Strategic framework

Focusing on the things that matter for our business

Sustainability is about the way we do business

Insurance acts as a societal safety net for us all. We use our expertise as a risk manager to enhance resilience to natural, societal, economic and financial risks. Living up to our purpose, create a brighter future together, will strengthen our core business and have a positive impact on our performance as an underwriter, investor and employer. With changing customer expectations and an increasing demand for social and environmental engagement, sustainability is increasingly becoming a driver for value creation. Our purpose inspires us to leverage our business model to scale positive impact for customers, people and planet and to build partnerships that can drive transformative change.

Materiality: what matters most to us

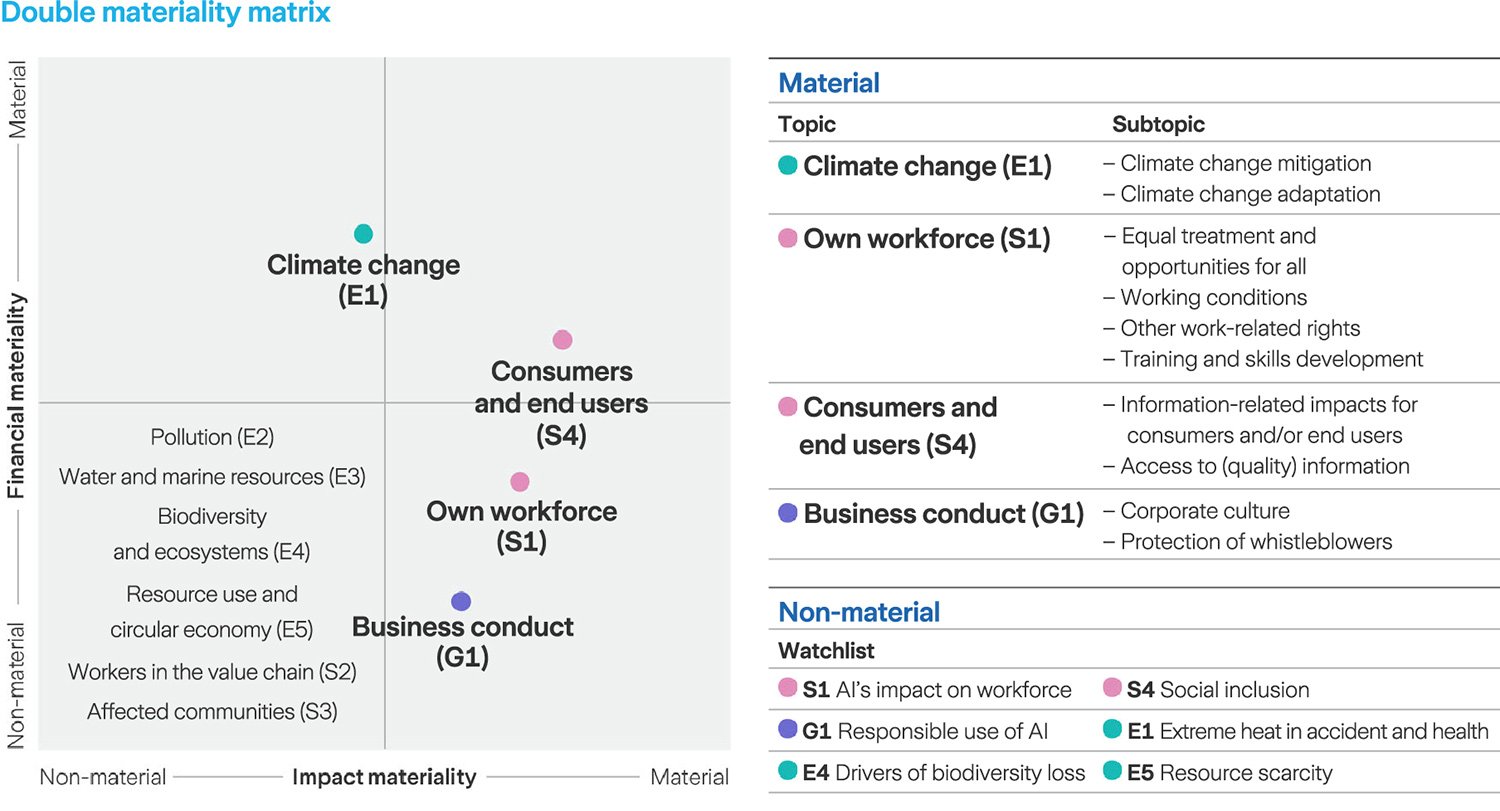

We strive to continually improve our materiality assessment process in order to deepen our understanding of our risks, opportunities and impacts. To do so, we work together with our stakeholders to get a clearer picture of what matters most for us from a sustainability perspective. To deliver robust results, we aligned our approach with the structure provided by the CSRD, which builds upon and strengthens existing EU requirements around non-financial reporting.1 Therefore, in 2024, we conducted our first double materiality assessment (DMA) in line with CSRD, taking both an outside-in and inside-out view of potential material issues.

