Highlights

We continue to deliver strong sustainable performance.

Explore to see details

Net income attributable to shareholders (NIAS)1

USD

1,7 bn

Market capitalization2

CHF

24,8 bn

Proposed gross dividend per share3

CHF

8

Customers interviewed through NPS4

162'796

CO2e emissions per employee5

0,8 tons

Total amount of impact investments6

USD

1,9 bn

1 Net income attributable to shareholders (NIAS)

2 Market valuation as of December 31

3 Gross dividend, subject to 35 percent Swiss withholding tax. 2019 is proposed dividend subject to approval by shareholders at the Annual General meeting.

4 In 2019, Zurich interviewed over 1 million customers (including Zurich Santander) in 25 countries through its NPS (Net Promoter System) program.

5 Number shown as of 2018; 2019 data will be available in Q2 2020.

6 Impact investments in 2019 consisted of: green bonds (USD 3.1 billion), social and sustainability bonds (USD 539 million), and investments committed to private equity funds (USD 163 million, thereof 36 percent drawn down) and impact infrastructure private debt (USD 747 million).

What are you interested in?

Story view Download the full Annual Report 2019 Download the financial review 2019Our strategy is successful

We continue to focus on customers, while simplifying our business and driving innovation. Our strengths provide a good basis for our success. We implement our strategy by remaining true to our purpose and values.

Focus on customers

Our transformation to become a truly customer-led company is well underway and we have established a platform from which to evolve and grow.

Simplify

We have successfully simplified our business and operations, to make better use of our resources.

Innovate

We are adapting to make sure we continue to meet and exceed customers’ expectations and needs.

How we delivered on our 2017-2019 targets

2017 - 2019 targets:

BOPAT ROE1

Z-ECM

Net cash remittances

USD

>4,0 bn (cumulative)Net savings

USD

0,6 bn by 2019 compared with 2015 baselineAchieved:

