How to Future-Proof Your Business Against Climate Change-Related Risks

Climate resilienceArticleSeptember 24, 20198 min read

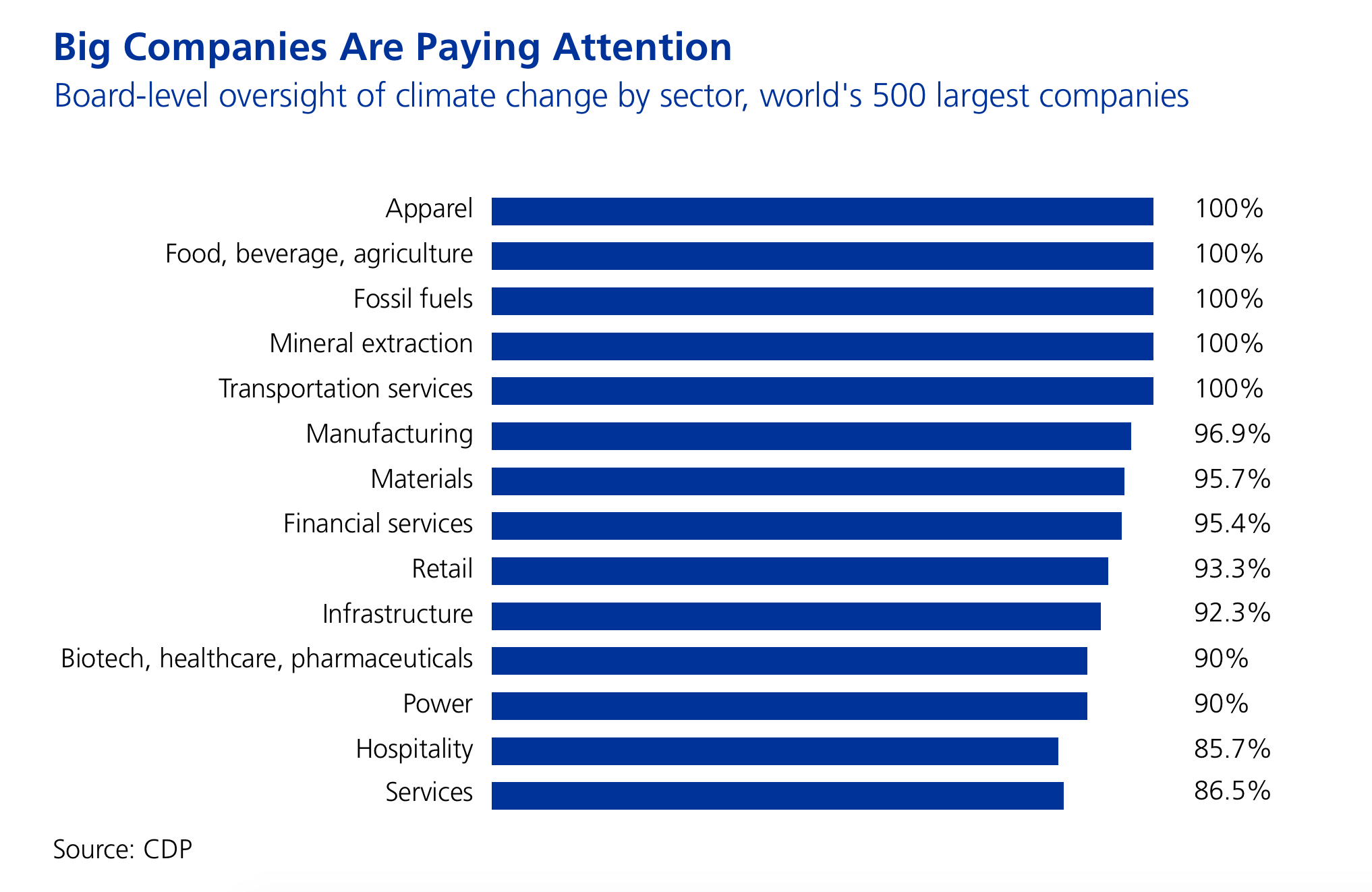

The world's biggest companies recognize the impact of climate change-related risks. Here are 3 steps to future-proof your business.

Business leaders are accustomed to altering course in response to market conditions, and that agility will be crucial in adapting to climate change-related risk while also mitigating the transition costs of repositioning companies.

Climate change-related risk poses an existential threat even to icons of global commerce. Bank of America fears flooded homeowners will default on their mortgages. The Walt Disney Company worries that its theme parks might become too hot for vacationers. Coca-Cola is concerned water supplies will impact its ability to make Coke. And AT&T—stung by natural disasters that cost the company $627 million in 2017—fears extreme weather might incur costly repairs and relocation of its network.

Natural catastrophe losses worldwide totaled $160 billion in 2018, only half of which was insured. Yet a report by the CDP (formerly the Carbon Disclosure Project) indicates that the cost of managing exposure is a fraction of potential losses. For example, the financial industry reported exposure of $677 billion but only an expenditure of $2.2 billion to effectively manage those risks.

The transition risk business leaders face in adapting to climate change is only slightly less unpredictable than the physical risk but no less urgent, according to Managing the Impacts of Climate Change 2019, a new report by Zurich Insurance Group.

“In contrast to the physical risks, the transition risks, which are largely technology and policy-driven, will potentially lead to economic and societal impacts on a much shorter time frame,” the report says.

Executives must develop a long-term sustainability strategy that aligns with three key constituencies who increasingly expect companies to understand, disclose and mitigate climate-change risk: investors, regulators and consumers.

It is a complex and daunting task, one that is best met with a holistic approach built on three key stages.

