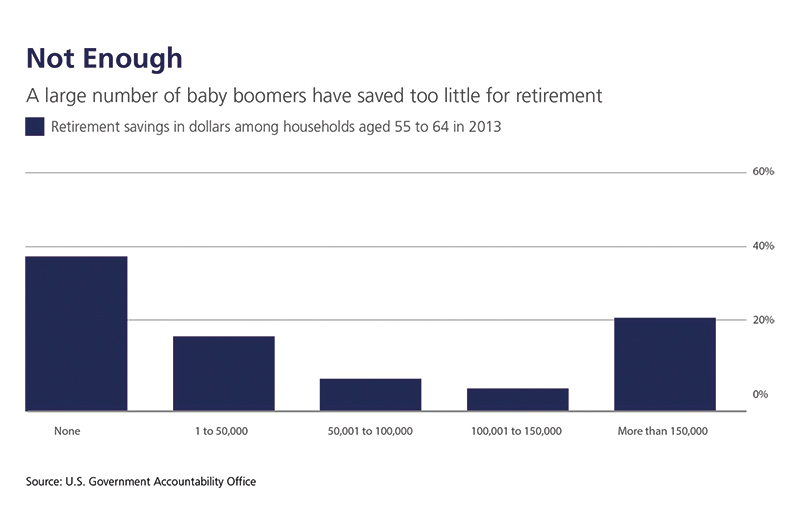

That concern is predictably elevated among older people for whom retirement is no longer distant and abstract: 59% of workers aged 55–70 say it’s their main issue — and with good reason. In the U.S., twice as many seniors are working today than in 1985, while a 2016 Government Accountability Office report revealed that nearly a third of workers age 55 and older have no retirement savings and no pension.

Yet even among workers in their 20s, almost as many are concerned about retirement (32%) as monthly bills (34%), reflecting the uncertainties of the workforce and the fact that younger workers can’t predict with confidence what future benefits might exist for them. These concerns explain why more employees would choose enhanced retirement benefits over a pay raise.

“That was a pretty stark and consistent finding,” says Stefan Kröpfl, Zurich’s Global Head of Life Business Analysis. “To put it bluntly, employees want the security or the support to be able to have a comfortable retirement.”

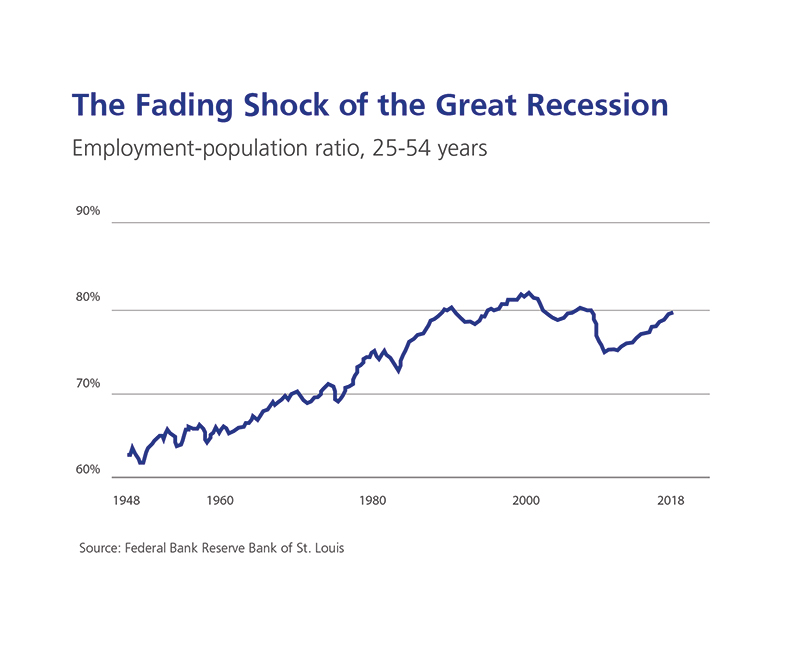

While many people are sufficiently secure to look beyond making ends meet in the short term [see chart above "The Fading Shock of the Great Recession"], it’s clear they still face significant and complex long-term financial challenges. Retirement is increasingly something to be feared rather than enjoyed.

