Introduction

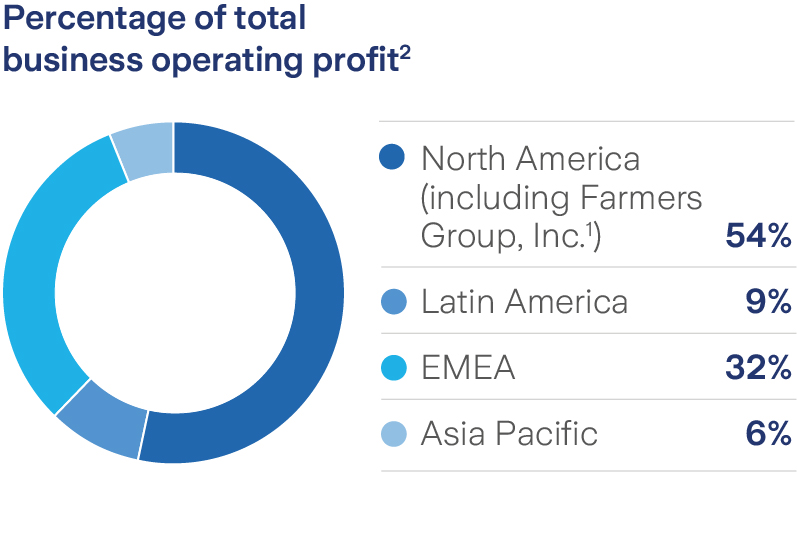

As one of the few genuinely global insurers, we have a balanced and diverse business. We have a strong position in North America and Europe as a provider of insurance to individuals, commercial operations and global corporate customers, with growing positions in Asia Pacific and Latin America.

Note: Percentages may not total 100 due to rounding. 1 Farmers Group, Inc., a wholly owned subsidiary of the Group, provides certain non-claims services and ancillary services to the Farmers Exchanges as its attorney-in-fact and receives fees for its services. Zurich Insurance Group has no ownership interest in the Farmers Exchanges. 2 Based on business operating profit before net expenses of group functions and operations and non-core businesses for which regional allocation is not available.

Europe, Middle East, Africa

Zurich has major operations in Germany, Italy, Spain, Switzerland and a presence in other countries, including key markets in the Middle East.

Property & Casualty gross written premiums and policy fees

USD 2.8 bn

Life gross written premiums and policy fees

USD 1.5 bn

Business operating profit1

USD 0.3 bn

1 Based on business operating profit before net expenses of group functions and operations and non-core businesses for which regional allocation is not available.

North America

In North America, Zurich is a leading commercial property and casualty insurance provider serving a number of sectors, including global corporate, large corporate and middle market. It additionally serves life clients in the retail, affluent and corporate markets. The Group also operates through Farmers Group, Inc.1 in the U.S.

Property & Casualty gross written premiums and policy fees3

USD 2.8 bn

Life gross written premiums and policy fees3

USD 0.1 bn

Business operating profit2 including Farmers Group, Inc.1

USD 0.5 bn

1 Farmers Group, Inc., a wholly owned subsidiary of the Group, provides certain non-claims services and ancillary services to the Farmers Exchanges as its attorney-in-fact and receives fees for its services. Zurich Insurance Group has no ownership interest in the Farmers Exchanges. 2Based on business operating profit before net expenses of group functions and operations and non-core businesses for which regional allocation is not available. 3Excluding Farmers Group, Inc.

Latin America

Zurich operates in Brazil, Mexico, Argentina and Chile, among other countries.

Property & Casualty gross written premiums and policy fees

USD 0.4 bn

Life gross written premiums and policy fees

USD 0.4 bn

Business operating profit1

USD 0.1 bn

1Based on business operating profit before net expenses of group functions and operations and non-core businesses for which regional allocation is not available.

Asia Pacific

Zurich has a growing footprint in Asia Pacific, with operations in Australia, Hong Kong, Indonesia, Japan and Malaysia.

Property & Casualty gross written premiums and policy fees

USD 0.5 bn

Life gross written premiums and policy fees

USD 0.4 bn

Business operating profit1

USD 0.1 bn

1 Based on business operating profit before net expenses of group functions and operations and non-core businesses for which regional allocation is not available.

- Intro

- EMEA

- NA

- LATAM

- APAC