Calling for dynamic social protection systems

Future of workArticleJuly 9, 2018

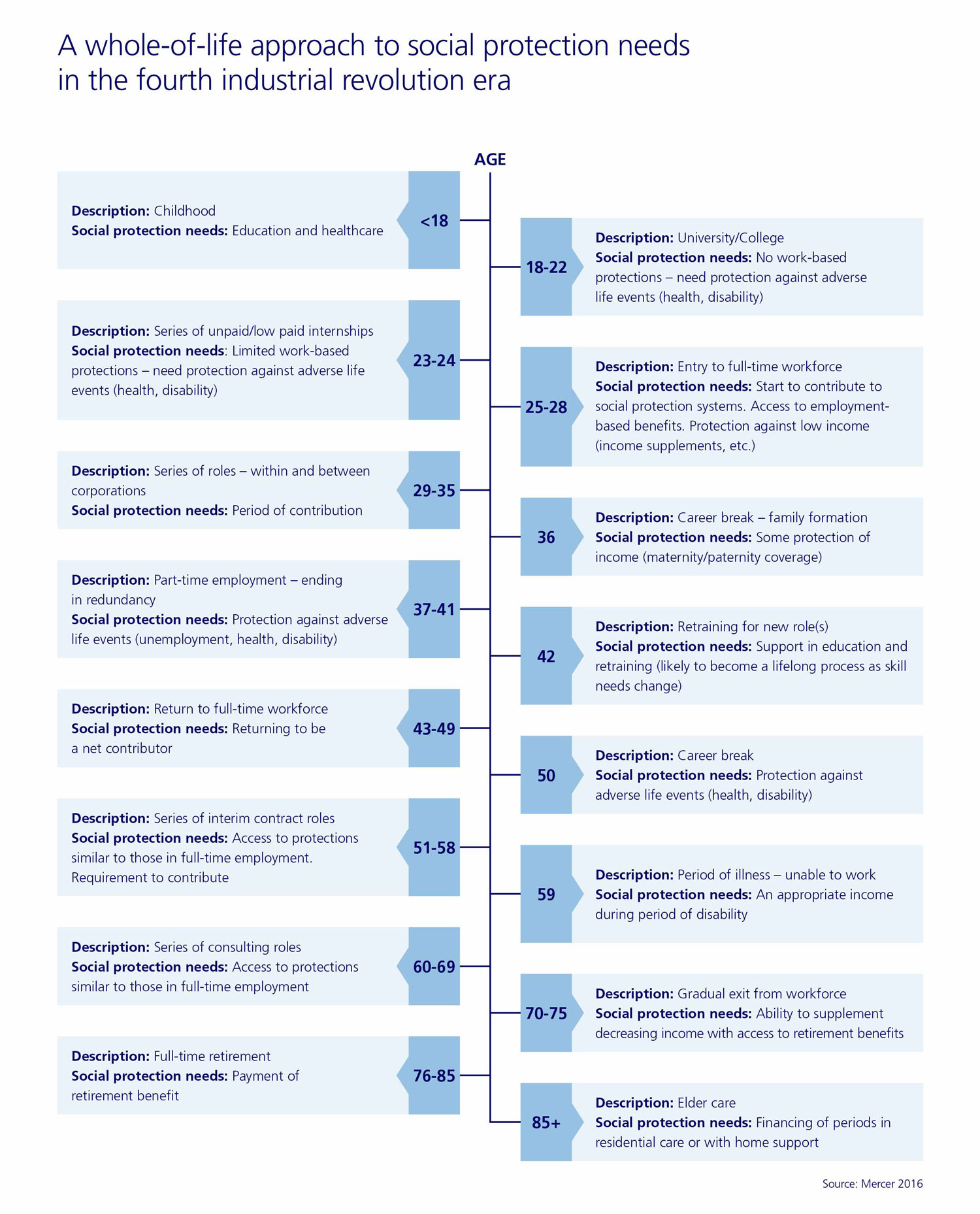

A shift to a whole-of-life social protection approach can reduce risks linked to sharing economy, aging and artificial intelligence.

Social Protection Needs: A Whole-of-Life Approach

The transformative effects on the workforce arising from the Fourth Industrial Revolution (4IR) mean traditional social protection models are increasingly ill-suited to 21st Century ways of life. Today’s social security systems emerged when salaried employees tended to spend their careers in one country (and sometimes one company) and retired by 65. Globalization has since transformed our economies, which must also support growing dependent populations as people live longer. Now the sharing economy and artificial intelligence (AI) are accelerating the trend toward individuals shouldering more of the risks.

Risks that demand a reset

The emergence of self-employed and freelance is an amplification of a dual labor market, according to Professor Gordon L. Clark, the director of the Smith School of Enterprise and the Environment, University of Oxford. “There is a group of people who benefit from self-employed status enormously; however, there is a group of people who are exploited as a consequence,” insists Professor Clark.

