What are the top risks to doing business in Latin America?

Global risksArticleApril 4, 20178 min read

Know more about the risks your business based in this part of the world is facing now, and hear from one of the key risk experts in the region how to mitigate those risks.

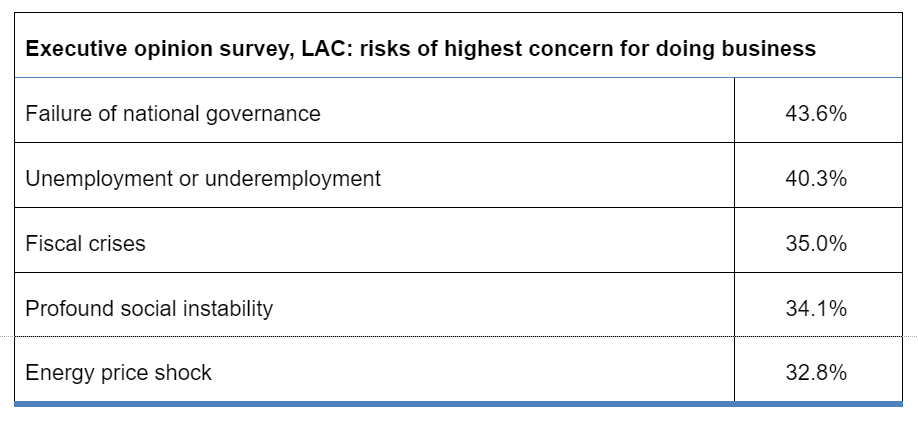

Failure of national governance”, “unemployment” and “fiscal crises” – all prominently cited as risks by Latin American and Caribbean (LAC) business executives. As in previous years, the Global Risks Report 2017; uses data from the Executive Opinion Survey, which asks LAC executives about the risks of highest concern for doing business. The findings shed some light on the anxieties of business people throughout the region and how these differ from those of their counterparts in other parts of the world.

While key concerns across the globe include cybersecurity and data fraud, terrorist attacks and large-scale involuntary migration, executives in LAC were more concerned with fundamental political and economic structural risks. A major theme that emerged among business leaders in the region was a lack of confidence in the state, both in terms of the legal frameworks within which business might operate and the economic and social management of a country.

Many of these findings will come as little surprise in a year of negative GDP growth with large falls in Brazil and Venezuela, where GDP dropped 3.6% and 14% respectively. The region was also affected by the reduction in commodity prices and FX volatility in 2016. In 2017, GDP growth is set to rebound with forecasts around the 1.6% mark. Growth is expected to be driven by external factors such as depreciated exchange rates, improved terms of trade and government investments. While this is good news for the region, there are still challenges that could bring a certain degree of volatility to the region.

Source: Global Risks Report 2017, World Economic Forum

Failure of national governance

According to data from the Executive Opinion Survey used in the 2017 report, the failure of national governance is at the forefront of LAC executives’ minds when it comes to identifying risks to doing business.

Recent events in the region go some way to explaining the reasons for this concern: Brazil’s numerous political and business; corruption scandals; corporate governance issues in Mexico; and the seemingly complete breakdown of national governance in Venezuela. There are plenty of examples of national and regional environments that present as high-risk scenarios for doing business across the region.

Although the existence of the rule of law is no longer an issue, every time most countries in the region Chile being a relatively stable, notable exception) have a new president, we can expect new – and sometimes radically different – policies, regulation and economic decisions, which affect both local and foreign investment. In the next two years, the region can expect presidential elections in many of the major markets including Brazil, Colombia, Chile, Mexico and Venezuela.

This high level of concern about national governance is unique to LAC: 44% of all executives in the region named the failure of national governance in their top five risks, while in all other parts of the world less than one in three executives felt this way.

The extent and vigor of governance across LAC may fall short of optimal standards, but there is almost certainly a role for business in promoting open and democratic systems. Through lobbying government, sponsoring civil society spaces and shining a light on corruption, business can hold government to account and deliver positive change for societies and business ecosystems.

