Europeans underestimate personal disability risk

Most Western Europeans underestimate their personal risk of becoming unable to work, according to a survey by Zurich in six European countries. Respondents generally tend to overestimate an accident as a leading cause of disability. But at the same time, they are unaware that the probability to become work-disabled during one’s working lifetime – whether due to an accident, or other causes – may be as high as 25 percent. Seven in 10 respondents believe that they would have significantly less household income if they became disabled. Yet they say that they would need at least the equivalent or more to maintain their current lifestyle.

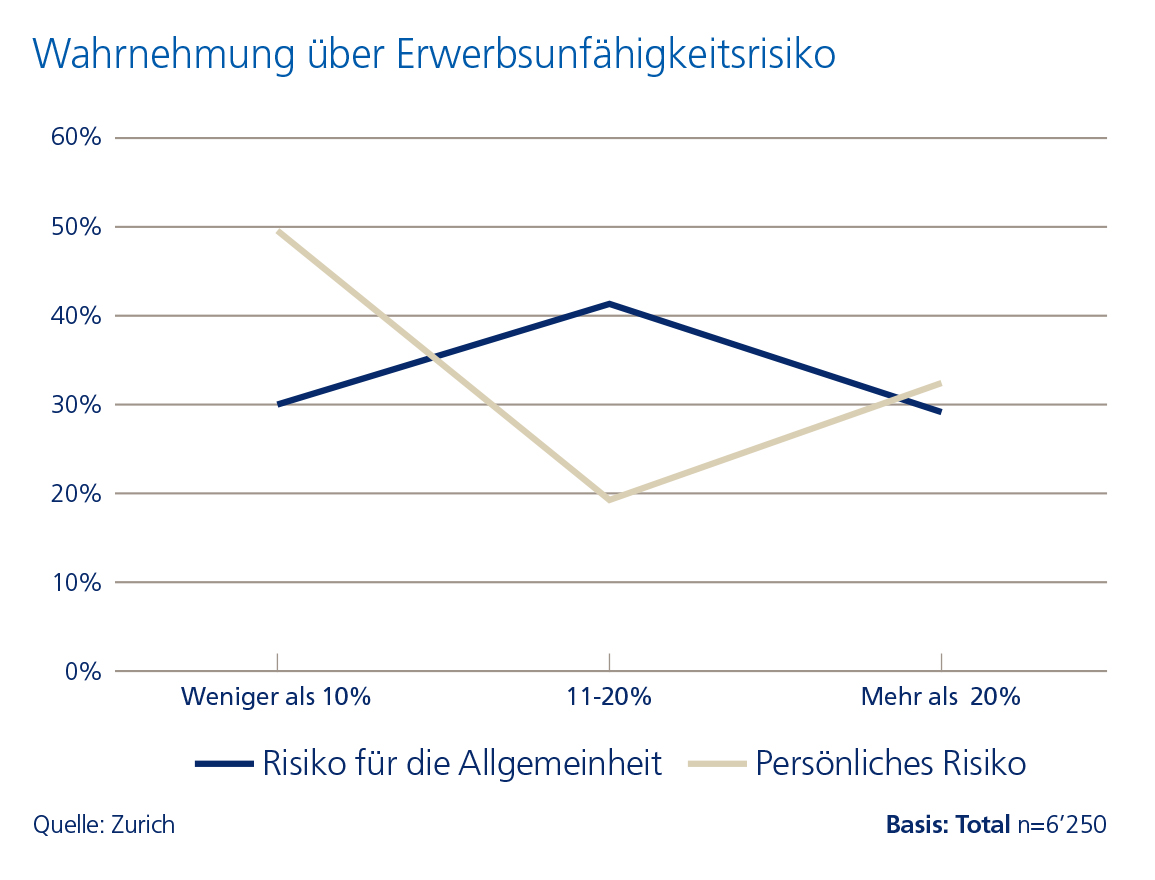

A recent study by Zurich Insurance Group (Zurich) carried out in Western Europe found that most people underestimate their personal risk of becoming unable to work. Half of the more than 6,000 respondents in Germany, Ireland, Italy, Spain, Switzerland and the UK believe their personal risk of losing their ability to work is less than 10 percent. But in reality, up to one in four Europeans may become unable to work for some period in their working lives. However, there are significant differences among countries: With 25 percent, Germany has the highest percentage of people who are unable to work during some time in their working lives. In Spain and the UK, it is 16 percent, in Ireland 13 percent, in Italy 7 percent and in Switzerland 6 percent. Interestingly, respondents in general see a significantly higher risk that others will become disabled than they see for themselves.

