The need for energy security should fuel the green agenda, not curb it

Climate changeArticleNovember 7, 2022

By Alison Martin, CEO EMEA and Bank Distribution

During the height of the COVID-19 pandemic, a fall in global energy demand resulted in lower carbon dioxide (CO2) emissions. This trend became more pronounced due to a fall in fossil fuel subsidies and an increase in renewable electricity generation and electric vehicle sales. People around the world started noticing positive effects: the air was less polluted, and nature was rebounding. It looked as if there was an opportunity for an economic recovery with a beating, green heart. One where green policies support sustainable economic growth that has a positive impact on our health and well-being. The COVID fog was lifting and a net-zero future appeared achievable, slowing greenhouse gas emissions and an environmental recovery seemed like a real possibility...

...and then the unforeseeable happened.

Who could have predicted the turmoil that was still to come and how it would stymie a steady green recovery and dampen our collective will to “build back better”? Russia’s war in Ukraine has polarized the world, triggered energy and food crises and fueled an acceleration of global inflation and a rise in the cost of living. It has thrust the issue of energy security to the top of the political agenda at the expense of energy transition. In the short term, countries are putting on hold their energy transition plans and with them the goal of limiting global warming to under 2 degrees Celsius (°C). Despite a slowing global economy, lockdowns and potential capital outflow in China, demand for coal is set to return to an all-time high in 2022, matching the record set in 2013, this time supported by soaring natural gas prices. In Europe, several countries are extending the life of coal plants scheduled for decommissioning, reopening closed plants or raising caps on their operating hours to reduce gas consumption.

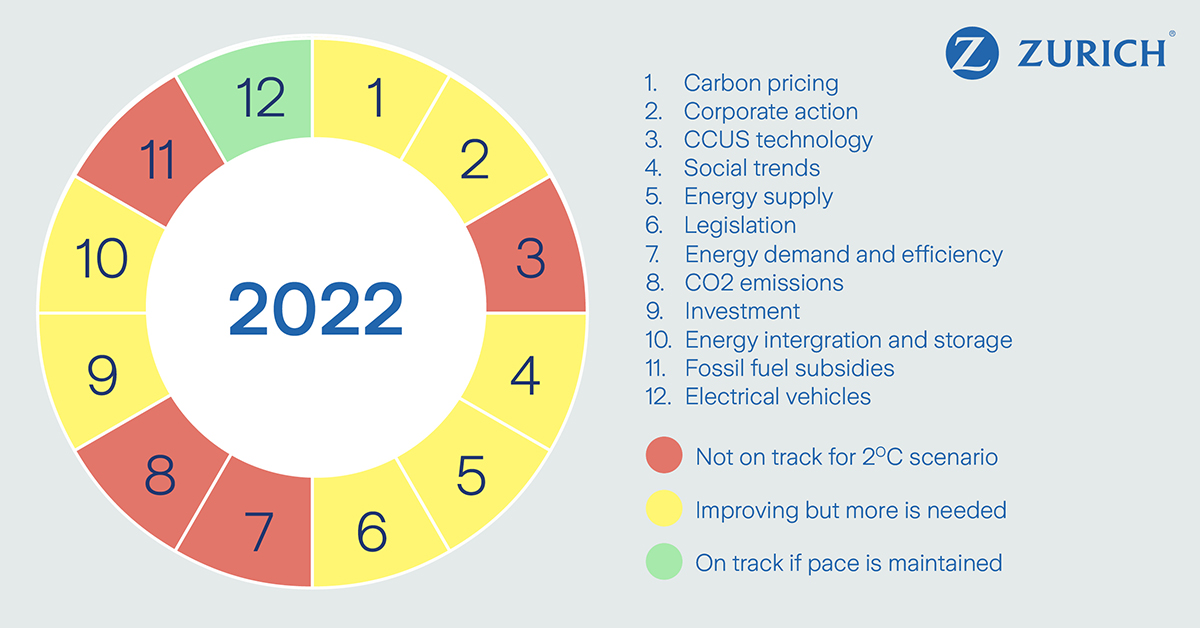

This will likely exacerbate climate change. Our Climate Change Scorecard, developed in 2017 and updated annually, shows that in 2022 the world is even further from its goal to keep global temperature rises below 2°C than in previous years.

Segments in green signify trends that enable the world to limit global warming to less than 2°C. Yellow segments represent significant improvements being made, but not on the scale required to hit 2°C. Segments not on track are colored red. On this year’s scorecard, red segments outnumber the green. In fact, three of the four red segments on the 2022 Scorecard were green last year: fossil fuel subsidies, carbon dioxide (CO2) emissions, and energy demand and efficiency.

