Classic car got a dent? Wine cellar flooded? We’ve got you covered

CustomersArticleAugust 3, 2018

Being well off is no guarantee against disaster. Fortunately, Zurich is there to offer discreet assistance, aiming to ensure you can focus on the really important things in life.

It’s an average morning: A customer has just been involved in a multi-car pileup. He relies on Zurich to insure the ‘family fleet’ of several vehicles. There are reports to file from witnesses, police, brokers and others – and, of course, a top priority – ensuring the customer’s wellbeing. A frantic broker calls a bit later: there’s been a fire on a customer’s multi-million pound property, a case requiring immediate, urgent action. And then a claim for lost piece of major jewellery – and, weirdly – another claim for damage caused by a helicopter hovering over someone’s private home.

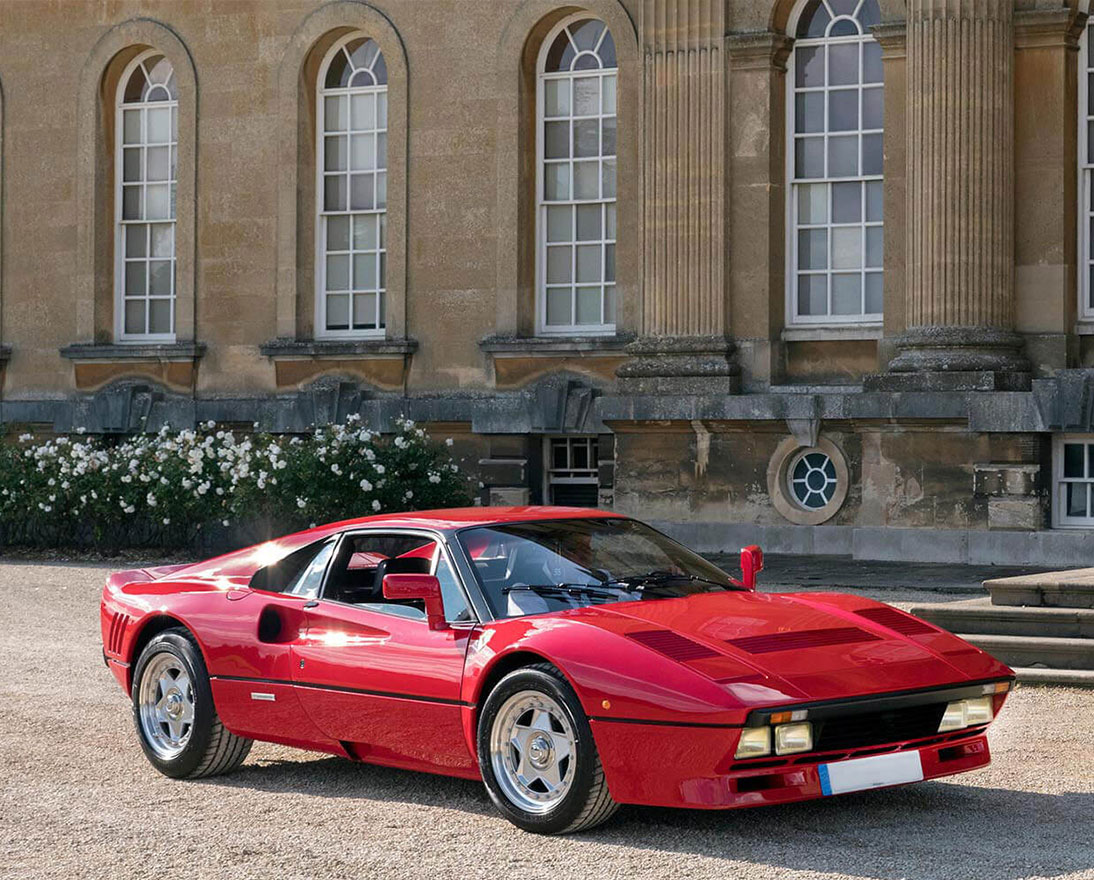

Welcome to the world of high net worth (HNW) insurance. “There are no typical days,” says Chris Aherne, Claims Manager at Zurich Private Clients, who is responsible for a team of six specialist claims handlers. The HNW customers Chris and his team look after may rely on Zurich to insure several homes, classic cars, art collections, wine, boats, and jewellery. And, in the case of one client, a very famous and expensive piece of furniture from a well-known movie that just happened to get wet. “Zurich could arrange for a full restoration, bringing in a HNW specialist restorer – the customer was very happy with the results,” according to Aherne.

