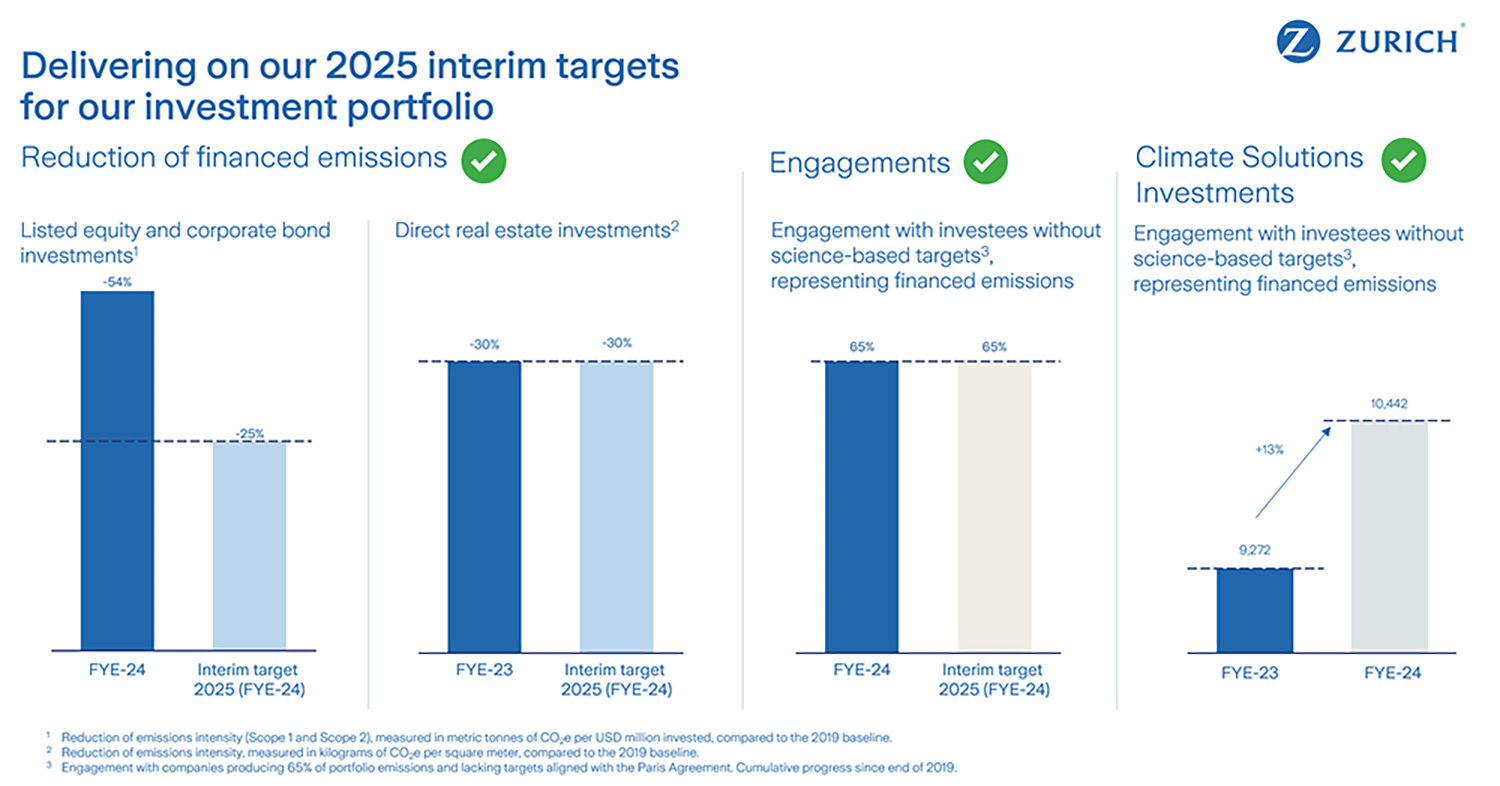

As a responsible investor, Zurich uses capital markets to fund solutions to many of the pressing social or environmental issues of our time. Zurich is committed to reduce the carbon intensity of its investment portfolios to net-zero by 2050. We also set intermediate targets for 2025 for listed equity, corporate bond and direct real estate investments. Furthermore, Zurich invests in various climate solutions via impact investment assets around the globe.

Through its private equity investments, Zurich directs its resources to generate positive impact. We follow the Global Impact Investment Network definition of impact investing as investment opportunities that allow us to intentionally target a specific positive social or environmental impact and allow us to measure the impact achieved. These investments target to generate a market-rate financial return commensurate with their risk.

Private equity as an asset class is particularly suited to impact investing. The companies receiving capital from private equity investors usually tend to be small and agile and more easily evaluated against impact objectives. Zurich typically invests in private equity, including impact investments, through fund investments. An in-house specialist team is responsible for selecting private equity fund managers which are then approved by an investment committee overseeing alternative investments. Zurich will generally not consider investing with fund managers targeting below-market financial returns, or first-time fund managers with no proven track record of value creation.

An example is Zurich's investment in a private equity fund that holds equities in NG Group (NG) since 2018.

NG Group is contributing to sustainable development by repurposing waste from households and industries. Its services extend from waste sorting to mass recycling, including separating contaminated and dangerous waste in order to provide appropriate treatment. Such services are essential to ensure that potentially heavy polluting waste is safely processed, and not discarded to have a harmful impact on people or the environment. On the other end of its processing line, NG Group has an ambition and responsibility to ensure that as much waste as possible is sent to recycling and material recovery, and enable access to recycled materials in the market to reduce the pressure on natural resource extraction. This is core to their mission of regenerating resources and abolishing waste and is a major step towards the circular economy. In 2022, Zurich’s investments helped to avoid approximately 12,000 metric tons CO2e through NG Group recycling activities, such as sending waste to recycling and material recovery compared to extracting virgin materials.

The global waste landscape presents a significant challenge with waste generation expected to increase by 70 percent by 20501. In Norway, where NG Group is headquartered, a total of 12.07 million tons of waste2 was generated in 2022. However, for Zurich and NG Group, the circular economy represents an opportunity to minimize waste, promote reuse, and enhance the use of secondary raw materials in the production of new goods.

With around 20 processing sites across Norway, Sweden, Denmark and Poland, NG Group handles 2.3 million tons of waste annually, of which 96 percent is sent to recycling, material and energy recovery. As one of Scandinavia’s largest providers of recycling and environmental services, serving over 40,000 commercial and municipal customers, its key business areas encompass recycling, green metals, urban re-use, circular and digital solutions, services related to environmentally friendly waste management and raw material extraction throughout the value chain. Zurich's investment in NG Group is aimed at facilitating innovative business models that enable the repurposing, reutilization, and repair of materials already in circulation for a transition to the low carbon economy.

1

Global Waste to Grow by 70 Percent by 2050 Unless Urgent Action is

Taken: World Bank Report

2

Waste accounts – SSB