Could you ship that, please?

CustomersArticleJuly 30, 2020

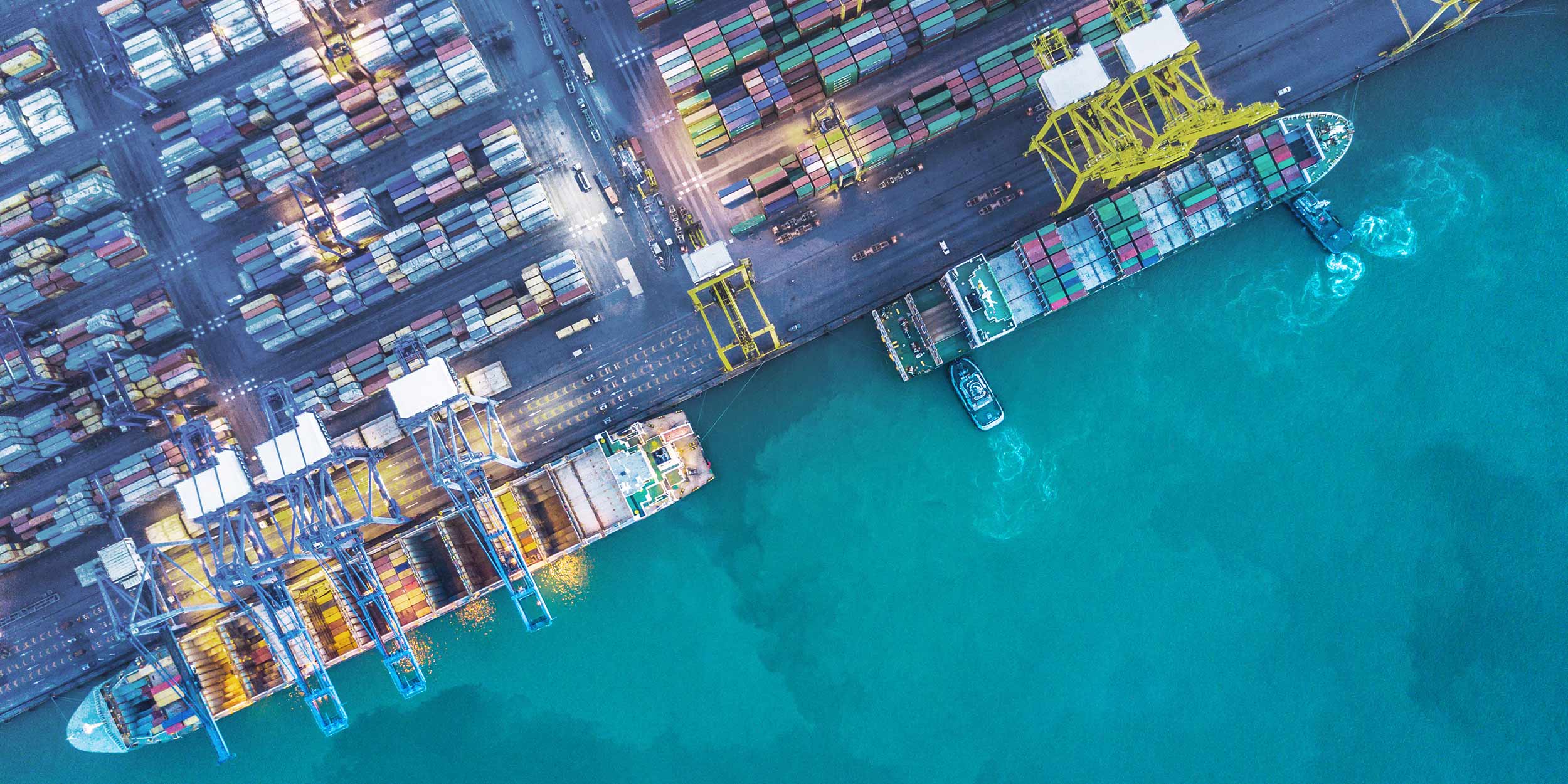

Zurich’s digital expertise in marine insurance is helping customers, including A.P. Moller-Maersk’s, to more easily insure cargo shipments with just a few clicks.