Service, service, service

“HNW customers expect the highest possible standard of service. They also require expert advice. Not only is the market for such customers growing, which makes it attractive, but such customers tend to be exceptionally loyal to their insurer,” says Paul Glasper, Zurich’s Head of Specialist Retail in the UK.

To provide the best opportunities to customers, in June 2018 Zurich acquired Oak Underwriting plc from RSA Insurance. The deal adds significantly to Zurich’s existing HNW business, putting it among the top three UK HNW providers of property and liability insurance in the UK.

Sailing with pets

Navigators & General, a Zurich-owned business that is one of the UK’s leading boat and yacht insurance companies, is also available to support clients on the water. Founded in 1921, with over 40,000 clients, beyond boats, Navigators & General also offers policies for seafaring pets. “There is a lot of safety gear for pets on the water, but my main suggestion would be for owners to spend time relaxing on board before sailing so their pets can get used to the boat,” says Bart Pavelin, claims manager at Navigators & General. When not working, Pavelin and the rest of the Navigators & General claims team are often on the water themselves, sailing, boating or surfing.

Highly personalized approach

As a global, financially solid company with nearly 150 years’ experience, Zurich can be an attractive insurer for HNW customers. Its services go well beyond paying claims. It provides a highly personalized approach to dealing with life’s little – and bigger – mishaps. For example, handing a claim after an antique British car’s finish was marred by acid rain. Or, in another case, helping the client whose property was the worse for wear after that helicopter hovered overhead for an extended period, ostensibly to check out sunbathers.

Zurich Private Clients also maintains close relationships to a number of top brokers, who often deal directly with these clients. Besides brokers, Zurich brings in leading experts in their respective fields. For example, when valuing art and jewellery and other valuables, it may work with Bonhams, the international auction house founded in 1793, or British jewellers Mappin & Webb, which holds a Royal Warrant as silversmiths, goldsmiths and jewellers to Her Majesty the Queen.

Providing choices

Quick thinking is part of the insurer’s job, and probably in the HNW business, nearly as important as the level of coverage. You’ve heard of a courtesy car? What about a courtesy chandelier? That was what Zurich provided when a prestigious light fixture came crashing to the floor right before a big party at one HNW customer’s home. It was able to quickly arrange for a ‘loaner’ of equal grandeur. The party went off as planned. “We also noted the ceiling was old and worn. We flagged that to the customer, too,” according to Aherne.

Besides knowledge, empathy and intuition play a major role in helping these clients to protect their valued possessions. For example, thinking to ask one customer what she was doing right before she lost her very expensive diamond engagement ring. Answer? “Gardening.” That was the ‘aha’ moment for the Zurich claims manager, who promptly called in a team with metal detectors. The ring was found, much to the customer’s joy. “We would have paid the claim on day one, but the customer really just wanted her ring back,” according to Aherne.

We’ve all had taken our eye off the ball for a couple seconds. Those moments of inattention can happen to anyone, including someone wearing major jewellery. One customer lost an important earring down a plumbing fixture. And there was another who went for a swim in the surf with earrings valued at something akin to a smallish luxury car. Claim filed: one lost earring. Zurich offered either a cash settlement or to create a new, matching one. The customer took the replacement. “For HNWs, it is all about choice,” says Aherne.

Risks lurking below ground

And clients who choose to do home improvements, especially basement excavations, need to plan for sufficient protection against water seepage. ‘Tanking’ (applying waterproof material to walls, floor and possibly the ceiling) is one approach. But in some older properties, cellars are actually designed to ‘breathe,’ according to Louisa Knight, a risk engineering specialist for Zurich Private Clients. She strongly recommends that customers planning a wine cellar consult first with a specialist. Also (horrors!), a flooded cellar could threaten contamination, including from sewage. Nearly as terrifying, excessive water could cause labels to come off bottles of treasured vintages. “This, of course, would have a massive effect on the value,” Knight says.

In any case, if something happens, we’re there to help. And, very likely, whatever it is, we’re unlikely to be surprised. After all, we’ve probably dealt with something similar before.