This crisis of confidence regarding long-term security requires collaboration among all stakeholders — including governments, employers and insurers — to devise solutions, and Kröpfl believes that process must begin with a difficult reality check.

“A basic stocktaking of what the situation is by generation and country would be a good start,” he says. “So we tell people, ‘You're 40 years old. Assuming you make the same contribution with an inflation adjustment per year, this is what you will have for retirement.’ Take stock on where people are and what the gaps are. In most places, unfortunately, this will be a rather painful exercise.”

Rethinking retirement presents opportunities for businesses that are willing to be flexible and innovative to attract and support workers, says Cornelius Fröscher, Director of Global Customer and Distribution Management at Zurich.

“Paying bills in an age of economic turmoil is no longer the chief concern," Fröscher says. "Employers could use this to differentiate themselves by offering attractive savings and investment options and by providing advice for workers on achieving their individual goals."

The future shape of retirement must reflect the realities of today’s agile labor market, in which most workers will have multiple jobs rather than the previously commonplace lengthy tenure with a single employer. That demands solutions that can combine pension savings accounts from one employer to the next over a sequence of jobs.

“It's not about saving for retirement. It's about saving retirement, period.”

Stefan Kröpfl, Global Head of Life Business Analysis, Zurich Insurance Group

“We need aggregators in the retirement products market. You get the benefit of larger stocks of money being invested rather than sitting in separate accounts and paying separate fees,” says Professor Gordon Clark, Professorial Fellow and Director Emeritus of the Smith School of Enterprise and the Environment at Oxford University. “They can aggregate for individuals, or provide employers with the mechanisms to draw contributions from previous employers into their own funds, then pass them on to the next employer. We need this when people are younger and switching jobs, because frequently their pension contributions are often stranded and eaten up with fees.”

Clark also advocates rethinking how workers should contribute to pension savings plans — allowing lesser contributions earlier in their working lives when there are competing claims on their disposable income, and creating options for people who want to continue saving for retirement while working past age 65. Employers could also enable workers to access third-party defined contribution platforms, even if they are ineligible for benefits in their own workplace.

The burgeoning market in technology can be used to encourage young workers to make frequent, incremental contributions to their retirement savings each month via their smartphones, then ratchet up the value of those contributions through a cost-effective platform.

“That is gaining traction among millennials who might not otherwise have access to or even understand the benefits of pension savings through an employer-sponsored platform,” Clark says.

Such innovative solutions are part of the fundamental reassessment of retirement—necessary in an era when increased longevity and demographic changes have rendered traditional pension programs unsustainable.

“We need to move beyond pay-as-you-go systems, or at least move away from the expectation that pay-as-you-go systems will be able to support people in maintaining their pre-retirement lifestyle,” Kröpfl says. “Clearly that's unrealistic.”

The increasing obsolescence of traditional retirement plans highlights another worrying trend laid bare in the Zurich-Oxford report: the lack of awareness about protection products. Forty-three percent of respondents in Ireland and Germany have personal pension insurance, but that figure plummets to just 16% in the U.S. and 14% in Finland and Mexico. That places an onus on insurers to create products that are easier to grasp and elastic enough for individual requirements.

“Customers have to understand what they really need,” Kröpfl says. “People need tailored or flexible solutions. You need something that's suitable to your needs but can be adjusted to changing needs.”

Even if those most vulnerable to a looming retirement crisis are many years from ending their working lives, Kröpfl says, there is an imperative today to create solutions that will enable them to adequately plan for their long-term security in a swiftly changing, agile economy.

“It's not about saving for retirement,” he says, “it's about saving retirement, period.”