Ireland, Italy, Spain, Switzerland and the UK believe their personal risk of losing their ability to work is less than 10 percent. But in reality, up to one in four Europeans may become unable to work for some period in their working lives. However, there are significant differences among countries: With 25 percent, Germany has the highest percentage of people who are unable to work during some time in their working lives. In Spain and the UK, it is 16 percent, in Ireland 13 percent, in Italy 7 percent and in Switzerland 6 percent. Interestingly, respondents in general see a significantly higher risk that others will become disabled than they see for themselves.

Kristof Terryn, CEO Global Life at Zurich, said: "There is growing awareness of the pension gap, but most people underestimate an even greater risk to their standard of living: losing the ability to work. Many see the state as the main provider of financial support to those no longer able to work. However, we at Zurich expect to see a gradual reduction in social security benefits and corporate pensions in many countries as populations age and national budgets come under pressure. People increasingly need to take personal responsibility to protect themselves and those they love. From the survey we know that just one in three is aware of income protection possibilities. As a global insurer we have a responsibility and an important role to play to increase awareness and help society mitigate the emerging risk of the income protection gap."

Accidents overestimated as causes of disability

Severe illnesses, mental and nervous disorders and accidents are regarded as the main causes of disability. Accidents, however, are generally overestimated as a cause of disability. In fact, in Germany, Ireland, Switzerland and the UK, mental and nervous disorders rank first, while in Italy skeletal and muscular disorders and in Spain rheumatic diseases are at the top.

Significant differences in age when disability occurs

Older age groups are perceived as having the highest risk of becoming unable to work across countries. Statistics show that in Ireland, Italy, Switzerland and the UK those older than 55 carry the highest risk, while in Germany, men aged 47 to 51 and women aged 45 to 47, have the highest risk of becoming work disabled. In Spain the average age of those no longer able to work is 51.

Less income expected, but more needed

Seven in 10 respondents believe that they would get less than 75 percent of their last household income if they became work disabled, with two in five thinking they would get less than half of the last household income. At the same time, six in ten (58 percent) said that they would need the equivalent or more than their income to maintain their current lifestyle.

