Sustainability report (SR) and Key performance indicators

You can download the relevant key KPIs of the SR 2023 here.

To ensure continuous improvement in our performance, we have defined KPIs for our sustainability focus areas.

Several of Zurich’s sustainability KPIs in the SR 2023, have been independently assured by the external auditor Ernst & Young Ltd.

The resulting assurance statement is available on pages 214 to 219 in the SR 2023.

Task Force on Climate-related Financial Disclosures (TCFD)

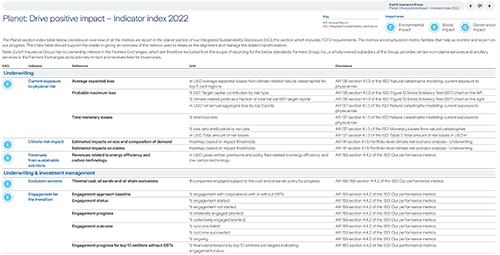

Given its global nature and the long time frames over which it will unfold, climate change risk is one of the most complex we face, both as a society and a business. Understanding how climate change risk could impact our business and ensuring an appropriate strategic response to those impacts, is central to our Sustainability Framework and ambitions.

Our climate risk related disclosure is in line with the recommendations of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD), and is embedded in the SR section of our Annual Report. Our TCFD disclosure can be found in the planet section of our SR. We perform our scenario-based climate risk assessment in three focus areas – underwriting and investment portfolios as well as our own operations and supply chain.

Outcomes of 2023 assessment

Our annual portfolio-level scenario-based climate risk analysis considers our operations and material business activities across underwriting and investments.

- Our P&C portfolio showed relatively little movement compared with 2022, with no material shifts observed in industry or line of business mix. Modelled medium-term impacts are contained to the property and fossil fuel lines of business, with aggregate impacts across in-scope line of business considered to remain low. With our portfolio mix remaining stable, no broad adaptations are required to in-force responses which we can adapt to balance near-term market movements against the mid-term strategic scenario expectations.

- The scope of our Life protection analysis was increased and although medium-term impacts to demand were noted to be more material than previous assessments, increases were not sufficient to warrant additional responses.

- Similar outcomes are noted across our proprietary investments, where analysis of key asset classes demonstrates a largely unchanged risk profile, with physical risk having an impact in a few sectors where we have limited exposure and where transition risk primarily impacts carbon intensive sectors. In line with 2022, observed impacts do not suggest material risk to our capital position.

Analysis of our operations suggests existing business continuity planning for critical processes, are sufficient to address observed physical risk impacts, while transition risk analysis does not suggest material financial impacts under the scenarios considered.

In line with previous cycles, analysis outcomes suggest that our customer-focused approach and diversified portfolios, supported by strong risk management practices, continue to provide the resilience and flexibility necessary to be able to adapt to the climate change impacts observed.