Stage One: Identify Your Risk

Understand the exposures your company faces, both from the physical risk of extreme weather like floods and hurricanes, and the transition risk involved in reducing your greenhouse gas emissions, changing or even reimagining your business for the future. Consider the impact of technological or regulatory changes, like the potential introduction of carbon pricing or other policies that favor low-carbon technology, like renewable energy or electric vehicles.

“The next decade will be characterized by profound uncertainty around climate change policies, new technology and the behaviors they drive and, as a result, what direction is most likely,” the report says.

Use scenario planning to analyze your risk in the short, medium and long-term and evaluate what the impact could be on your business, strategy and financial planning. To arrive at that insight about your current level of resilience means interrogating various scenarios detailing both physical and transition risks.

Stage Two: Know Your Risk

Obtaining a granular view of your risk means developing models that determine your company’s most critical frailties—a micro view of the macro risks you’ve identified using scenarios. Gathering and using appropriate data to model both physical and transition risks helps, but the nature of those models will depend on a company’s particular circumstances (such as industry, products and services, supply chain, physical location of assets, business model maturity and risk appetite).

With physical risk, is there a location with a high concentration of asset value or multiple locations that could be impacted by one event? Are there facilities reliant on workers living in highly-exposed neighborhoods? Or factories dependent on vulnerable public infrastructure and utilities?

Sophisticated natural catastrophe models have been developed in the insurance industry that can assess the impact of physical risk on many regions and industries, but current models are generally designed to reflect current climate conditions. It’s important for businesses to incorporate the latest climate and natural catastrophe modeling capabilities to better understand the impact of climate change on physical risks.

With transition risk, regulatory or technology pathways of de-carbonization need to be built into models that analyze the impact on products and services, or even entire businesses. The challenge is that in some sectors the pathways of change are well understood but in others they are not, but it is crucial for businesses to begin the analysis of transition risks and opportunities, or they risk losing critical competitive advantage in a rapidly decarbonizing world.

A forensic examination of climate-related risk shouldn’t end at the perimeter of your organization, but instead drill into the shortcomings among vital vendors in your supply chain, highlighting the potential impact of both physical and transition risks.

Stage Three: Mitigate Risk, Find Opportunities

The insight gained in rigorous scenario planning should inform follow-up actions. For example, conducting on-site assessments at exposed locations on the effectiveness and reliability of emergency response and business-continuity plans. This information helps set a medium- to long-term resilience strategy, shapes investment priorities, and frames budget priorities for capital expenditure projects and added resilience measures.

The endgame in resilience strategy planning is deceptively simple: to separate what your business can control from what it can’t. Doing so will require developing a meaningful greenhouse gas emissions reduction strategy, one that could entail innovations in products and services, perhaps involving significant business transformation.

"It can be extremely useful to put up measurable targets and goals precisely because it makes you move."

Charlotta Groth,Global Macroeconomist, Zurich Insurance Group

There is an increasing realization that insurance alone is not a sound risk management strategy for physical events related to climate change, and that maximum resilience entails a range of measures—physical, organizational and involving financial risk transfer. Business leaders must clearly define governance to empower a chain of command that assumes oversight not just of risks but also the opportunities presented by climate change, such as an increased consumer appetite for low-carbon products and services.

“That's the challenging bit: thinking it through for your own company, then coming up with not just a strategy but the actions here and now to achieve these goals,” says John Scott, Head of Sustainability Risk at Zurich. “If you put that together in an overarching purpose statement, then your consumers and your employees will really get what you're trying to deliver.”

Setting goals and metrics for your company is an effective tactic for focusing your employees on climate-change risks, which can be complex to navigate without an organizing principle.

“It's great that so much data is available, but it makes it very difficult if you don't happen to be a climate change specialist,” says Charlotta Groth, Global Macroeconomist with Zurich Insurance Group. “Anything that can simplify extremely complex issues without making it too one-dimensional is helpful. It can be extremely useful to put up measurable targets and goals precisely because it makes you move.”

How Zurich Works With Businesses

Konecranes, a Helsinki-based manufacturer of cranes, engaged Zurich to assess its exposure to climate risk and to minimize its environmental footprint in the 50 countries where its 16,000 employees operate.

“Zurich has helped us better understand our natural hazard and climate-change-related risks on a local level,” says Nathalie Cle´ment, Konecranes' Director of Corporate Responsibility. “Their reports are also part of the material used to build scenarios that show how climate change could affect our business going forward.”

Zurich’s assessment included playing out 100-year flood and wind scenarios at the firm’s Jingjiang location in China’s Yangtze River watershed to determine the potential business impact and help set mitigation strategies.

"Zurich has helped us better understand our natural hazard and climate-change-related risks on a local level.”

Nathalie Cle´ment, Director of Corporate Responsibility, Konecranes

Amar Rahman, Zurich Risk Engineering's Global Practice Leader for Natural Hazard Resilience, spearheaded the exposure analysis for Konecranes.

“Not a day passes without the mention of climate change in global media outlets," Rahman says. "So it’s very rewarding to support a customer who is aware of the urgency of the problem and to actively work with them to develop viable solutions."

Successfully charting the path to sustainability—balancing long-term adaption with short-term transition—means executives need to carefully consider their attitude to exposure.

“Business leaders must recognize what needs to change strategically over time and what needs to happen now,” Scott says. “You can't just have it as some esoteric academic exercise rooted 10 or 20 years in the future. What does it mean for the actions you take today?”

Scott concedes that climate risk is a complex challenge for business leaders, but insists that just hoping for the best is not a winning strategy when competitors are taking action to ensure their sustainability.

“In many industries there will be winners and losers,” he says. "There always have been, but this issue will create even more pressure on companies to deal with transition. Setting yourself goals and targets that are aligned to broader climate goals of reducing global warming is a great way to future-proof your company’s growth.”