The 2024 DMA included both quantitative and qualitative analysis including direct engagement with our key stakeholders combined with an extensive round of interviews with a wide range of leading experts from across our diverse businesses and geographies. In particular, we engaged with senior management, employees, investors, customers, brokers, suppliers, industry associations and nongovernmental organizations (NGOs) to understand their points of view on impact and financial materiality across environmental, social and governance dimensions. This DMA helps us identify those sustainability matters that are most material to our stakeholders, while also considering how they influence our company.

We followed a two-step approach for stakeholder engagement:

- Step 1: We engaged through interviews with senior management and through surveys with various employees around the world, using a draft list of the European Sustainability Reporting Standards (ESRS) topics to guide discussions. Post-interview, surveys were issued to capture further thoughts on sustainability in relation to our Group.

- Step 2: We engaged a broader group through topic-level surveys to identify sustainability priorities. The process aimed to gather different perspectives on the materiality of topics identified in earlier steps.

Using these insights, we identified four core material areas spanning 10 material specific subtopics. Additionally, we also developed a watchlist of topics that, while not currently classified as material in the DMA, are deemed significant enough to warrant ongoing observation. This additional list allows us to track developments, gauge potential impacts, and prepare for any necessary action should these topics gain material significance in the years ahead.

1 Our methodology is aligned with the DMA implementation guidance from the European Financial Reporting Advisory Group (EFRAG).

