The original firefighters: How insurers protected London from fire

RiskArticleSeptember 1, 20235 min read

The London Fire Brigade is one of the largest firefighting and rescue organizations in the world and its origins may surprise you.

It started with the Great Fire of London in 1666. A long dry summer, tightly packed homes and flammable building materials meant the city was a tinderbox waiting to ignite. A stray spark at a bakery on Pudding Lane on September 2 soon became an inferno that destroyed much of the City of London within days.

The devastation left many in financial ruin. But with a heightened fear of fire, several entrepreneurs spotted a new business opportunity and established the first property and fire insurance companies, which would pay claims to customers that had their property and contents damaged or destroyed by fire.

A focus on fire prevention

But by 1700, the insurance companies realized it would be cheaper to put out the fires than to pay for rebuilds. And so, they began to employ their own firefighting units tasked with preventing and minimizing fire damage to properties insured by them.

“People think solely of insurance as a form of protection if disaster should strike. And it’s correct that insurers reimburse customers for losses. But the true DNA of insurance also encompasses prevention,” says Jean-Pierre Krause, Chief Risk Engineering Officer at Zurich Insurance Group.

Customers were issued with “fire marks.” These were metal plaques marked with the emblem of the insurance company and displayed on the front of insured buildings to allow them to be identified by the firefighting units. They were also an early form of advertising and can still be seen in parts of London today.

A flawed system

Unfortunately, this system was both inefficient and flawed. Despite some reciprocal arrangements, firefighting units would often ignore burning buildings which were not covered by their own insurance company. To overcome this issue, in 1833 a group of 10 fire insurers united to form the London Fire Engine Establishment (LFEE). It was London’s first fire service, and it was entirely funded by the insurance industry.

