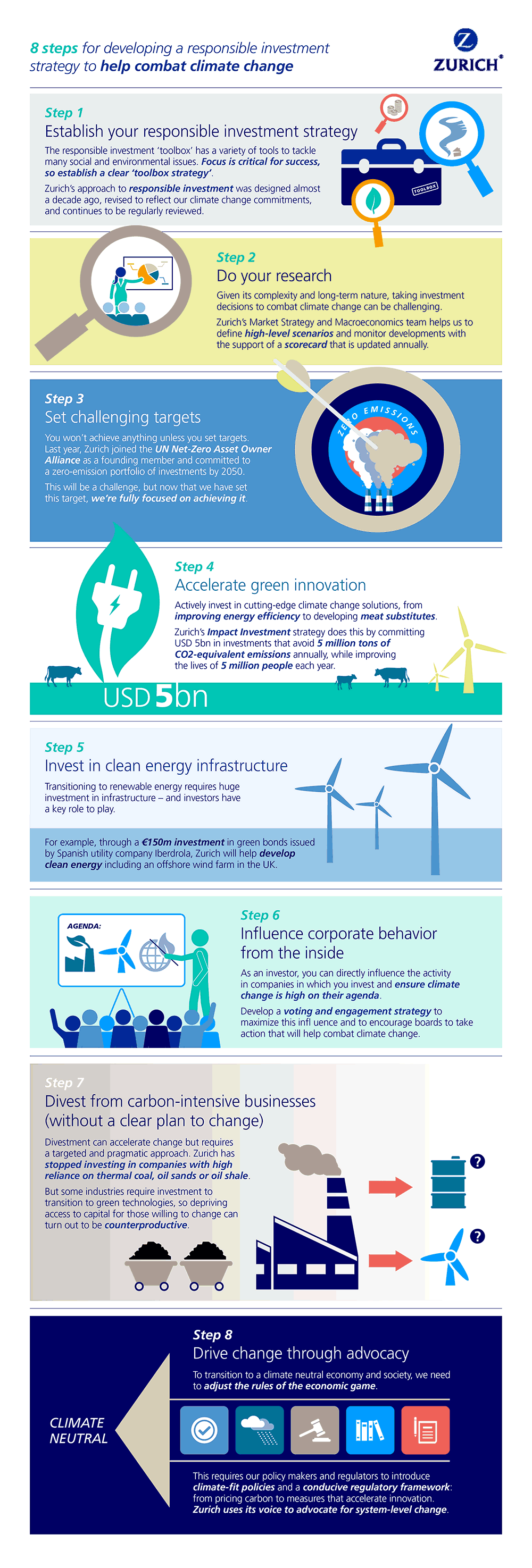

Combat climate change: Eight steps to a responsible investment strategy

Climate resilienceInfographicSeptember 1, 20202 min read

How and where we invest can have a direct impact on corporate behavior, while helping to finance the transition to a climate-neutral economy. Follow this responsible investing guide to help your investments provide environmental value as well as financial returns.

As we look for ways to combat climate change, much emphasis is placed on the consumption of resources – what we buy, what we eat, how we travel, and so on.

But how and where we invest can also have a significant impact on climate change. The concept of responsible investment has grown in popularity among both retail and institutional investors and is now viewed as a powerful tool to help combat climate change and help society.

Responsible investment is simply a strategy that integrates environmental, social, and governance (ESG) factors into investment analysis and decisions and takes a long-term view.

“The ultimate objective of responsible investment is to create social and environmental value alongside financial returns,” says Johanna Köb, Head of Responsible Investment at Zurich.

“At Zurich, we have fully integrated responsible investment practices into our overall investment approach and made them part of everyday investment decision-making,” she adds.

“For us, it is about managing our assets of approximately USD 200 billion in a way that creates sustainable value. In other words, generating superior risk-adjusted returns for our customers and shareholders, while having a positive impact on society and the communities where we live and work.”

Here are Johanna Köb’s eight steps for developing a responsible investment strategy to help combat climate change: