Resilience begins at home: Societies take strength from well-prepared citizens

Global risksArticleMarch 2, 2021

A fresh look at the vulnerabilities exposed by the COVID-19 pandemic will help societies stand up to threats to the health and livelihoods of their people, businesses and governments.

Societies’ resilience against shocks from health and financial crises such as the COVID-19 pandemic will grow stronger as individuals learn to better prepare for such calamities, experts agree.

While societal resilience isn’t strictly defined, it is generally described as the ability of individuals, households and institutions to absorb and adapt to extreme events. In the case of COVID-19, lockdowns and social distancing tested resilience in a massive shock to the physical, mental and economic health of global populations.

The pandemic showed that many were hard-pressed to deal with the severe disruption to society that left them struggling to meet financial obligations and care for their families and themselves. As the crisis unfolded, it became clear that while governments and employers could provide valuable assistance to people whose earnings and savings were vanishing, it was in many cases not enough to keep families and businesses out of trouble.

Some made out better than others. Most assistance came from governments, but even with that, many families lacked enough resources to weather even a short-term shutdown. Businesses worldwide – particularly small and women-owned businesses - collapsed under lockdowns that prevented them from opening their doors.

In addition, the digital transformation of society has led to an increasing number of people working in independent arrangements, agency and platform work, and other atypical forms of employment. In many cases, these workers were more affected by the pandemic than those in traditional jobs, as they worked in sectors hard hit by lockdowns and the economic downturn. Many were not covered by social security programs.

“It varies by country, but generally people were not very well prepared for this,”said Stefan Kröpfl, Global Head of Life Business Analysis, Life Technical Functions at Zurich Insurance Group.

“After the first lockdown, some people used up their savings despite government support,” he noted, leaving them particularly vulnerable when conditions tightened during a subsequent lockdown.

Covering the gaps

Not everyone was caught flat-footed by the severity of the COVID-19 crisis, but now that it has dragged on for more than a year, even many who were prepared with significant financial resources have been hurt as their livelihoods disappeared and savings were eroded.

“Month-to-month savings is very challenging for a significant portion of the working population across the OECD,”

And those savings deficits, along with limits on the capacity of governments and employers to provide the amount of assistance to fully protect people in a crisis means that insurance has a very important role in sustaining individual and household wellbeing, he added.

Income protection insurance is available to help many people through hard times when income is lost, Mr. Clark explained. But the most vulnerable workers are often unable to take advantage of such a safety net, given their month-to-month reliance on earned incomes.

Research on income protection gaps conducted by Zurich and the Smith School of Enterprise and the Environment revealed that those who purchased the coverage were likely to be older, high-wage earners with longer job tenure and with families to support. Importantly, Mr. Clark pointed out, and they also tend to have experienced shortfalls in income because of an accident or other health-related events.

“I don’t discount the importance of informing people about the importance of insurance through advertising and other communications,” Mr. Clark said. But experience is a far more powerful motivator. “You can tell people about the importance of insurance, you can explain it to them in all kinds of ways,” he added, but the demand for the coverage is highest among people who have lived through hardship and can afford to pay the premiums.

“COVID-19 has really brought this issue front and center,” Mr. Clark said.

The severity of the pandemic has made it clear that those who can least afford a loss of income usually suffer the most, Mr. Clark pointed out. “We must think seriously as a society about pre-funding or requiring co-funding by employees and employers to pick up some of these welfare costs…If we’re going to protect those most at risk, we have to think about the provision of insurance on a mandatory basis with assistance for those who can’t afford it.”

Zurich calls for policymakers to increase attention to financial education in the areas of income protection and pensions. As the digital transformation of work continues, Zurich believes policymakers should foster a regulatory environment that enables and incentivizes the creation of and access to contemporary financial products that provide lifelong, tailored income protection to workers in all types of employment, including more novel arrangements such as platform work and career breaks.

Past is prologue

COVID-19 isn’t the first crisis to remind us of the importance of self-resilience, said Cornelius Fröscher, Director of Global Customer and Distribution Management, Corporate Life and Pensions at Zurich. The 2008 financial crisis also revealed the necessity for people to prepare for unexpected financial shocks.

And, the financial crisis and pandemic aren’t likely to be the last global shocks, Mr. Kröpfl pointed out. “As societies, we need to get to a better place to prepare for the next thing that comes along.”

Providing aid during the pandemic has left governments less resilient and, in some cases, deep in debt, he noted. “The right way to build resilience is to begin emphasizing personal responsibility. Rather than relying solely on governments to sort it all out, we’ve got to turn things around and start with individuals.”

“If you have financial resilience in the form of a buffer, invested in a smart way, you will have a sense of self-reliance,”Mr. Fröscher said.

