Insurers look to put a price on climate change risk

Climate resilienceArticleDecember 11, 2019

Insurers and risk managers need to model and price for climate change risk and build resilience, as a warmer world looks ever more likely, according to Zurich Insurance Group.

By Stuart Collins, Commercial Risk

Two studies published last week indicate the risks of a warmer world are increasing, as governments fail to adequately tackle climate change. The latest annual UN emissions gap report reveals that the world is likely to miss the UN Paris Climate Agreement target of keeping temperatures below 2°C more than pre-industrial levels, let alone the deal’s more ambitious goal of 1.5°C.

In fact, greenhouse gases reached record levels in 2018, according to a recent World Meteorological Organisation study. Current levels of CO2 emissions put the planet on course to experience a temperature rise of 3.2°C by the end of this century. Even if all current emissions targets are met, the world would still warm by 3°C by 2100, the UN emissions gap report states.

The UN report argues that the world’s biggest polluters are not cutting emissions fast enough – 15 of the 20 wealthiest countries have no timeline for a net-zero target. If the world is to avoid exceeding 1.5°C warming, countries would need to increase their carbon-cutting efforts fivefold, the report notes.

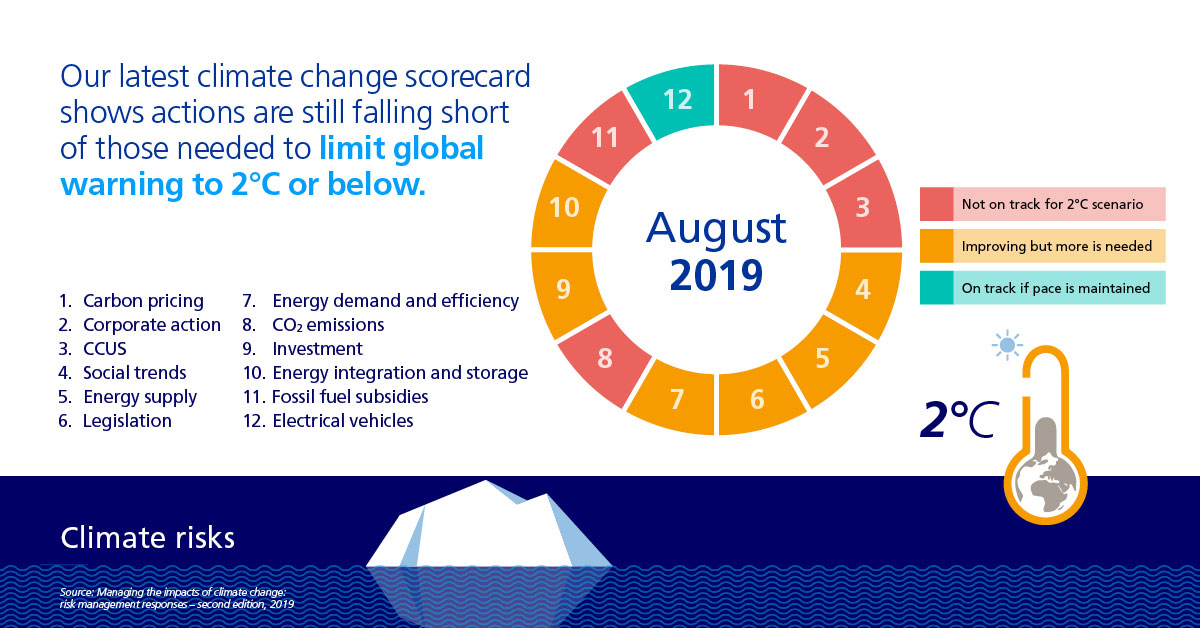

These findings echo research from insurer Zurich. Its climate change scorecard analysis in 2019 finds that – despite legislation, sentiment and social trends that have shifted in favor of tackling climate change – actions still fall short of what is needed to sustainably transition the global economy and societies to a 2°C scenario. In its initial scorecard in 2017, Zurich estimated the likelihood of missing the Paris Agreement’s target was higher than achieving it.

In fact, during the past three years, actions needed to avoid the likely “irreversible and catastrophic effects” of exceeding the Paris Agreement’s 2°C target are less developed than they were in 2017. Five of the 12 indicators monitored by Zurich’s climate change scorecard are not on track to meet the 2°C target in the 2019 report, compared with just three in 2017. For example, fossil fuel subsidies have risen, not fallen, while investment levels in climate change measures are lower.

“Despite an upswell of climate change activism, regulation and legislation in recent years, actions are still insufficient and emissions have continued to rise. As it stands, we appear to be on track for a world that is 3°C or 4°C warmer. Unfortunately, this will mean we are likely to continue to see an increase in the volatility of storms, floods, heatwaves, droughts and wildfires,”commented Alison Martin, Zurich’s chief executive officer for Europe, Middle East and Africa.

Speaking to Commercial Risk, Ms Martin said risk managers and insurers have an important role to play in raising awareness of climate change risk and mitigating the impacts. In particular, insurers and risk managers could demonstrate the cost of climate change, to both aid discussion on risk and to guide investments and decision making, she said.

The role of risk managers is to raise awareness of climate change risk at board level, but it is often difficult for them to link climate change risks to earnings, which are reported quarterly, said Ms Martin.

“The role of the risk manager should be to identify and quantify the physical risks of exposure as well as the transitional risks for various climate change scenarios, such as changes in consumer behavior or stranded assets. They can help their organizations understand what these scenarios might look like and the likely impact,” said Ms Martin.

”It is becoming more and more likely these risks will crystallize, and being aware of what might lie ahead is just good risk management,” she said.

According to Ms Martin, insurers and reinsurers are already looking at whether climate change risk can be transparently priced into cover.

“Attribution of climate change is difficult but it would be useful for businesses if insurers were able to say what proportion of insurance premium represents the cost of climate change – in other words, to put a price on climate change risk. As an industry, we are beginning to explore if there could be an agreed method for providing that kind of attribution. Whether we could provide an indication of current catastrophe loading in pricing,”Alison Martin, Zurich’s chief executive officer for Europe, Middle East and Africa.

There are also moves to develop climate risk modelling tools that could be used by insurers and large corporates alike. Corporates could use models to develop adaptation strategies to the physical risks of climate change, and even to help understand the physical impacts of climate change on supply chain risks, Zurich said.

The insurer is soft launching a climate risk advisory service, which will provide large corporates with bespoke and granular-level analysis and modelling of climate change exposures and their impact. The service has been piloted with a number of Zurich clients and will be expanded and improved over time, in part with advancements in technology, explained Ms Martin.

Catastrophe modelling and analysis have historically been proprietary for insurers, which use the outputs of models to manage their own natural catastrophe risks. However, other industry sectors are beginning to look towards the insurance industry to apply this expertise beyond the understanding of current climate risks and to apply it in a forward-looking manner to climate change risk, according to Zurich.

Demand for risk management tools that measure the impact of climate change is increasing, driven by the increased impact and frequency of natural catastrophes and the realization that insurance alone is not an adequate strategy for such events. The challenge for insurers, however, is to combine the industry’s expertise in catastrophe modelling with climate change models, which predict the potential effects of climate change for given scenarios, according to Zurich.

Original story published by Commercial Risk online.