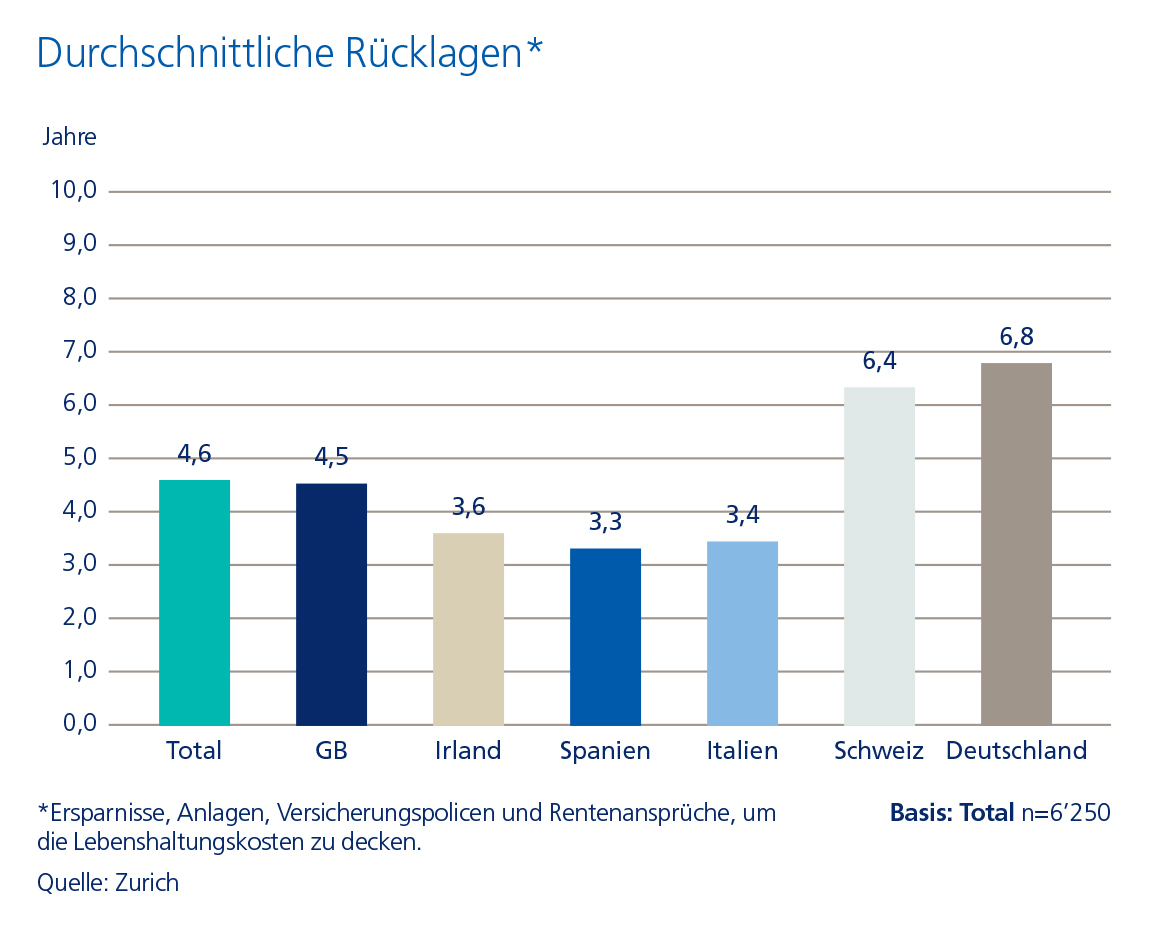

Zurich also asked people how many years of living expenses they have set aside through savings, investments, insurance policies and pensions.  On average, Europeans report having a savings buffer of 4.6 years. In Ireland, Spain and Italy, this buffer is only about 3.5 years, while in Switzerland and Germany it is about 6.5 years.

On average, Europeans report having a savings buffer of 4.6 years. In Ireland, Spain and Italy, this buffer is only about 3.5 years, while in Switzerland and Germany it is about 6.5 years.

High hopes for state support

About two in three Europeans expect the state to provide financial support to those who are unable to work. In Italy and Spain, expectations that the state will provide support are even higher, with four out of five expecting their government to be the main provider of assistance. While respondents in Switzerland, the UK and Germany are generally confident in their government's ability to deliver on its social obligations, trust in state social welfare programs is much lower in Ireland, Italy and Spain.

More than half of respondents believe that the financial crisis had a negative impact on their financial situation. In Ireland, Italy and Spain that figure rose to 75 percentage. Many say that income was reduced, while debt, fear of getting ill and stress levels increased.

Western Europeans feel they do enough to protect themselves, but do they really?

Three out of four respondents believe that they have sufficiently protected themselves from becoming work disabled. Yet only about one in five have income protection insurance in their households. There are major differences between countries: in Italy, Spain and the UK, people are less likely to have income protection, while about one-third of Germans and Swiss have it.

Leading a healthy lifestyle or having a good work/life balance generally are thought to provide the best prevention against disability. Yet for Spaniards and Italians, workplace safety also plays an important role.

If they became work disabled, people in Ireland, Italy and Spain would most fear not being able to support their families and becoming a burden to their loved ones. The former is also a concern for the Britons and the Swiss. The Germans and the Swiss are most concerned about poverty and physical and mental pain. Poverty would also be a major concern for the Britons and the Irish.

Further information

Zurich's Income Protection Gap Survey was carried out by market research company Epiphany in April and May 2015. The study is based on a nationally representative sample of consumers aged 18 to 70 in Germany, Ireland, Italy, Spain, Switzerland and the UK. Approximately 1,000 consumers per country completed an online survey consisting of 53 questions.

Zurich will continue to do research into the income protection gap and will publish further findings later this year.

Further key findings of the research for Germany, Italy and Switzerland are available on the respective websites.