Impact investment

Impact Investing:

- Intentionality

- Measurability

- Profitability

As a responsible investor, we use capital markets to fund solutions to many of the pressing social or environmental issues of our time. Integrating environmental, social and governance (ESG) factors and excluding certain assets from portfolios manages the risks you take on. Impact investing, however, goes one step further. It covers a broad range of complex social and environmental objectives that aim to build a brighter future.

Zurich is a leading impact investor. We have a history of challenging ourselves, learning and sharing these learnings back to the market.

In November 2020, Zurich announced it had exceeded the original financial allocation target for its impact investment portfolio of USD 5 billion, and from now on will prioritize the impact this portfolio generates.

Over recent years, Zurich has developed a methodology to measure and aggregate impact across various asset classes. Measuring impact for various years has led to many lessons in how to measure and manage impact, specifically in how to interpret the impact intensities of various types of investments.

This knowledge allows Zurich to prioritize the targeted impact, allowing committed funds to follow. Zurich confirms its ambition to help avoid 5 million metric tons of CO2-equivalent emissions and improve the lives of 5 million people every year. We will build the diversified and profitable impact investment portfolio needed to meet these ambitions.

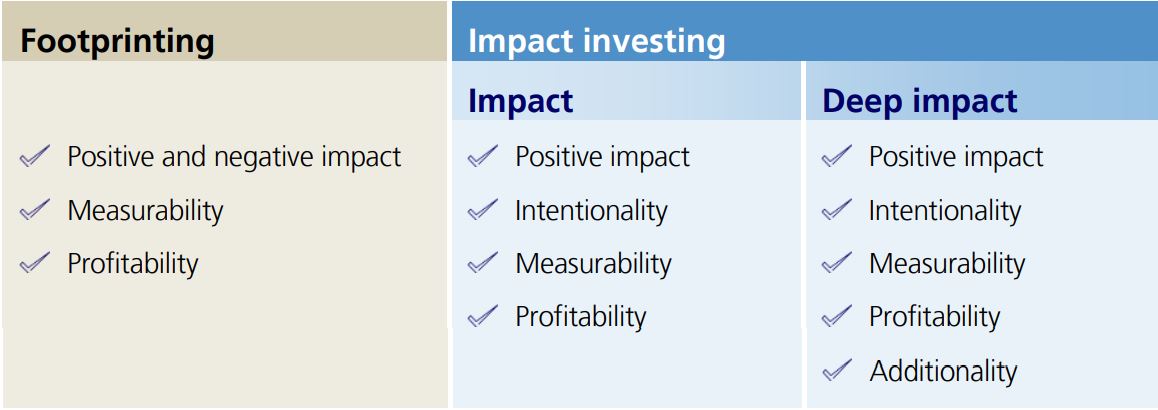

Defining impact investing

At Zurich, we define impact investing as investment opportunities that allow us to intentionally target a specific social or environmental impact, provide a measurable impact, and are profitable - meaning that they generate a financial return commensurate with their risk.

Zurich evaluates impact investments within the context of specific asset classes and creates dedicated strategies for impact investments within those classes. While continuing to make systematic use of ESG data in investment decision-making and valuation, we look at a variety of ways to grow our impact investment portfolios around the world. We focus on the following asset classes.

| Supranational, Government and Government Guaranteed Bonds / Corporate Credit |

|

| Private debt |

|

| Private Equity |

|

Zurich will evaluate new prospective opportunities across asset classes to broaden its approach and increase its investment volume.

Based on our experience as an impact investor, we also differentiate between investments that are aligned with increasing our impact and those which play a truly catalyzing role.

Impact measurement

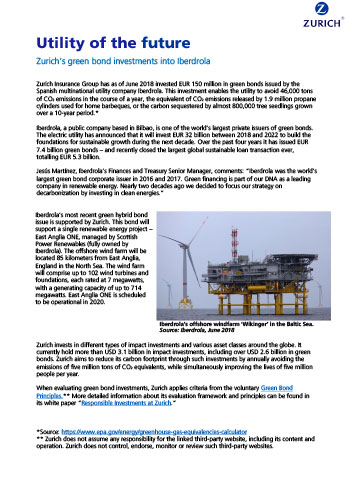

At the end of December 2024, Zurich’s impact investment portfolio of USD 8.5 billion helped avoid 3.9 million metric tons of CO2-equivalent emissions and improved the lives of 5.3 million people. The portfolio includes green bonds, as well as social and sustainability bonds, and commitments to eight private equity funds active in areas such as financial inclusion and clean technology, as well as private debt impact infrastructure investments such as wind or solar farms.

In 2024, we reached our impact ambition ‘people benefited’ by improving the lives of 5 million people through our impact investment portfolio. Zurich measures the number of individuals benefiting from a service and/or products in the sectors of healthcare, education, financial inclusions, social housing or access to clean energy.

In 2018, we developed an impact measurement framework to track the success of our impact portfolio. In 2017, Zurich increased its commitment to impact investments and became the first private sector investor to introduce impact targets. While committing to an overall investment of USD 5 billion, innovative impact targets were set, including the goal of avoiding 5 million metric tons of CO2-equivalent emissions and improving the lives of 5 million people per year.

In 2013, Zurich was the first investor to issue a request for proposal (RFP) for a dedicated green bond mandate. In a market of under USD 13 billion in issuance, we pledged to invest USD 1 billion in green bonds, which we later raised to a USD 2 billion target, catalyzing this nascent market.

Impact investing KPIs

Impact measurement

Impact portfolio

| (Impact investing portfolio) | 2024 | 2023 | Change | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|---|

| Total amount of impact investments (USD millions) | 8,460 | 7,882 | 7% | 6,328 | 7,037 | 5,770 | 4,555 | 3,790 |

| Total amount of impact investments - environmental share | 70% | 73% | - | 73% | 73% | 77% | 80% | - |

| Total amount of impact investments - social share | 30% | 27% | - | 27% | 27% | 23% | 20% | - |

| Green, social & sustainability bonds (USD millions) | 7,502 | 6,857 | 9% | 5,247 | 5,846 | 4,677 | 3,645 | 3,104 |

| Impact private equity (USD millions) | 210 | 216 | -3% | 213 | 211 | 189 | 163 | 145 |

| Impact infrastructure private debt (USD millions) | 748 | 808 | -7% | 867 | 980 | 904 | 747 | 540 |