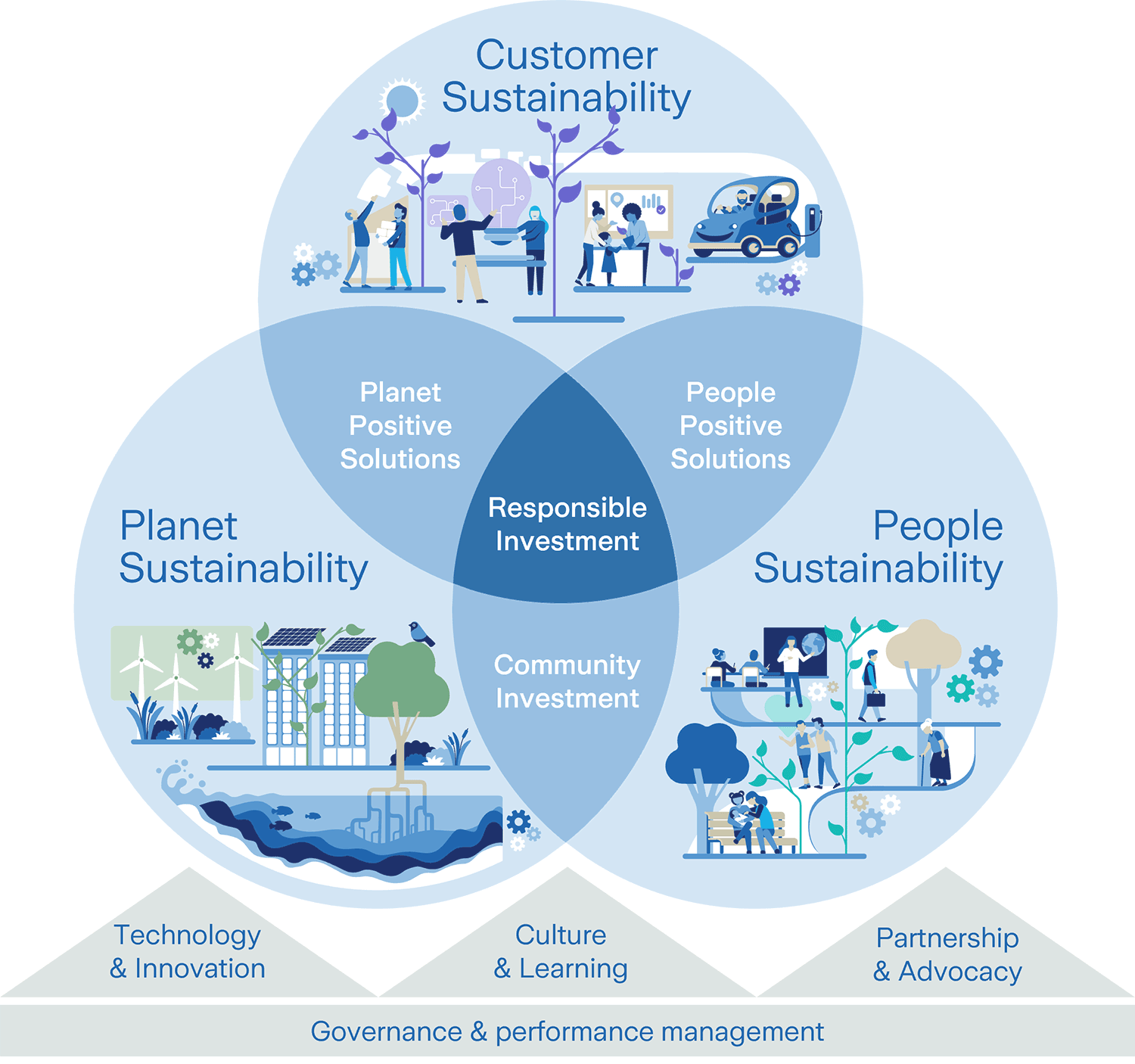

Our Sustainability Framework

We have been working to integrate sustainability across our strategy for many years through our Sustainability Framework, using technology, innovation, learning, partnerships and governance as key enablers of implementation.

In 2024, we continued to execute on our Sustainability Framework and scale impact to bring our sustainability ambitions to life, especially in relation to better supporting our customers and catalyzing our own transition journey through the publication of our first climate transition plan.

As an advocate, adviser and role model, we want to empower individuals and organizations to act today to create a better tomorrow.

Key Group-wide sustainability targets

We have set the following targets for each of our focus areas.

Planet: Mitigate and adapt to climate change

- Net-zero operations by 2030, investments and underwriting by 2050.

- New interim 2030 engagement and emissions targets set for underwriting and investments1.

- 75 percent of managed procurement spend2 with suppliers with net-zero targets by 2030.

1 For more details, see our Sustainability Report on pages 125 to 128.

2 Managed procurement spend (MPS) means the spend of approximately USD 2 billion annually managed centrally by Zurich’s Procurement and Vendor Management function on goods and services that are required to enable Zurich to maintain and develop its operations.

To provide up-to-date and relevant information about our performance, we report against the most respected sustainability reporting standards and participate in a number of ratings and indices, such as CDP, FTSE4Good, EcoVadis CSR Performance Monitoring Platform, MSCI ESG and Sustainalytics.

Signatories

We believe sustainability is too complex and interconnected a topic to be tackled on our own. Therefore, we have become a signatory of a number of global initiatives that help us advance our work in collaboration with industry and global peers.