The business benefits of tackling environmental risks

Climate resilienceArticleMay 26, 2017

Discover why understanding and mitigating environmental supply chain risks is vital to businesses success

Climate change and other environmental risks have gradually been moving up the global business agenda, becoming a mainstream issue in most boardrooms, rather than simply a matter of compliance. Yet current approaches to managing scarce natural resources and building resilience to environmental threats still leave much to be desired.

The problem relates not to awareness - environment-related risks have featured among the World Economic Forum’s top global risks for seven consecutive years and the 2017 Global Risks Report which Zurich was involved in as a strategic partner, classes extreme weather and failure to mitigate or adapt to climate change as high impact, high likelihood scenarios. The business ‘blind spot’ seems to be around how to measure and mitigate the risk.

Cecilia Reyes, Group Chief Risk Officer, Zurich, says: “Part of effective risk management is understanding the risks, their triggers and one’s exposure. Companies need to go through each value chain and ask themselves about the likelihood and potential impact of adverse events. Only then can they start taking actions to mitigate the probability of such an event or reduce the adverse impacts.”

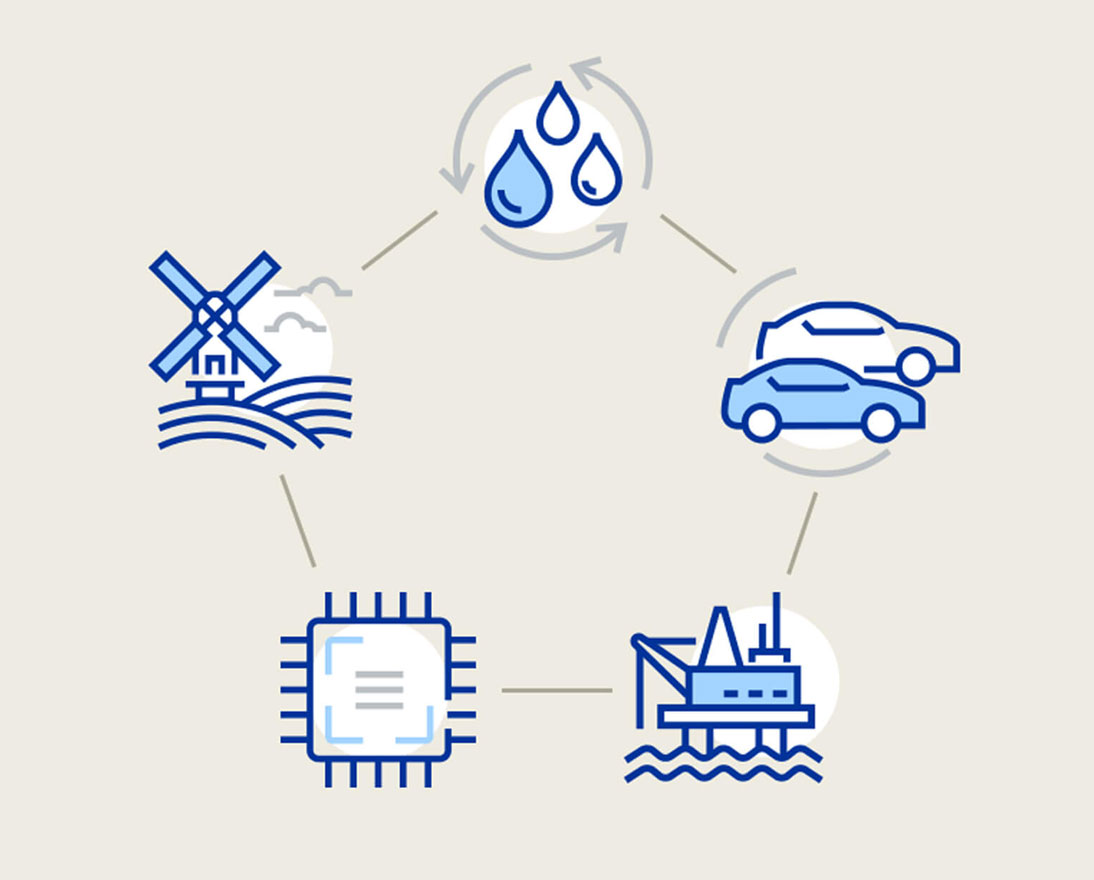

The scale of concern over environmental risks is leading companies and countries to realize they need a better understanding of how environmental and social risks are interconnected and can exacerbate each other, how knowledge of these risks can be used to make supply chains and business output more resilient; and how the technologies of the Fourth Industrial Revolution (4IR) can be used to manage environmental risks and promote productive use of natural resources.

"The understanding of long-term impacts starts at the top with the board and has to be embedded in long-term strategy all the way down to individual employees”, says Cecilia Reyes.

The level and nature of environmental risk varies between companies, depending on their business, but at a global level water scarcity is one of the biggest environmental challenges - and one that has been underestimated, according to Zurich’s Risk Report on Water Scarcity. The report highlights water as a global challenge to business, pointing to a World Bank statistic (2016) that suggests regions of Africa and the Middle East could see growth rates decline by up to 6 percent of GDP by 2050 due to water scarcity.

Valuing Natural Capital

Experts hope that by articulating the water risk in financial terms businesses may feel better equipped to address it. A workgroup has begun assigning value to natural resources, to motivate efficiency and allow companies to quantify their exposure in more tangible terms.

A company that understands its risks and dependencies has a competitive advantage.

Dr Maria Mendiluce, WBCSD

The Natural Capital Protocol [see box] provides the first standardized international framework for companies to assess their dependency and impact on natural resources. The World Business Council for Sustainable Development (WBCSD) led the development of the Protocol, which can be applied to any sector and any location.

