Volatile markets reveal hidden economic risks in an interconnected world

Global risksArticleJanuary 17, 2018

The strength of the global recovery will face a crucial test in 2018.

The rosy picture of global stock markets at all-time highs, along with broad-based GDP growth, didn't make it through February as the return of volatility rocked financial centers around the world and wiped out almost $5 trillion from stock markets in a single week.

In the Global Risks Report (GRR) 2018, released at the World Economic Forum in Davos, Switzerland, in January, economic risks are perceived to have receded significantly, but the recent downdraft is a reminder that business leaders and policy makers should never develop a blind spot around economic risks.

As the world finally emerged from the Great Recession of 10 years ago, economic optimism was like a high tide that covered up some significant risks beneath the surface, according to Guy Miller, Chief Market Strategist and Head of Macroeconomics at Zurich Insurance Group. The recent market turmoil uncovered some of these risks, but tempered optimism in the global economy remains welcome and necessary, Miller says.

"We've needed the animal spirits to come through to allow business investment to pick up, and improve productivity." Miller says. ”However, balance is needed between having that sentiment rising, while not being complacent in addressing the issues that remain, in particular high levels of debt."

Understanding the potential connections between one event and another is key to driving growth, along with broad, holistic management of risk. For example, Miller says, the Federal Reserve’s intent to raise interest rates multiple times in 2018 may not have a major impact until a tipping point is reached. The Fed has already raised rates five times since December 2015, and the economy has continued to grow steadily, but the situation reminds Miller of test-driving a sports car.

“As you lift your foot up on the clutch of the car, at some point it will move—but you don’t know exactly when, or how fast it will be propelled, and if it can be controlled when that process starts,” Miller says. "Yes, the Federal Reserve increased rates five times, and nothing appears to have happened—the economy is growing above trend, unemployment is falling and confidence remains high—but there's a danger that the lagged effect of higher rates results in too much tightening as has often been the case in the past."

We've needed the animal spirits to come through to allow business investment to pick up and productivity to be improved.

The key to why these interest-rate rises may trigger unwelcome events is the context in which these rises are planned. The global recovery has taken hold in different places at different points in time, and to different degrees. The U.S. has led the way, while some nations, such Brazil and Russia, have only just entered into a recovery and growth phase. But a common theme is that in most regions both private and public debt levels are extremely high.

A prolonged period of low interest rates has led to some complacency, according to the GRR. Businesses have taken advantage of cheap debt, while consumer and mortgage debt is still very high. There were 162 major corporate defaults in 2016, the highest number since 2009, according to S&P Global, and the debt-to-equity ratio of the median S&P 1500 company (excluding financials) has doubled since 2010.

China, whose growth played a big part in helping to alleviate post-financial crisis economic strains, is now a potential flashpoint. The International Monetary Fund (IMF) recently found that China's corporate debt has reached 165 percent of its GDP, some 25 percent above its long-term trend, and distressed-debt funds are now taking on some of its bad loans.

For Miller, high corporate debt levels, particularly emerging-market corporate debt, is a serious economic risk as the Federal Reserve and other central banks increase interest rates.

"What I think people are overlooking is that corporate leverage is unusually high for the current stage of the cycle and interest coverage is low." Miller says. “At some point, interest rates will move up, and the danger is that all this leverage that's been built will result in a business environment very sensitive to higher rates, and ultimately that could be an undoing.”

