Disclaimer and cautionary statement

Read the full Disclaimer and Cautionary Statement.

By accepting you represent that you have read and understood the full Disclaimer and Cautionary Statement.

Highlights

We continue to deliver strong sustainable performance.

Net income attributable to shareholders (NIAS)

USD

3.8

Market capitalization1

CHF

56.2

Proposed gross dividend per share2

CHF

20

Customers interviewed through NPS3

1025000

CO2e emissions per employee4

1.8

Total amount of impact investments5

USD

5.8

Net income attributable to shareholders (NIAS)

USD

3.8 bn

1 Market valuation as of December 31

2 2020 is proposed dividend per share, subject to approval by shareholders at the Annual General Meeting. Gross dividend, subject to 35 percent Swiss withholding tax.

3 In 2020, Zurich interviewed over 1 million customers (including Zurich Santander) in over 25 countries through its Net Promoter System (NPS) program.

4 Number shown as of 2019; 2020 data will be available in Q2 2021.

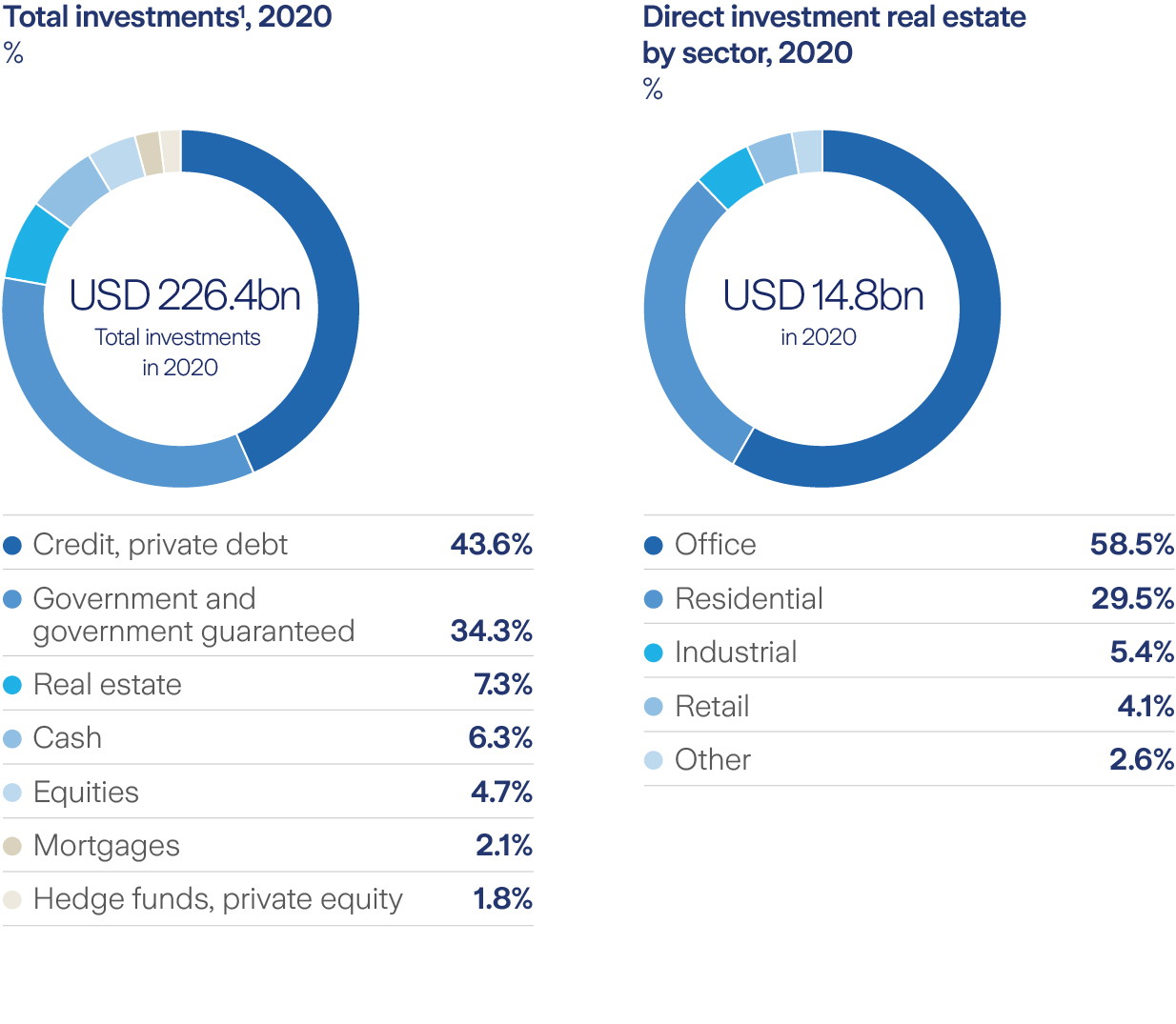

5 Impact investments in 2020 consisted of: green bonds (USD 3.8 billion), social and sustainability bonds (USD 904 million), investments committed to private equity funds (USD 189 million, thereof 64 percent drawn down) and impact infrastructure private debt (USD 904 million).

What are you interested in?

Story view Download the fullAnnual Report 2020 Download theFinancial Review 2020Leveraging our strengths

We continue to focus on customers, while simplifying our business and driving innovation. Our strengths provide a good basis for our success. We implement our strategy by remaining true to our purpose and values.

Our targets for 2020-2022

We see opportunities to grow the business. We will remain cost-driven and continue to simplify the organization. We aim to improve portfolio quality and make better use of capital.

1 Business operating profit after tax return on equity, excluding unrealized gains and losses.

2 Before capital deployment

3 From FY-20 the basis for the Group’s target capital has been changed to the Swiss Solvency Test (SST). Previously the target was based on the Group’s internal Z-ECM basis.

Dynamic, agile and well balanced

Together with the Group’s customer-focused strategy and simplified operating model, the results position the Group well to take advantage of ongoing changes within the global insurance industry and to deliver further value to shareholders.

Our business segment performance:

Insurance, services and risk insights.