Unemployment or underemployment

Only sub-Saharan African executives were more concerned than those in LAC about the impact that unemployment or underemployment might have on doing business in their region.

While LAC executives understandably desire the ability to operate in vibrant and thriving economies, unemployment (particularly among young people) saw a sharp increase in 2016, despite the narrative of a growing and upwardly-mobile middle class. The International Labour Organisation (ILO) placed the official unemployment rate across the region above 8% in 2016 - the highest level in a decade - and among 16-24-year-olds the figure sits at 14%.

The consequences for business are far reaching. Growing unemployment increases the prominence and structural importance of shadow economies (jobs without contractual or social security), which both undermines social security and demotivates the next working generation.

Fiscal crises

Many business leaders in LAC will have first-hand experience of the devastating impact that the 1980s Latin American debt crisis had on business and development in the region. The so-called Lost Decade had damning implications for the growth of the region and it is unsurprising that businesses today are wary of history repeating. At a time when the fiscal regulatory environment in LAC is complex and volatile it is unsurprising that just over a third of all respondents cited fiscal crises as a top five risk – only Eurasia (45%) had a higher figure.

The direction and quality of fiscal policy within LAC is also strongly linked to the question of national governance, where legal, economic, and political aspects of the state can work together to deliver a strong, robust environment in which business can operate.

Indeed, if the region is to reduce structural rigidity and improve business confidence, fiscal results must be stabilized. We are likely to see such adjustments in LAC during 2017 and the next few years. For example, in Argentina, Treasury Minister Nicolas Dujovne announced new targets for the primary fiscal balance and presented a new fiscal framework to increase transparency and credibility. At the same time, Brazil is implementing austerity measures, a tight monetary policy and the government continues to introduce changes to the tax framework and pension system.

Profound social instability

In the 2015 Global Risks Report, profound social instability was ranked as the biggest risk facing LAC, in terms of how well-prepared the region was. Among this year’s business respondents, the number who consider this a major risk has remained broadly static (up marginally from 33.3% to 34.1%), while other risks have grown in prominence.

As one of the pillars in traditional PESTLE (political, economic, social, technological, legal and environmental) analysis, negative social factors represent fundamental risks to a successful and fully-functioning operating environment for business. With an ageing population, reduced but still significant levels of social inequality, and a growing, vulnerable lower-middle class, there is much for LAC businesses to be concerned about.

It’s also important to understand that although LAC countries share historical, social and demographic similarities, such as language and religion, the region is very diverse and unique. There are often several differences within individual countries, for example, the big cities frequently have a completely different landscape from the interior and more rural parts of the same country. This is why it is critical to increase joint efforts between governments, the private sector and civil society to reduce social inequality in the region by increasing access to housing, health and education. This determination is essential for reducing poverty and inequality.

These same challenges should also be viewed as opportunities for business to work with government and other organizations to introduce solutions and improvements across the region.

Interconnections

We must of course caveat these somewhat artificial “risk buckets”: to understand risks within a business ecosystem one must recognize how they interact and influence one another. While the failure of national governance and fiscal crises are almost impossible to separate, there are also strong connections between profound social instability and rising unemployment figures.

When assessing risk, businesses may be tempted to review individual factors as discrete hazards, but only when these issues are taken together will they be properly understood and the most fitting mitigating tactics identified.

Mitigation and collaboration

The risks outlined above cannot be entirely eradicated. Business – in LAC as in almost all global regions – will always deal with some levels of risk across these sectors.

Business is strongest when it works together in collaboration with governments and third sector organizations. Initiatives like the World Economic Forum’s Partnering Against Corruption Initiative (PACI) can shine a light on the shortcomings that undermine business. Similarly, asset managers are organizing in Mexico, looking to change governance structures to give business and investors more transparency and accountability.

Steps to mitigate risk must be high on the agenda of every board. When this approach is bolstered by increased collaboration, there is every opportunity for a robust environment conducive to business to flourish and deliver social and economic benefits. With this approach we hope to see the topics identified in 2017 diminish in coming reports.

Originally published by the World Economic Forum as part of the World Economic Forum on Latin America 2017.