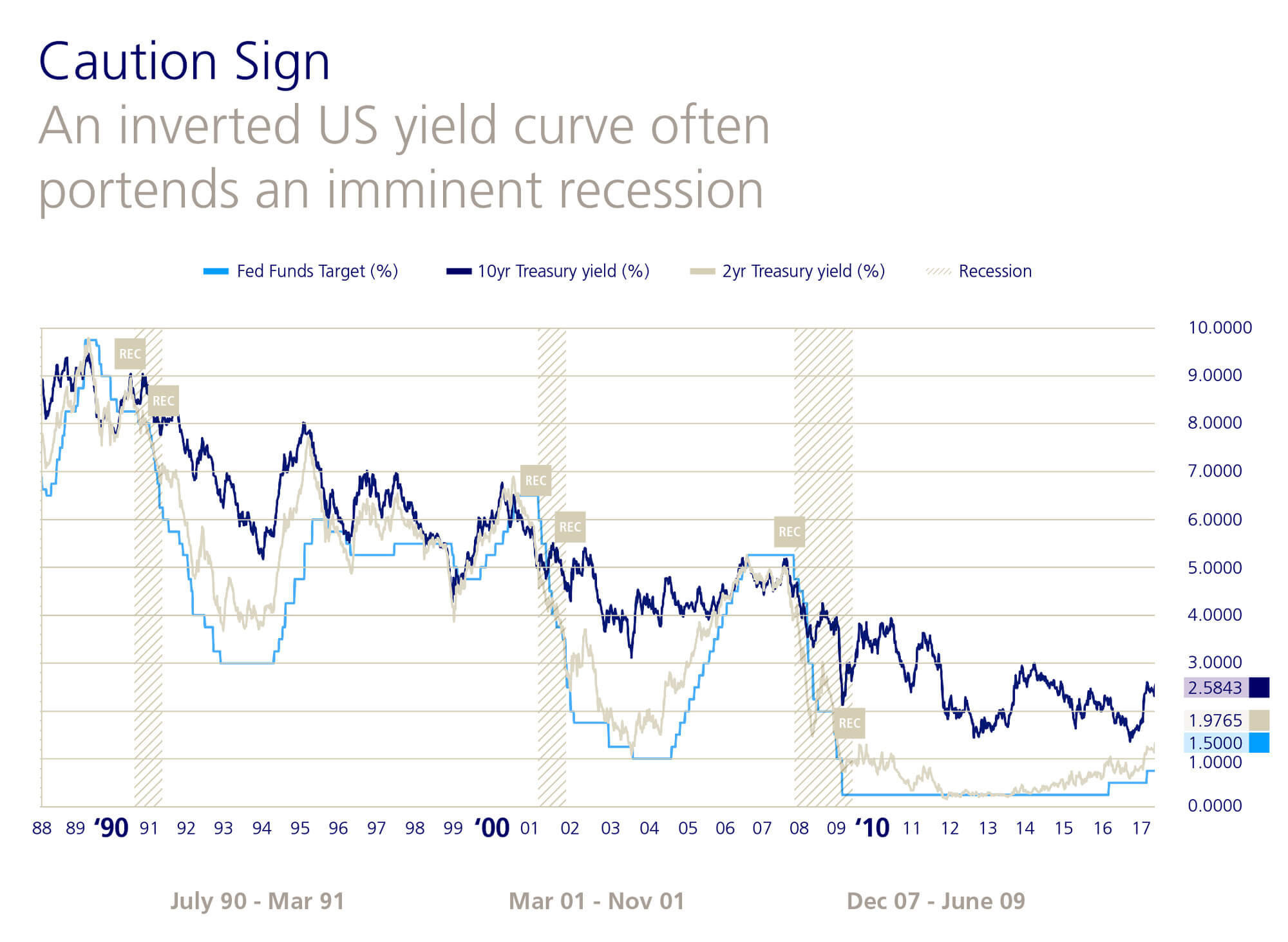

US Federal Reserve rate hikes increase the cost of borrowing short-term debt, flattening the Treasury yield curve. This chart shows the Treasury yield curve between 2-year Treasuries and 10-year Treasuries. Historically, when the curve inverts, this is often a good signal that recession will follow.

Chart source: Bloomberg

The IMF’s index of global home prices is close to its pre-crisis peak, with London now seeing an average homebuyer’s 20 percent deposit of £80,000, from £50,000 a decade ago, according to the Nationwide House Price Index, while a chronic cycle of low productivity and stagnant wages worldwide has restricted consumer spending.

“When you look at wage growth globally, even in the United States, by historical measure it’s still very low, despite the dramatic fall in unemployment" says Miller. "It's almost as if employees have forgotten how to ask for wage rises."

The CEO must see the big picture, the global environment, and understand the interconnected risks impacting their firm,

their competitors and, of course, their clients.

So what advice should businesses take from the GRR 2018? Miller says that business leaders need to see the continued strength of the global economy as an opportunity to build resilience, by bolstering their balance sheets, investing in new technology and equipment, and increasing workforce training. The knock-on effect of improved productivity and workplace flexibility can lead to potentially larger profits and bigger wage increases.

No one knows what will cause the next downturn, just that it will come eventually. The Stark family motto on the TV series Game of Thrones is "Winter Is Coming." Business leaders should follow that sound advice, even in the best of economic times.

“It's imperative that companies bolster their financial resilience and make sure they've got a labor market that is flexible and dynamic enough to adapt to change,” Miller says.

While businesses will look at the chief financial officer, chief risk officer and chief human resources officer to raise and coordinate on these issues, Miller says a successful approach needs to come from the CEO and flow down across the entire board and senior management.

“The CEO must see the big picture, the global environment, and understand the interconnected risks impacting their firm, their competitors and, of course, their clients,” says Miller.

Businesses that survive shocks are those that manage their capital and liquidity requirements and have an engaged and motivated workforce. They also integrate risk management into their strategic planning. Appreciating the broad interconnectedness of the environment in which your business operates is essential to reaching your full potential.

Key takeaways:

- It is vital to understand the trends, imbalances, potential triggers and possible consequences in an interconnected world. Have you considered your exposure to economic risks emerging from a rise in interest rates and next cyclical downturn?

- Despite global growth and robust sentiment, high levels of public and private debt, low productivity and highly correlated financial markets mean that businesses must be more proactive in understanding how a much broader range of factors can impact business performance.

- Take advantage of the good times to mitigate risk by making your business resilient. Structure your finances so you have robust capital management—whether to enable investment or to protect against the likely increase in the cost of debt.

- Your people are key to your future. Train them to be flexible and more productive, and consider your policies to keep the best people engaged and motivated.

- Risk management starts at the top. The CEO must form a holistic view of risk, and then support a culture where risk management is integrated with strategy.

1 The Global Risks Report is an annual study published by the World Economic Forum in collaboration with leading institutions such as Zurich Insurance Group.