Up to 162 million Americans and Europeans work in the sharing economy with 50 million doing so out of necessity, according to the McKinsey Global Institute. While many also hold other jobs, huge numbers must cope with unpredictable incomes and few or no employment rights. Millions more could lose their jobs to AI in the coming decades: a 2013 University of Oxford report said 47 percent of U.S. jobs are at risk and Forrester predicts that 6 percent will go within five years. The 4IR will make ‘flexicurity’ ever more important as companies target ‘hyper-agility’ and workers face constant pressure to reskill. Therefore, the need to rebalance the risks these dynamics create calls for more relevant social protection programs.

Aging populations are also putting huge pressure on state-funded safety nets: a 2016 report by The Geneva Association think tank estimated the worldwide pension gap to be USD 41 trillion. Globalization and the associated transience of millions of workers pose another challenge: 244 million people were living outside their country of birth in 2015, a 41 percent increase compared with 2000.

The University of Oxford’s Professor Clark points to the differing income protection safety nets, according to background. “Migrant workers in many countries almost always regard family as the first port of call. They may possibly consider the employer who sponsors their migration but will rarely rely on government. If you talk to non-migrant workers in the same country, they would consider the family and the employer equally obliged to provide protection. And in some cases, in some countries, there are high expectations of government.”

Research by Zurich and the Smith School of Enterprise and Environment (SSEE) at the University of Oxford has already highlighted the extent of income protection gaps in traditional and emerging economies. Only a radical move to a whole-of-life approach can address all the risks involved. This is especially true at a time of slow growth in mature markets, high levels of government debt and widespread retrenchment of state support for the unemployed and vulnerable.

The way forward: public and private sector solutions

Individuals will need to be more proactive to make themselves and their families financially resilient: finding the right protection at the right time, whether their focus is education, work, raising children or retirement. Zurich’s research with SSEE highlighted a number of problems relating to people’s understanding of their personal risk. Specifically, many people underestimate the risk that they will need income protection insurance and overestimate the likely cost of coverage. Furthermore, as the sharing economy grows, increasing numbers of workers lack the benefits afforded to permanent workers by employers and the state.

Paolo Marini, Zurich’s Director Global Customer & Distribution Management, Corporate Life & Pensions said individuals need help from both the private and public sectors. In his view, employers and governments have a shared interest in tackling a “dangerous cocktail” of income insecurity and rising housing costs. Businesses guaranteeing a minimum protection level for all workers will attract and retain talent, while nation states stand to reduce social unrest. Governments could run educational adverts, encourage apprenticeships to cut unemployment and even impose levies on companies that replace workers with automation, Mr Marini said. “In the past technology was supposed to free people but it now threatens many people’s quality of life,” he added.

New solutions must strike a balance between the need for safety nets and encouraging people to save more. The financial services industry must work to gain greater public trust so that people will embrace new products that could protect them for 40 years, Mr Marini said. Technology makes products more accessible but could also make it harder for brands to build trust by decoupling solutions from providers, he warned. In terms of savings, portable funds, flexible contributions and ‘pension holidays’ could all play a part. “Portable funds would create a bridge between periods of formal and informal work, and between different places, employers or industries,” Mr Marini said.

The private sector is most likely to drive such innovation, according to Paul Ladd, Director of the UN Research Institute for Social Development. “People need security and if they are stuck in nation state systems that will act as a brake on labor mobility,” he said. But emerging economies also have a real opportunity to introduce bold state schemes. “Many large, developing countries don’t have comprehensive systems and could learn from and improve on what the rest of the world has done over the last 50 years,” Mr Ladd said.

Thomas Dominique, former chair of the EU Social Protection Committee, said secondary schools should play a role in increasing financial literacy. “People aren’t always aware of the situation they are in or of the consequences of their decisions on the future,” he said. Workers need to accept a trade-off between public schemes providing more flexibility in areas like parental leave and having to retire later, Mr Dominique added.

Driving change

Social protection will be essential to giving huge numbers of people both income continuity and the chance to remain relevant in tomorrow’s workplace. We should expect an explosion of unconventional products and companies may even allow freelancers or suppliers to opt-in to schemes. “Employers have to be very conscious of how to attract the best talent and ensure those individuals remain committed to the organization,” says Professor Clark. “In this scenario, how do companies adapt their recruitment strategies in order to ensure consistent availability of talent and skillsets?”

People will also need to be more aware of their personal vulnerabilities and more active in protecting against them. But a shift to an innovative whole-of-life approach could also help governments to limit their costs and businesses to enhance their reputations. The transition will not be easy. But the case for collaborative efforts to drive change is abundantly clear.

Key takeaways:

- Traditional social protection models are ill-suited to supporting people whose working lives are being transformed by the Fourth Industrial Revolution

- A new ‘whole-of-life’ approach could offer flexible and portable solutions designed to take account of fragmented careers and volatile earnings

- Individuals will need to be more proactive about social protection but both the private and public sectors stand to benefit from enabling more dynamic systems