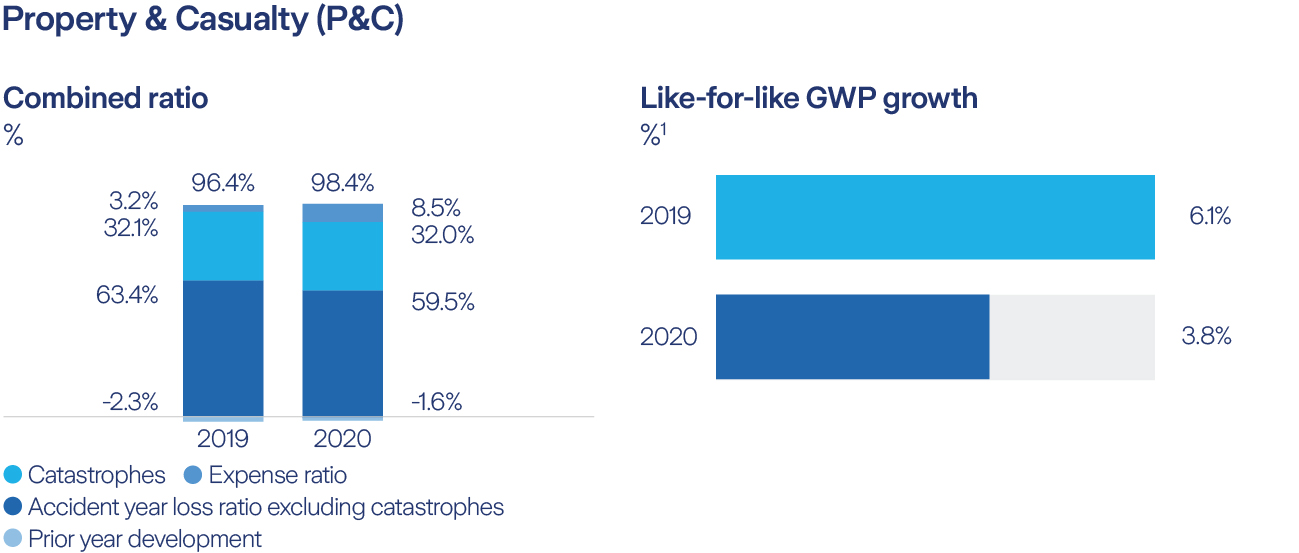

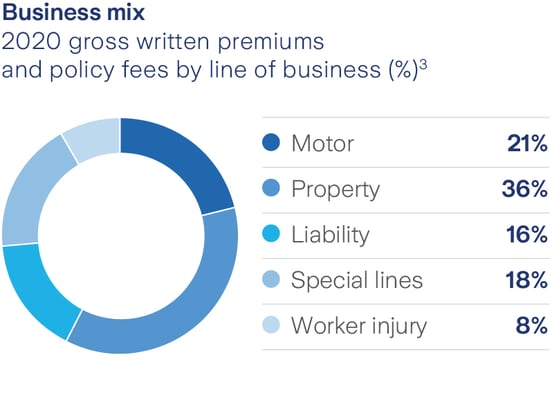

Commercial insurance generates around two-thirds of the Group’s Property & Casualty gross written premiums. Zurich is well placed to benefit from strong pricing trends expected in commercial insurance in 2021, having reshaped its commercial portfolio during 2016-2019.

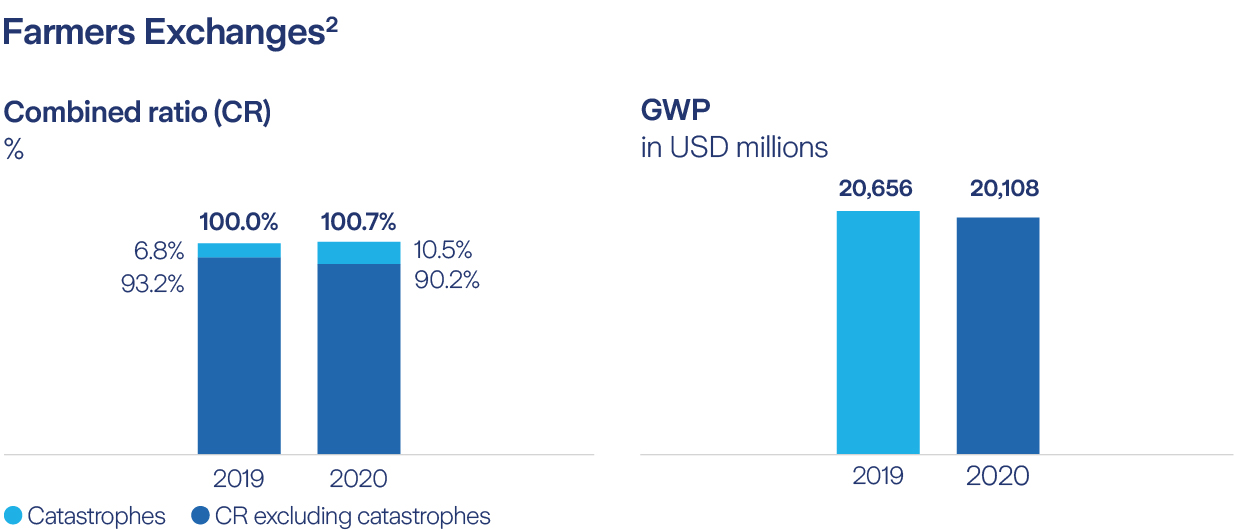

1 Zurich Insurance Group has no ownership interest in the Farmers Exchanges. Farmers Group, Inc., a wholly owned subsidiary of the Group, provides certain non-claims services and ancillary services to the Farmers Exchanges as its attorney-in-fact and receives fees for its services. Details on business mix of the Exchanges are provided for informational purposes only.

2 Based on business operating profit before net expense of group functions and operations and non-core businesses.

3 Percentages may not total 100 due to rounding.

As an insurer, we have a key role to play in supporting customers, employees, investors, communities, and the planet we share, by building resilience and serving their needs.

The Path to sustainability

During an unprecedented year of social and economic disruption, we have demonstrated our commitment to supporting a sustainable future. Zurich is proud to make a difference to the lives and the futures of our stakeholders. Our non-financial measures below provide more insight:

Read more about our stories from the year

Downloads

| Full Annual Report | (16.5 MB/PDF) |

| Group overview | (9.2 MB/PDF) |

| Governance | (4.7 MB/PDF) |

| Risk review | (556 KB/PDF) |

| Non-financial statements (incl. GRI index) | (511 KB/PDF) |

| Financial review | (1.7 MB/PDF) |