“This financial part is the un-tackled challenge in building resilience, compared with the mental, societal and physical aspects, which are at the heart and center of a lot of existing wellbeing programs.”

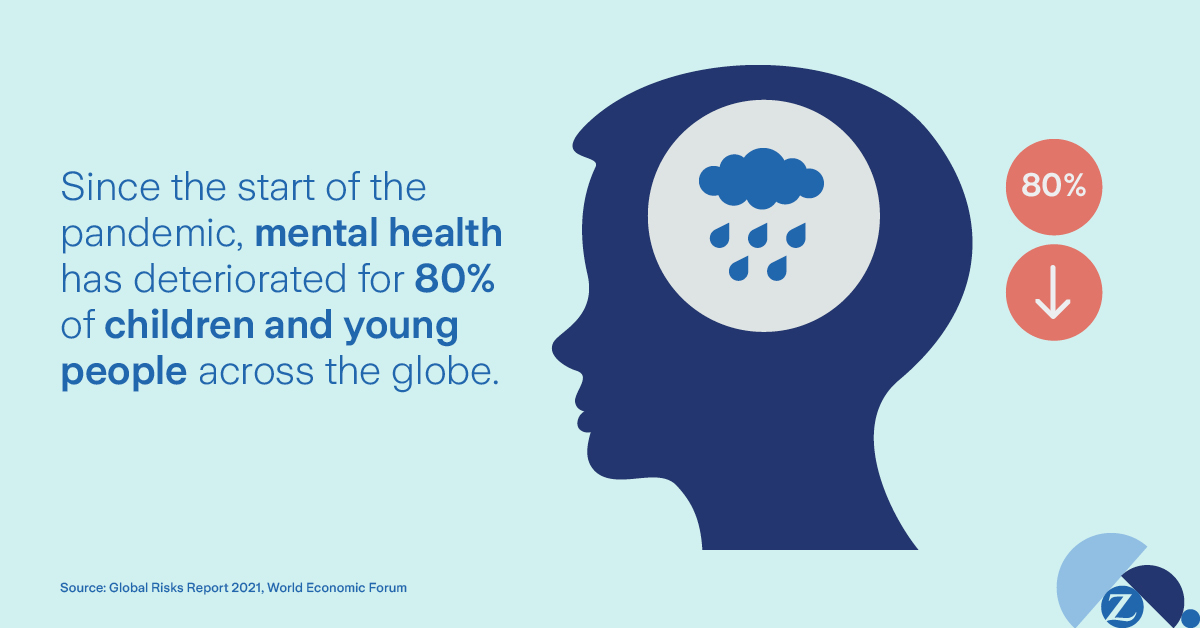

Mental health issues

“Research shows that financial literacy is clearly not to the standard we would like,” said Mr. Fröscher. And, it indicates that those who have suffered financial or health-related setbacks may also suffer from anxiety that affects their lives at work and home, he added.

When individuals consider resilience-strengthening measures, they should look closely at their finances, Mr. Fröscher said, because that’s what it takes to eat and meet financial obligations. If that part is not in place, it can create a spiral that affects mental and physical health, he added.

John Scott, Zurich’s Head of Sustainability Risks, pointed to direct effects of the pandemic on mental wellbeing.

“If you shut people down and they can’t connect with other people, they can deal with that in the short term, but in a few days or weeks the impact on their mental health can be significant,” he said. “Interaction is critical to building personal resilience. It’s not enough just to have a Zoom call with your friends and family. You want to go for a walk or talk to someone over the fence even if you are five meters away. That’s worth a lot.”

Those who are struggling financially or are disadvantaged in other ways “may feel as though they have been dealt a poor card in terms of access to health care, information and money to help them weather the economic impact. All of that has an impact on people’s mental health,” Mr. Scott noted.

Social and income disparities show up in all nations, and support for those who are struggling is critical to building thriving and resilient societies, Mr. Scott said. “This is a challenge not only in poorer countries, but in the poorer parts of even the wealthiest countries in the world. It’s not just an emerging market problem, and we have to make sure as businesses, governments and civil society more broadly that we support people in those situations. If you don’t, you can create a very divided society, exacerbating existing disparities of race, gender and income with all the consequences of that – angry and upset people, disenfranchised people – which holds back economic growth and societal resilience.”

Zurich urges policymakers to help increase awareness of mental health issues and promote prevention programs at all levels of society, including employer-based resilience programs for employees and mental health upskilling training for managers.

Everyone has a role to play, Mr. Scott emphasized. “You can have a lot of things in life, but if you don’t have a support network around you to get through tough times, you can be in a bad place. The foundations of societal resilience are built on socioeconomic and social cohesion, identity and community. Combine this with good governance and leadership, a population largely working and with access to services and in good general health, and you have a recipe for societal resilience.”