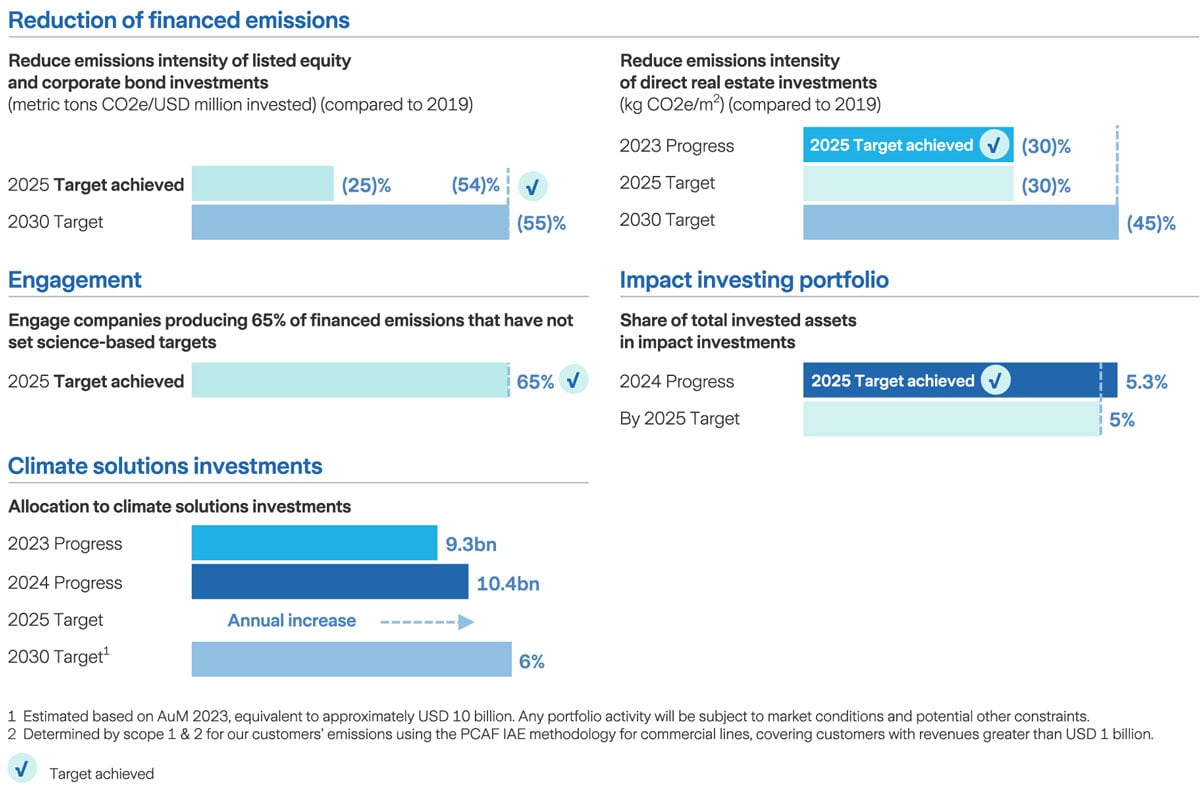

Zurich is dedicated to achieving net-zero in its investment portfolios by 2050. To support this goal, we have established intermediate targets for 2030. Supporting companies to finance their transition, Zurich invests in a variety of climate solutions through impact investment assets worldwide. Following the Global Impact Investment Network's (GIIN) definition of impact investing, Zurich seeks investment opportunities that intentionally aim for specific positive social or environmental outcomes and enable the measurement of the achieved impact. These investments are designed to generate a market-rate financial return that aligns with their associated risk.

Private infrastructure debt investments as an asset class are suited to impact investing and climate solutions investment particularly: By investing in infrastructure, impact investors can achieve a dual objective of generating financial returns while contributing to positive social and environmental outcomes. An example is the transition to a low-carbon economy, which requires large investments in new infrastructure. Here, renewable energy projects can play a vital role and be easily evaluated against specific impact objectives, such as avoided CO2e emissions.

One example is Zurich's investment in a portfolio of solar parks in Spain. The 23 ground-mounted solar parks can produce 180,000 megawatt-hours (MWh) annually enough energy to power around 9,000 homes, supporting the growth of Spain’s renewable energy sector and the contribution towards clean electricity generation. The solar parks are owned by a developer with extensive expertise in the renewable energy market in Spain and Italy, specialized in independent renewable energy solutions and asset management services. The developer was later acquired by an international group. The group now operates in Spain, Italy, Greece, Uruguay, USA, Colombia, Australia, and the UK. It is a long-term owner developer across onshore wind, solar photovoltaic, concentrated solar power, battery energy storage systems, and transmission line technologies.

Zurich is invested in the transaction via one of our external asset management mandates. The financing is an 18.5-year, fixed rate, amortizing senior secured loan to support the operations of the solar park. The rationale for investing in the transaction includes the attractive risk–return profile; the geographically diversified nature of the portfolio of the underlying solar energy generation assets; and the favorable regulatory environment that ensured stability of cash flows and limited exposure to electricity market price fluctuations. Moreover, Zurich’s investment in the well-established, long-term solar energy asset that facilitates the avoidance of 1,300 metric tons CO2e emissions annually, shows our dedication to the transition of the economy to a low-carbon energy model.