A.P. Moller-Maersk (‘Maersk’), the world’s largest container-shipping company, aims to realize its vision of offering integrated container logistics services. As part of that, to provide a digital insurance solution, Maersk’s developers cooperated with Zurich Insurance Group (‘Zurich’), which had already built an online marine insurance technology product, Swift, for Zurich’s own customers.

Maersk expects its insurance offering, called Maersk Cargo Insurance, to be introduced to more countries in Europe and beyond in due course after initial launch in Spain in March 2020.

Maersk, which operates what it believes is one of the largest B2B websites in the world, is thus starting to offer its customers insurance coverage provided by Zurich on its online platform through a solution co-developed with Zurich.

Collaboration that benefits customers

According to Maersk, global reach was one of the reasons it selected Zurich. “If you want to offer a global insurance product, you need access to a global network,” says Lars Henneberg, Vice President, Head of Risk Management at Maersk. Zurich’s financial strength also played a part. “Zurich is a well-known, reputable carrier with strong financials, which is important for us when we offer this product,” he added.

Beyond that, Zurich demonstrated “willingness to innovate, and go beyond conventional solutions, and to explore innovative solutions together,” Henneberg says.

Providing digital solutions

“The collaboration with Maersk represents digitalization at its best,” says Howard Kingston, Global Head of Marine, Commercial Insurance, at Zurich. “Combined with the development of Zurich’s own Swift platform, it illustrates the steps that Zurich is taking to provide innovative insurance solutions in the marine space,” he adds.

Customers are increasingly looking for digital solutions to make managing freight easier. For example, Maersk Cargo Insurance lets customers buy insurance with just a few clicks as they book their shipment. The cost of insurance is added to their shipping invoice, and cover is door-to-door, starting from point of origin (such as a factory or production site) to the destination. It can extend to ‘connecting conveyances’ (e.g., trucks, rail cars, barges, or in exceptional cases, air freight). Cover includes storage if the cargo has to remain in a port, and transit from the final port to the ultimate destination. Maersk can thus extend its reach to new types of services beyond shipping, while making sure customers have the right insurance in place.

Not only do Maersk’s customers gain access to Zurich’s solutions. Zurich is separately rolling out the Swift platform to allow insurance brokers and other intermediaries – freight forwarders and shipping agents, for example – to use the technology to allow them to manage virtually, where appropriate, aspects of their customers’ cargo insurance needs. Policies can be issued for both single shipments and on an annual basis. The Swift solution enables customers to get quotations, allows the binding of policies (i.e., confirmation) and can issue the needed documentation including policies, as well as the insurance certificates that verify the policy.

Demand growing for digital solutions

Such products are meeting a growing demand for digital solutions across industries. For freight, the need is especially crucial. Transporting goods from point A to B is not always simple. Add to that the complex supply chains that large companies rely on, and risks can quickly escalate.

The Covid-19 crisis also heightened vulnerabilities, according to a recent survey by intelligence gathering services Shipping and Freight Resource and sponsored by Ocean Insights, a provider of data and market intelligence for the logistics industry. The survey found that some 67 percent of shipping and freight professionals plan to invest in technology following Covid-19.

Zurich revisits its roots

Marine insurance is part of Zurich’s heritage. Founded in 1872, Zurich began by providing marine insurance for the Swiss textile industry, which flourished during the nineteenth century, and depended on ships to transport raw materials and finished goods to and from European ports.

Today Zurich continues to look for ways to offer services that match customers’ evolving needs, including new and innovative digital solutions. Through its experience and expertise, Zurich is proud to be helping Maersk to realize its vision of becoming a leading integrator of container logistics.