Nature offers businesses a route to net-zero

Climate changeArticleNovember 3, 2022

The road to net-zero is paved with good intentions. Investing in novel nature-based solutions offers a way for businesses to turn aspirations into action.

The mother of invention is necessity. So perhaps it’s not surprising that more and more businesses are exploring innovative solutions rooted in Mother Nature to achieve net-zero.

They’re acknowledging what the science has spelt out. Carbon removal is a crucial piece of the decarbonization jigsaw and both nature-based and technology-based projects are needed to ensure success.

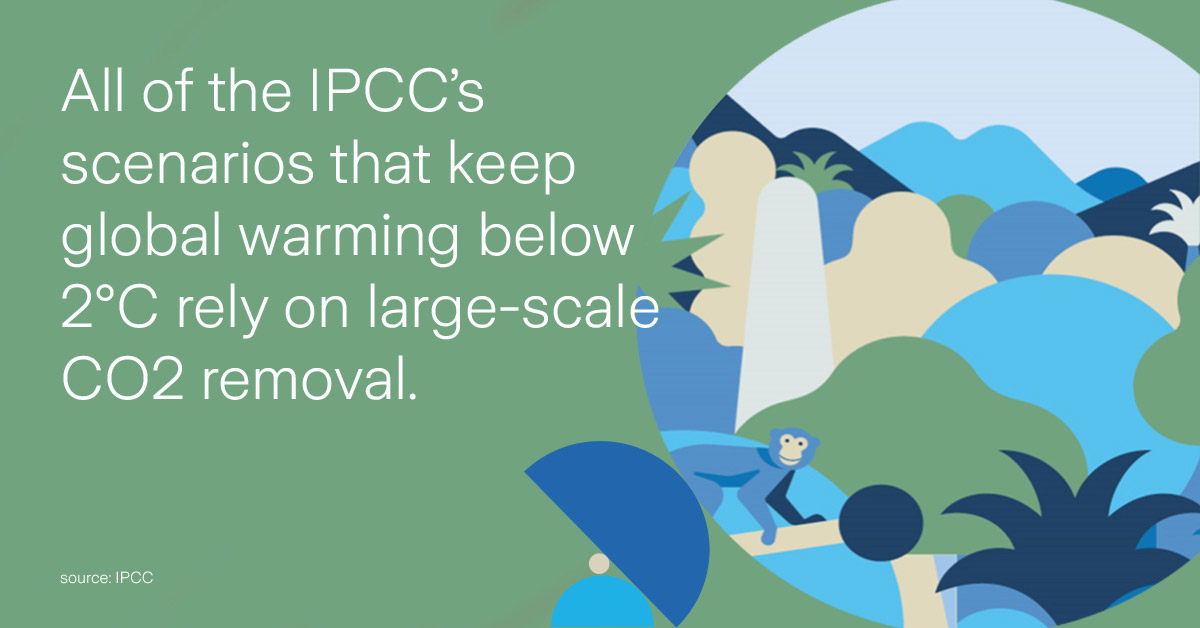

While the priority is to reduce emissions as much as possible, there’s no escaping reality. Industries like iron, steel and glass manufacture, which need extreme heat in blast furnaces, are difficult to decarbonize. Others, like cement production, rely on a chemical reaction that produces carbon dioxide (CO2) as a by-product. Meanwhile the technology required to decarbonize shipping and air travel – through electrification or with new fuels like green hydrogen – is still decades away.

It means that if we’re to achieve net-zero, we need to remove as much CO2 from the atmosphere as we pump into it. And we need it quickly. We simply can’t wait for future clean fuels and other green technologies to be developed and scaled. The Intergovernmental Panel on Climate Change (IPCC) recognizes that simply preventing, reducing or eliminating sources of greenhouse gas emissions will not be enough to achieve the Paris Agreement’s goal to limit temperature rise to below 2 degrees Celsius (°C) and ideally to 1.5°C. Indeed, all of the IPCC’s scenarios that keep global warming within that range rely on large-scale CO2 removal.

Permanent storage

When it comes to enhancing natural carbon stocks through nature-based solutions, the choice is huge including afforestation and reforestation, conserving peatlands and coastal wetlands, regenerative farming techniques, agroforestry and improved livestock management. However, some of these approaches cannot guarantee permanence. For example, a wildfire can destroy a reforestation project. There are also concerns that some approaches could even be harmful to the environment as nature-based solutions involve some degree of intervention in complex socio-ecological systems.

