Empowered workers most likely to succeed in the agile economy

Future of workArticleOctober 15, 2019

Empowered workers are more likely to enhance their education and skills, creating a “virtuous cycle” for employers.

In your parents' labor market, in which most workers had long-term relationships with a single company that provided pension benefits, self-employment was often considered a risky choice dictated by necessity. Today, it is increasingly viewed as an opportunity.

The job-mobility trend is driven mainly by employees' desire for flexible schedules, independence and control over work schedules and workloads, according to the People protection: Insights on empowering an agile workforce report, an in-depth survey of 18,000 working-age respondents in 16 countries conducted by Zurich Insurance Group and the Smith School of Enterprise and the Environment at the University of Oxford.

Job insecurity also contributes to the move toward mobility. The study found that almost one-fifth of workers say they plan to leave their jobs and become freelancers in the next 12 months, which corresponds approximately to the number who fear losing their jobs in the same time period. Meanwhile, 30% of workers worry about losing their jobs due to automation within five years. The findings illustrate how technology, globalization and demographic shifts are driving wholesale change in today’s global workforce.

An important finding from the report shows that employees with a significant degree of control over their daily work are 25% more likely to express willingness to undertake skills training during their leisure time. "Worker independence is a virtuous cycle,” the survey notes.

According to Professor Gordon L. Clark, Senior Consultant and Emeritus Professor at the Smith School at Oxford, agile employees are increasingly viewed as an important asset.

"Employers face increasing competition for people, not just for their education, but for their willingness to adapt—people who are going to use opportunities for skill enhancement will contribute to their own employability and to the value of their employer," Clark says.

Freelancing appears on balance to be a positive, active choice for workers who want to have more freedom and control over their work, according to Cornelius Fröscher, Director of Global Customer and Distribution Management at Zurich.

“To retain staff, employers are going to allow them greater autonomy and more control over their workloads," says Fröscher.

While freelancing offers more opportunities, it still entails risk and can come at the expense of employment and income security. Experts say nurturing the empowered, agile workforce demands reciprocal flexibility from all stakeholders—governments, employers and insurers—to evolve financial, insurance and skills training products that enable continuity as workers move from job to job.

Stefan Kröpfl, Zurich’s Global Head of Life Business Analysis, says traditional social protection systems have not yet adapted to the evolving realities of work, leaving complex decisions about insurance, savings and pensions to workers themselves.

“We need flexibility in our products and from governments, like establishing protection schemes that are related to an industry rather than a specific employer to have a pension system catering to all employees in an industry even if they switch employer,” Kröpfl says. “Flexibility is key.”

Innovation is also critical—like a plan developed by the Australian Tax Office that aggregates contributions and benefits across a person’s life.

“That same type of service can be done by insurance companies, by investment companies or by third-party providers that have the technology and wherewithal to follow people through their working lives,” says Clark, who believes technology can help support the welfare of today's increasingly agile workers.

“The one thing millennials and older workers have in common across jobs and across where they live is a social media account. Maybe those accounts could be the medium through which you provide insurance services, pension savings, even banking services,” Clark suggests. “The medium is efficient and cost-effective, and if managed well can be a very useful way of carrying a person’s benefits and entitlements across jobs over the longer term.”

Beyond financial planning tools, the Zurich-Oxford Agile Workforce report states that increasing the awareness and uptake of insurance solutions is crucial to protecting workers in the new economy. The report, studying the uptake of three protection products—term life insurance, personal pension products and income protection insurance, universally available in the 16 countries surveyed—shows 36% of respondents hold no type of insurance, a figure that rises to 54% in Brazil.

A lack of preparedness is particularly evident among those most vulnerable to workforce change, who the survey found were less able or willing to be flexible or proactive in their careers, whether by retraining, up-skilling or protecting themselves with insurance products.

“One reason people discount the value of re-skilling or up-skilling is that they don't have confidence in job tenure,” Clark explains. “Some people are short-term-oriented in the labor market for immediate income and immediate benefit, and some people have a longer-term perspective over their career path.”

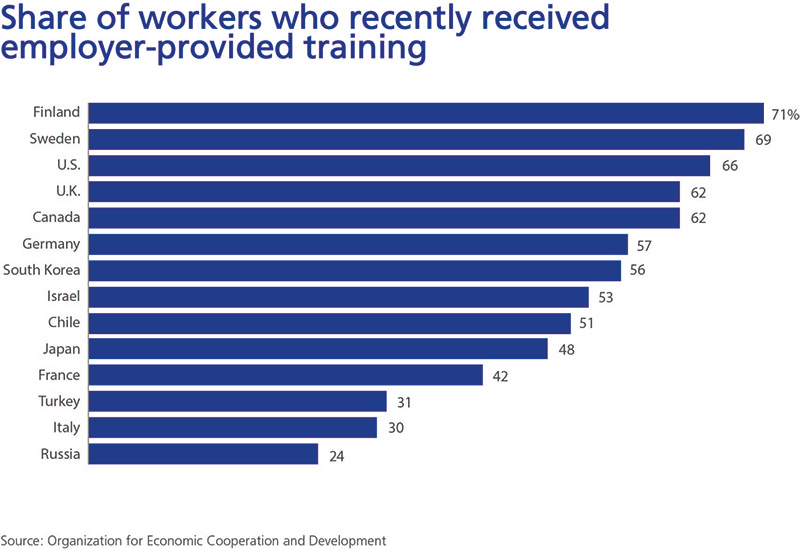

A significant majority of respondents see the value in retraining, and this requires new kinds of skill enhancement programs that are more relevant to employers and employees. Employers often regard government-run programs as rudimentary and not job specific. But transforming generic programs into training that pays off in the workplace requires a collaborative effort.

“Public-private partnerships for skills training is a very important way of going forward,” Clark says. “Many employers, until recently, have seen training as not their responsibility, but as a government’s or third-party provider’s responsibility. If employers are sensible looking forward, in a world where there's going to be a smaller stock of adaptive employees, providing skills training at the workplace is very important. But I don't think companies are going to do it without encouragement.”

Incentives could come in the form of tax advantages for companies that provide workplace training, perhaps with similar enticements for workers who elect to take part in such programs.

“A significant finding across the board – across all countries, and across all kinds of people – is that more than 60% of respondents, on average, would retrain, are willing to retrain and can see there's a significant benefit in retraining,” Clark says. “That is a big wake-up call for employers and governments who are notionally in the business of skills training.”

Devising social systems that adequately protect workers in the new economy is an enormous challenge, but Kröpfl believes there is more cause for optimism than concern, that there is an appetite for the kind of empowerment necessary to support an agile workforce.

“In principle, your employees are positive and open-minded. If you give them the freedom, they will pay it back by flexibility, by being open towards training,” he says. “Embrace technological change and look to where you want to move your workforce. Train them. Take them with you.”