Climate change’s forgotten risks

Climate resilienceArticleMarch 2, 20216 min read

If you thought managing climate change risks meant only installing flood prevention measures, think again. There is a plethora of transition and liability risks that can rip through your business like a tornado. And the impact could come sooner than you think.

Climate change is a core business risk. Period. But is your business assessing and mitigating against all climate risks?

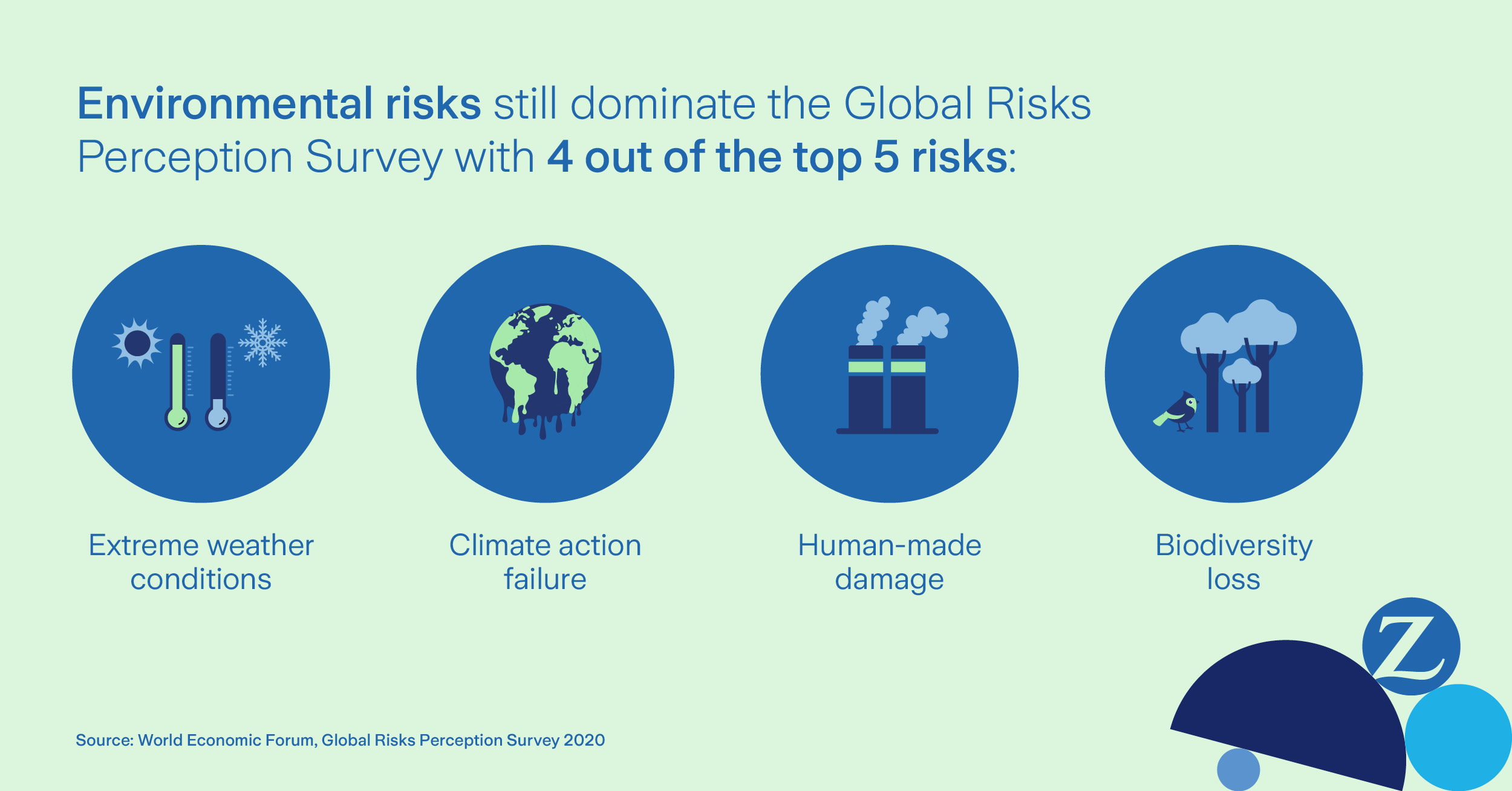

The most obvious, and the most documented risks associated with climate change are ‘physical risks’, such as an increase in the frequency and severity of severe weather. These risks can manifest themselves suddenly in the form of a flood or a hurricane, or gradually over time such as sea level rise or an increase in temperature.