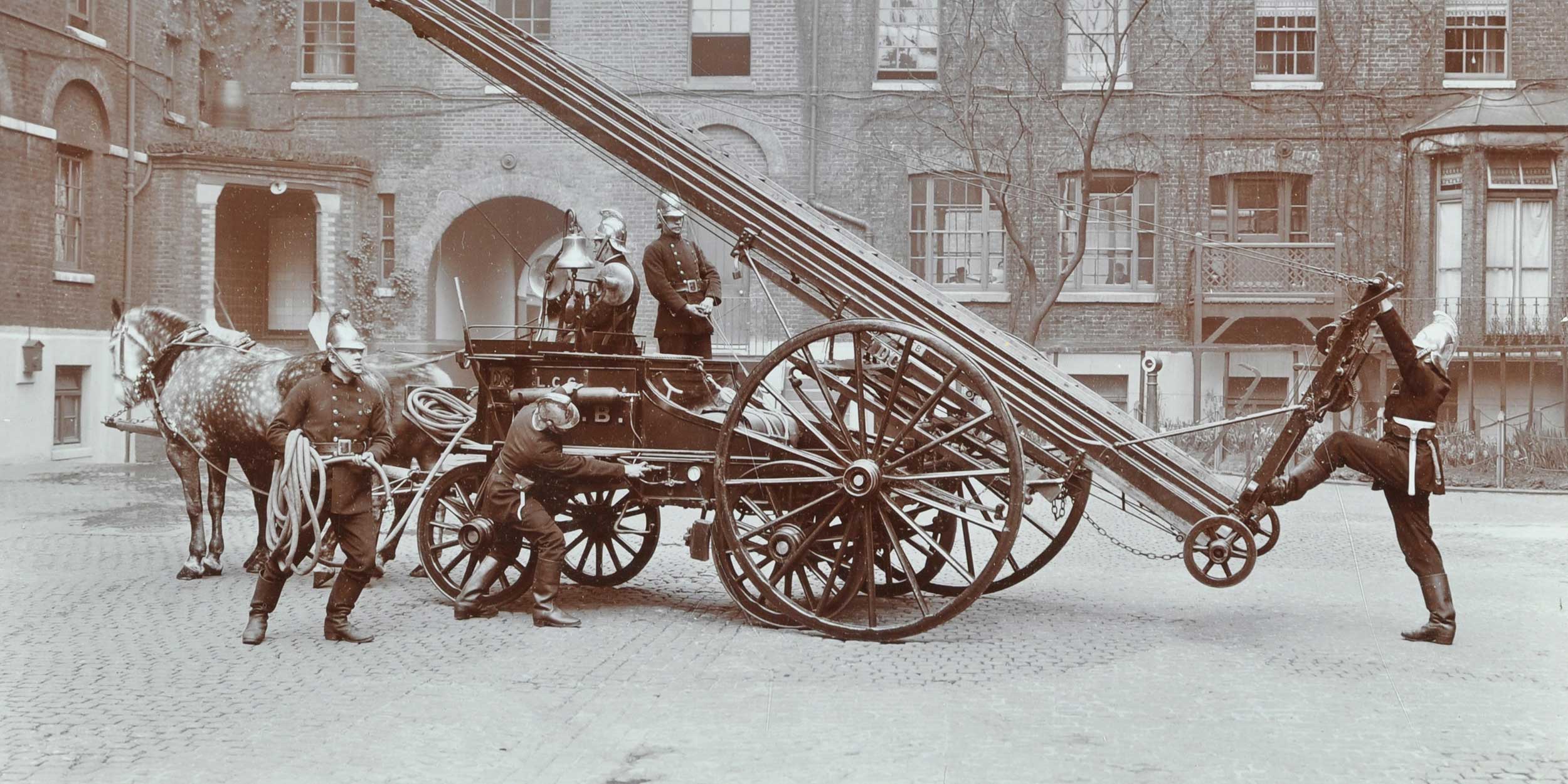

Led by James Braidwood, the first Superintendent of the LFEE, it provided the public with a more effective and better equipped fire service. It introduced many firefighting principles that remain in use today, including uniforms that provide personal protection, an emphasis on training and a scientific approach to tackling blazes.

The focus of the LFEE, however, was on protecting property – and not people. In response, the Royal Society for the Protection of Life from Fire was formed in 1836 to help people escape from burning buildings. Dozens of wheeled escape ladders – that could reach up to 18 meters (60 feet) high and were operated by trained conductors – were kept in churchyards during the day and placed on street corners at night.

A pivotal fire

But over the next 30 years, the growth of London combined with several large fires meant the LFEE was too costly and unsustainable for the insurance companies to fund.

A pivotal moment came in 1861 with the Tooley Street fire. It started in warehouses at Cotton’s Wharf, near London Bridge, which were filled with a huge array of combustible goods, including jute, hemp, cotton, spices, tea and coffee. The fire spread for a quarter of a mile (0.4 km) along the south bank of the River Thames and took two weeks to extinguish.

It was London’s biggest fire since 1666 and the first time that most fire insurers had lost money since the introduction of private firefighting units. James Braidwood also died while tackling the fire. In response, the insurance companies raised premiums and required customers with warehouses and wharves to store goods in a safer manner.

A call for government action

In 1862, the insurance companies also began lobbying the British government saying they could no longer be responsible for London’s fire safety. They wanted the government to provide the fire brigade at public expense and management.

Eventually in 1865 the British government agreed and passed the Metropolitan Fire Brigade Act, which created the Metropolitan Fire Brigade as a public service. In 1904 it was renamed the London Fire Brigade.

“At Zurich, much like the early insurers in London, we want to prevent fires and other catastrophic events. And like they did back in 1862, we will also lobby and advise governments to ensure they are taking the necessary steps to improve safety and minimize risks,” says Krause.

“From fires to floods, we’ve been advising customers about how to avoid or minimize the impact of potential risks since we were established in 1872. Now with Zurich Resilience Solutions, we use the latest data, tools and techniques to help our customers protect themselves from newly emerging risks like cyberattacks and climate change.”