“A company that understands its natural capital risks and dependencies has a competitive advantage, as it can better hedge its risks,” said Dr Maria Mendiluce, WBCSD’s Managing Director, Natural Capital. “The worst thing for a company to discover is a risk they haven’t thought about when it’s too late.”

Cecilia Reyes of Zurich agrees: "Insurance is an efficient tool to protect against risks but it still makes sense to identify and mitigate the risks because the cost of buying protection is directly proportional to the level of exposure."

Experts say water scarcity is partly a result of a failure to value it appropriately, especially in inefficient agricultural use. One solution to this being mooted is blockchain-enabled water markets. “When people talk about blockchain, they’re talking about trading water and that’s immensely important,” says Dr Richard Damania, Global Lead Economist at the World Bank’s Water Practice. “The contribution of water to the economy is less than it could be, so reallocation matters.”

Dr Damania said the concept puts a welcome emphasis on assessing inputs as well as outputs. “Governments can’t and shouldn’t dictate who consumes water but they can create enabling frameworks that allow water transfers to occur while ensuring environmental protection.”

Improved water stewardship has huge benefits for human wellbeing and economic progress; poor sanitation can impair cognitive and physical development and cause poor girls to miss out on education. Dr Damania says these issues are bringing finance ministers to the table in the search for solutions. “Education and health are very powerful arguments,” he says. “Everyone buys into that.”

One European study found that a 1 percent improvement in resource efficiency could boost GDP by up to EUR 23 billion and significantly boost employment. But as with any public sector initiative, success is more likely when the private sector is on board. Because businesses rely on a secure supply of water it makes business sense for companies to also make a commitment to water stewardship through steps such as appointing a champion from senior management and implementing a water management and conservation plan. (See further recommendations in Zurich’s Risk Report on Water Scarcity)

Managing Environmental and Resource Risks

Resource scarcity is only one of the many dimensions to environmental risk. The impact of severe weather, climate change and the related disruption to supply chains is an area that is hard to address in a practical sense – especially when seemingly localized problems in one country can cause major challenges in other parts of the world.

In 2011, Japanese carmaker Toyota saw its profits hit after floods in Thailand disrupted the supply of parts. Thailand is also the world’s biggest exporter of natural rubber. Further flooding in January 2017 pushed up the price of rubber and threatened Thailand’s ability to meet orders from China, the world’s biggest automobile market.

Through its work with partner companies the WBCSD has become aware that

businesses in many sectors remain surprisingly reliant on a few supply sources in a single region despite globalization – adding to their vulnerability. The council believes companies that fail to understand their exposure and mitigate the environmental risks to their operations are likely to be challenged by shareholders.

Zurich’s Global Catastrophe Management team uses sophisticated models to assess the probability and severity of extreme events. Iwan Stalder, Head of Catastrophe Management, Global Underwriting says diversifying supply chains is desirable but adds that pinpointing potential problem areas is often challenging. Especially large companies with thousands of suppliers or fast growing companies lack “perfect knowledge” of their supply chains and others are reluctant to list all their suppliers for reasons of confidentiality. “There’s also the technical challenge and cost of getting all the information in a standardized form when it might be spread across papers, websites and tables,” he says.

Risk management is not only about looking at the downside but also the upside.

Cecilia Reyes, Group Chief Risk Officer, Zurich

But organizations need to understand that this process is crucial to mitigating their risk exposure. “It has to be viewed as an investment in avoiding larger potential losses,” Mr Stalder adds. “When you get the data you need, you get a deeper insight.”

Cecilia Reyes, Group Chief Risk Officer, Zurich, says companies should audit all their supply chains for vulnerabilities before deciding which actions are appropriate for them – and for good reason. “Risk management is becoming ever more important as a success factor for any company,” she says. “It’s not only about looking at the downside but also the upside.”

This data-led and financially measurable approach to managing risk around extreme weather and resource scarcity means companies now have sophisticated tools to analyze and quantify their risk – but so too do investors, and the implications of this are huge. Environmental risk has the potential to snowball from a local resource problem to a global supply chain problem to an operational issue to a financial issue. In other words, any company neglecting its environmental risk is not only exposing itself to operational risks – but also financial risks as investors lose confidence.

Companies that recognize the interconnected nature of global and local risks on the one hand and environmental and financial risks on the other are empowered to put top-down strategies in place for mitigating and protecting their operations. Combined, their efforts should also help mitigate the potential for environmental devastation.

Key Takeaways:

- Awareness of environmental risks is increasing, but company leaders need to improve their understanding of what these risks mean for them in a very specific sense so they can analyze, quantify and mitigate their risks

- To help companies better understand their exposure to natural resource scarcity efforts are advancing in quantifying natural capital – assigning a value to the water that a company uses for its operations, for example

- Companies are also being encouraged to audit every link in their supply chains to understand where they are vulnerable; this is amplified by the fact that despite globalization a surprising proportion of companies still rely on suppliers from a single region, meaning a localised extreme weather event can trigger a global supply chain crisis

- Environmental risk can very quickly become a business risk and therefore a financial risk, so companies that fail demonstrate environmental risk resilience are likely to be punished by investors

The Natural Capital Protocol is a standardized framework to help companies make better decisions by fully considering interactions with nature. Natural capital refers to renewable and non-renewable sources such as plants, animals, air, water, soils, and minerals. Launched in 2016, the Protocol enables businesses to identify, measure and value their impacts and dependencies on such capital. WBCSD led its development in partnership with experts from science, academia and other areas.