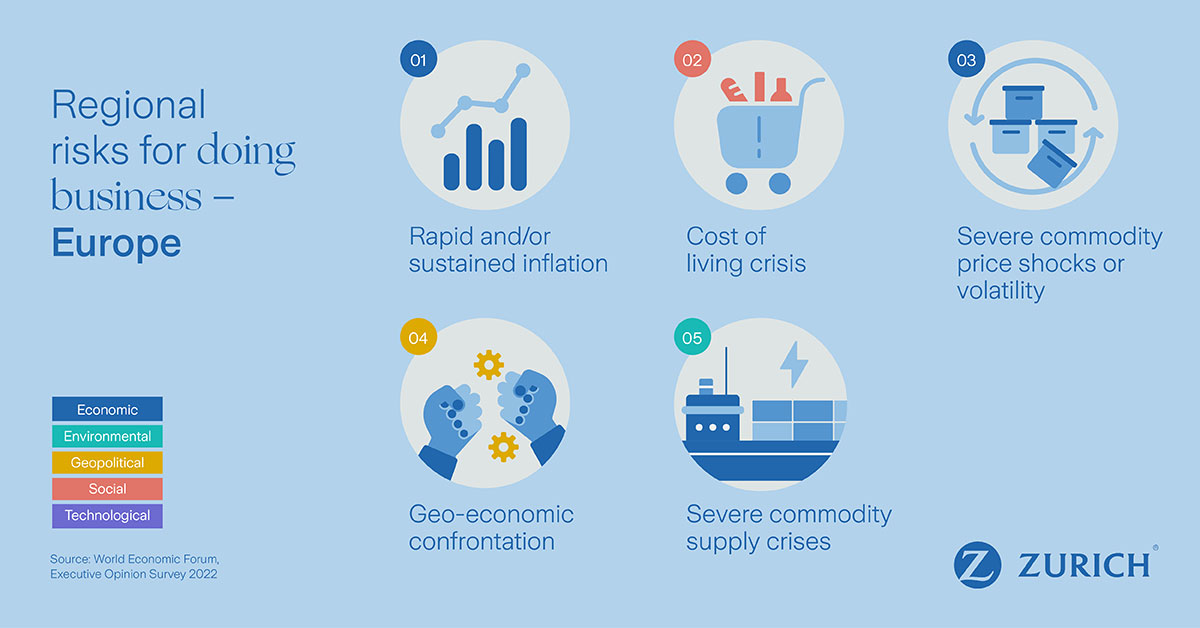

The results of the World Economic Forum’s Executive Opinion Survey 2022 show very clearly that the slow but steady progression toward environmental disaster sits low on the agendas of business leaders, who were surveyed about their top concerns. Even in climate-conscious Europe, environmental risks are being downplayed by the current geopolitical and economic worries.

Climate change is here. Its effects and consequences do not only occupy a distant future they are a reality now. The summer of ’22 brought extreme weather across the globe: record heatwaves, droughts, devastating wildfires, destructive floods. As climate change triggers more frequent and intense extreme weather events, we urgently need greater investment to strengthen resilience and reduce vulnerability to climate change.

Not only will this protect communities, it makes economic sense, too.

Studies from the Zurich Flood Resilience Alliance show that every USD 1 invested in climate resilient infrastructure saves between USD 5 and USD 10. But investment must be targeted. It’s critical we act on the three key areas: climate risk models, risk preparedness and innovation.

More risk data and modeling are needed to better inform policymakers and business leaders on current and future extreme weather exposure and vulnerabilities. We need to increase disaster risk financing and education to foster resilience towards extreme weather events. We need to use digitalization, including big data and machine learning algorithms, to increase the impact of risk finance and insurance on resilience.

It’s not all gloom and doom. As Secretary-General of the United Nations António Guterres said at the Economist Sustainability Summit in March 2022: “Instead of hitting the brakes on the decarbonization of the global economy, now is the time to put the pedal to the metal towards a renewable energy future.”

Policymakers are realizing that developing renewables and other clean energy, such as nuclear power and blue and green hydrogen is also a very effective energy security strategy because it reduces the need to import fossil fuels. Higher oil and gas prices should also reduce demand – a trend that could remain in the long term.

Recent insights from the IEA World Energy Outlook highlight that the energy crisis may become an opportunity and a historic turning point towards a cleaner, more affordable and more secure energy system. The pandemic proved that the world could unite, albeit briefly, when faced with a common threat. Now, we not only can—but must—come together, this time for the long term, to manage another existential crisis: climate change. There are opportunities for COP 27 to put the green agenda front and center; the question is: can we keep climate change in focus this time?