BOPAT ROE

Z-ECM2

Net cash remittances

USD

4,5 bn

Net savings

USD

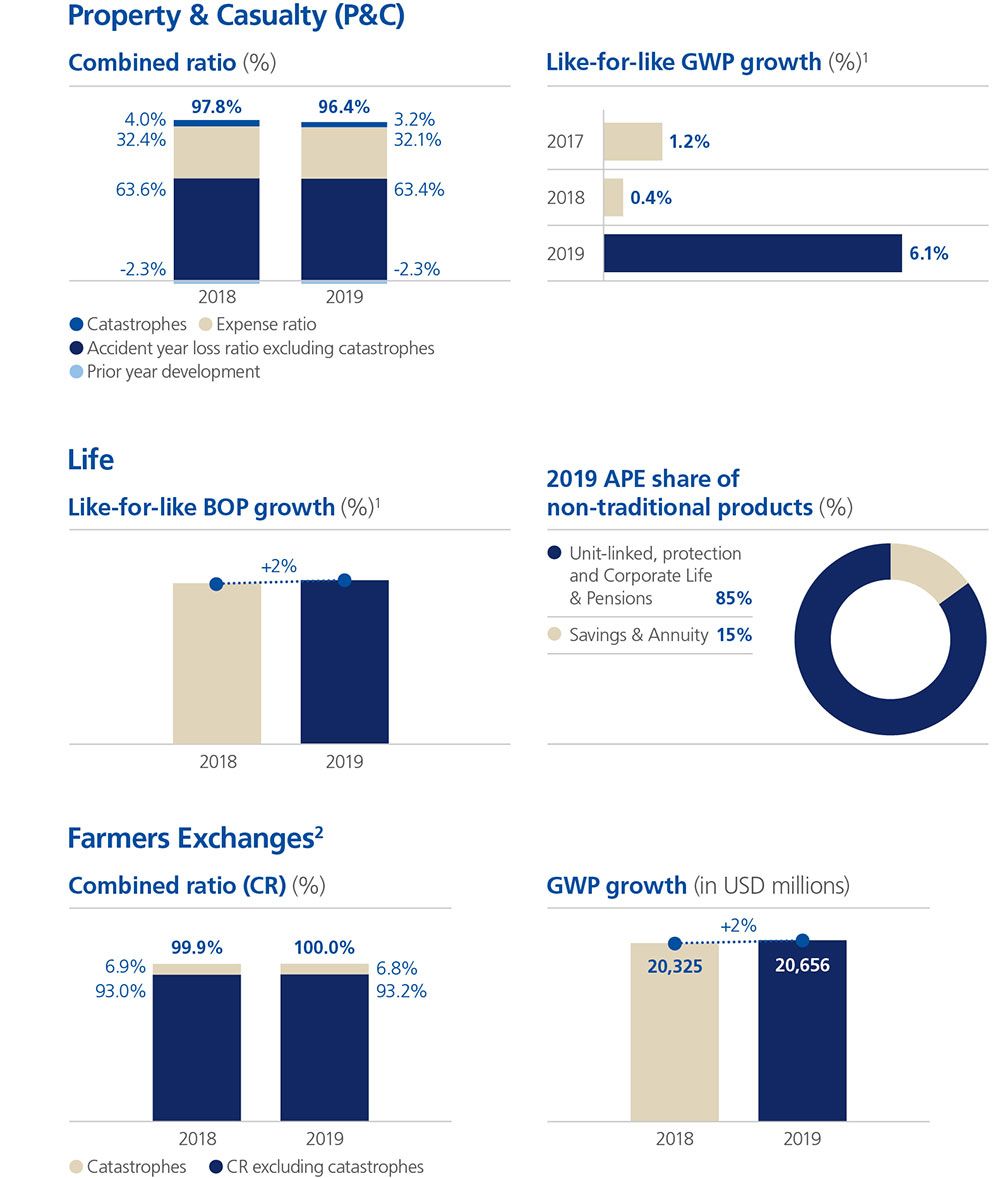

0,7 bnWe improved our business mix, reduced volatility and improved profitability of our Property & Casualty portfolios while further growing our Life franchise through targeted acquisitions. We entered new and innovative markets and succeeded in reducing expenses. Our management structure has been strengthened and reinforced. And customer and employee satisfaction has improved. Farmers Exchanges has transformed its agents force and expanded its solutions for millennials.

Our targets for 2020-2022

2020 - 2022 targets:

BOPAT ROE1

Z-ECM

Net cash remittances

USD

>4,8 bn (cumulative)Compound organic earnings per share growth3

at least

2% per annumWe see opportunities to grow the business. We know which type of growth we want to achieve. We will remain cost-driven and continue to simplify the organization. We aim to improve portfolio quality and make better use of capital. To sharpen our focus on customers, we are also adding two new KPIs.

Our strategic focus has enabled us to deliver a strong performance across our business

Together with the Group’s customer-focused strategy and simplified operating model, the results position the Group well to take advantage of ongoing changes within the global insurance industry and to deliver further value to shareholders.

Our business segment performance:

Business operating profit

USD

1,2 bnGross written premiums and policy fee

USD

14,3 bnWe also continue to build on our commitment towards a sustainable future

Zurich is proud to make a difference in the lives and futures of our customers, employees, investors and communities. Our non-financial measures below provide more insight:

Read more about our stories from the year

Downloads

| Full Annual Report | (8.8 MB/PDF) |

| Group overview | (3.8 MB/PDF) |

| Consolidated non-financial statements (incl. GRI index) | (171 KB/PDF) |

| Governance | (2.6 MB/PDF) |

| Risk review | (709 KB/PDF) |

| Financial review | (1.7 MB/PDF) |

1 Business operating profit after tax return on equity, excluding unrealized gains and losses.

2 Full year 2019 Z-ECM reflects midpoint estimate with an error margin of +/–5 percentage points.

3 Before capital deployment.