But a range of new nature-based solutions that help enhance nature’s sequestration – often called “enhanced bio-sequestration” – could provide a more permanent solution as the captured carbon can be secured for centuries with low risk of reversal. They include biomass burial and biochar, both of which form part of Zurich Insurance Group’s (Zurich) approach to achieving net-zero emissions in its operations by 2030.

Biochar

Biochar is a charcoal-like substance made by heating organic material from agricultural and forestry wastes (also called biomass) in a limited supply of oxygen. In this process, called pyrolysis, the organic material does not combust and no carbon is emitted. This creates a stable form of carbon that can be stored in the soil for centuries and even thousands of years, making it an ideal technology for scalable carbon removal.

In addition to sequestering the carbon inside organic material, preventing it from turning to carbon dioxide, biochar has multiple environmental and social benefits.

In certain types of soil, burying biochar can improve water retention, moderate the acidity of the soil, reduce nutrient leaching and lower the need for irrigation and fertilizer, decreasing the environmental impact of agriculture and farming practices and helping this critical industry to become more sustainable.

Besides enriching soils and potentially enhancing crop yields, other main commercial uses include city landscaping, drainage water systems and in landfills as a filter.

Zurich has two pilots, one with Bio-Restorative Ideas that converts waste and invasive bamboo into biochar in Puerto Rico. The other with Oregon Biochar Solutions that sources biomass from forestry waste, including fire hazard biomass and forest fire burnt wood.

Biomass burial

Plants and trees return CO2 to the atmosphere when they die and decay. But biomass burial locks up this carbon by burying it underground or in saline pits to avoid composting.

Zurich’s pilot with InterEarth takes this process a step further by growing indigenous trees on degraded and previously cleared farmland in Australia. The trees are harvested with the collected biomass buried underground in a sealed cavity. The roots are left in the ground allowing the trees to regrow and be harvested again, allowing the burial process to be repeated to capture and permanently store carbon for hundreds of years.

Scientifically robust

With all the startups out there, what sort of criteria should one evaluate when reviewing potential projects to select?

First and foremost, the project has to be scientifically robust in demonstrating the permanence of carbon capture and storage.

Secondly, the projects should follow the no-harm principle and be without direct downsides. Is this project capitalizing on waste as feedstock? Is it causing harm by displacing other crops or impacting biodiversity? Is this the most efficient feedstock for the conversion process with more positives and fewer negatives than other potential use?

A third consideration is to prioritize projects which could not be delivered without the financial support provided via the sale of carbon removal certificates.

Advance payments will help these suppliers further develop, scale and commercialize their early stage and innovative technologies.

“The urgency of the situation means we need to be proactive and help scale up the carbon removal industry which is still in its infancy,” says Alison Martin, CEO EMEA and Bank Distribution.

Transparency

Carbon removal certificates are independently verified documents that confirm that 1 metric ton of CO2 equivalent has been removed from the atmosphere and stored for the long-term using a verified removal method. The certificate is issued to the supplier and purchased by a buyer who wants to reduce their emissions in a trusted, credible way. The certificate must be retired, ideally as close to the purchasing time frame as possible, to ensure a unique and credible carbon removal claim.

Since many removal solutions are still in the early stages of development, working with a credible partner in the removal space, like Puro.earth, which has established a transparent methodology and certification framework, helps ensure the integrity of purchasing decisions.

“Finally, for many businesses, it is also important that co-benefits are aligned with broader sustainability goals,” says Anja-Lea Fischer, Head of Operational Sustainability. “For Zurich, that includes flood resilience, wildfire prevention and – through support for good quality jobs in sustainable industries – developing a fairer society.”

Biodiversity metric

At the moment, nature-based (as well as technology-based) solutions for permanent carbon removal are far from the levels that can help tackle climate change. They are largely untested, untried and underfunded. But courageous investment decisions by business could help tip the balance.

Inevitably, there’s an element of risk involved in supporting these early-stage projects in the hope that they can support the journey to net-zero in the coming years.

A new accounting methodology that captures the multidimensionality of diversity for biochar and biomass projects as well as quantifying their climate benefits will help project developers in generating carbon credits to attract investments.

It again highlights the need for a globally agreed biodiversity metric that can be readily integrated into carbon projects as outlined in Zurich’s recent white paper: Net positive: why biodiversity metrics make for more effective carbon markets.

Creating nature-based carbon removal credits could in turn encourage investors and businesses to identify some of the most promising suppliers of carbon removal and channel capital to enable them to scale.