But there is a relatively new broad category of climate change risks, called ‘transition risks’, that can rip through your business like a tornado. And the impact on your business could come sooner than you think.

What are transition risks?

“Transition risks are linked to the transformation towards a low carbon economy, so they are driven largely by changes in societal perception of carbon intensive industries, new public policy, new technologies, changing investor preferences, and shifting consumer sentiment. This will potentially lead to economic and societal impacts on a much shorter time frame than the physical risks of climate change,”

The move towards a low carbon world could see sectors of the economy face big swings in asset values – for instance, the market value of businesses exposed to thermal coal has fallen in recent years – or higher costs of doing business such as labeling consumer products as low carbon or new green building codes. Carbon intensive industries could lose subsidies and others could be subject to carbon pricing or other forms of green taxation, either explicitly or implicitly.

Transition risks can also derive from regulatory and technological changes designed to reduce emissions. The automotive industry is challenged with both, due to government targets that will phase out the sale of new petrol and diesel vehicles – in some cases as early as 2030. Automakers without a robust electrification strategy will be potential losers, although there may be other low carbon engine technologies that enter the market, such as hydrogen fuel cells. This means it is not just a sectoral problem, but a competitive strategy challenge too.

Other transition risks come from demand-side changes resulting from a shift in consumer trends as they become more sensitive to environmental issues or change behavior due to economic incentives. This could create reputational risks for companies and brands perceived to be part of the problem rather than part of the solution. At the same time new opportunities will be created, through increased demand for low carbon products and services.

Physical and transitional climate change risks are not mutually exclusive. The California wildfires in 2017 and 2018 showed how climate change can incur very specific near-term physical costs – as well as transitional ones. The wildfires led to the California-based utility company PG&E filing for bankruptcy after facing liability for damages. This was one of the first bankruptcies tied to climate change, where extensive damage was amplified by extremely hot and dry weather conditions.

“Businesses should aim to take action on climate change sooner rather than later and focus on developing strategies that build resilience to both the decarbonization of the services they deliver and the physical risks of climate change,” says Scott. “Only then will they be able to phase in action and take gradual steps that will limit disruption.”

What are liability risks?

There is also another set of climate change risks generally referred to as ‘liability risks’. These relate to legal liability exposures arising directly or indirectly from a company’s business activity and could include, for instance, people or businesses that have suffered from physical events, such as flooding, making claims against companies who they see as responsible for causing or contributing to climate change.

“Climate litigation is increasing worldwide, reflecting advances in attribution science, evolving legal disputes and changing public sentiment,”

“This is an area where we see a good measure of ‘agenda-setting litigation’ where claimants seek to hold companies and their boards to account for their contribution to climate change. Additionally, the increased focus of regulators and investors to ensure businesses provide necessary disclosures and on the evolving regulatory landscape, is increasing climate-related litigation.”

The Bank of England’s Prudential Regulation Authority has provided a useful grouping of the liability exposures that can lead to litigation, namely ‘failure to mitigate’, ‘failure to adapt’, and ‘failure to disclose or comply’.

“Although climate litigation has been predominantly against governments in the past, litigation against companies is on the rise with allegations often based on company law obligations with the objective of compelling climate-friendly action,” adds Báez-Safa.

The need for consistent, defined global disclosure standards is being discussed in several countries and these will place greater responsibility on companies to report and demonstrate that they are implementing sustainability measures and risk management strategies for different climate change scenarios.

To mitigate this risk, companies should meet demands for reliable climate-related risks disclosures in line with the guidelines set by the Sustainability Accounting Standards Board and the Task Force on Climate-related Financial Disclosures.

“This requires using different quantitative and qualitative tools, data and metrics to monitor and assess exposure to physical, transition and liability risks. But this process does not just expose the risks, it can highlight opportunities too.”

The physical risks of climate change remain the biggest existential risk to the planet. To avoid this planetary emergency, governments and industries will have to make many ground-breaking decisions to achieve a net zero-carbon future, which is the goal of the Paris Agreement.

At the same time, these necessary actions will also impact and increase transition risks, as well as potential liability risks. But these risks cannot be avoided if we want to create a brighter future for people and the planet. Instead, we must learn to manage, adapt and mitigate the potential exposures.