Zurich Connector API Solution

Let’s connect by going fully digital to integrate all your risk and insurance information seamlessly into your risk management system. Find out more about the usage of API technology in the commercial insurance space.

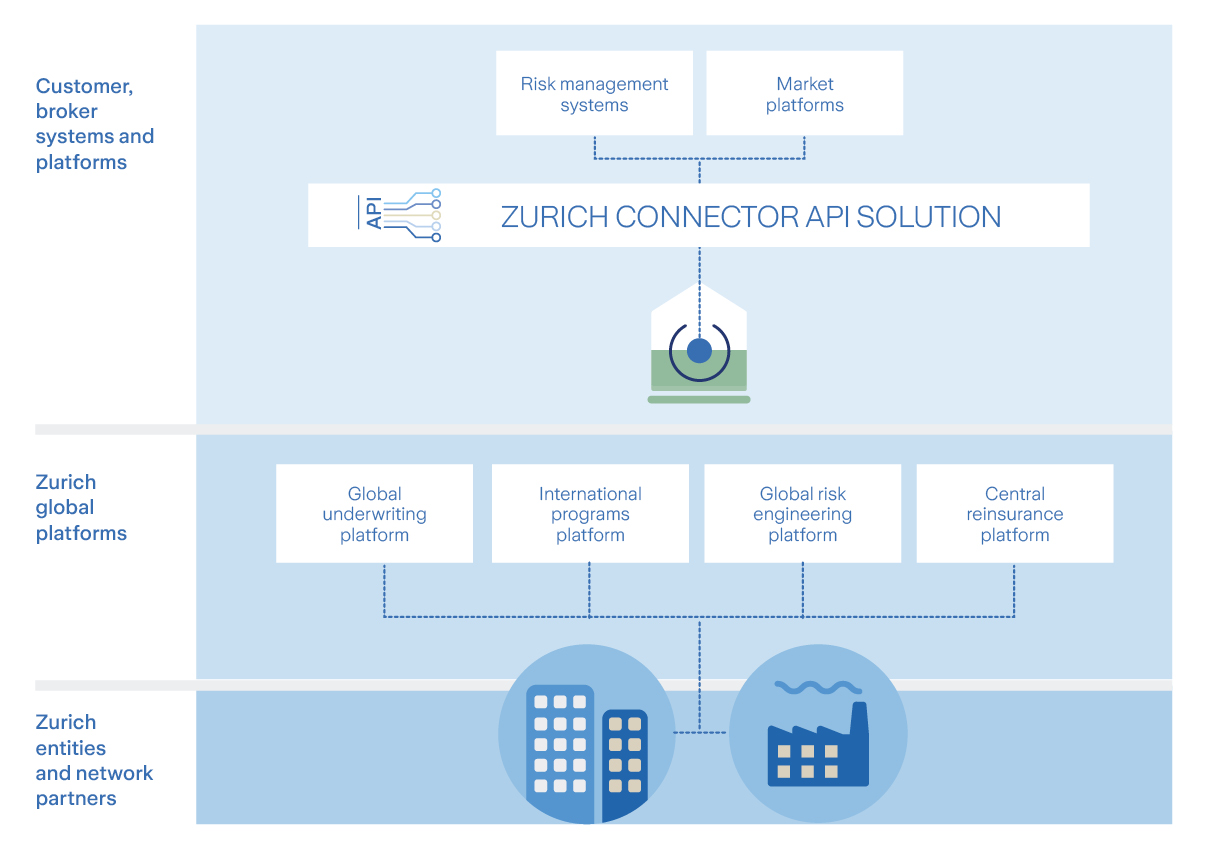

An integrated, digitized approach can give you the transparency and control you need to handle your risk management and insurance data effectively and efficiently. My Zurich allows you to gain valuable risk insights, but you can make managing risk even more seamless by directly connecting your risk management system with our global platforms using Zurich Connector API Solution.

Let’s connect and make managing international programs seamless, sustainable and smart by sharing data with guaranteed security. And it frees up your teams to focus on other, more worthwhile tasks. We can help you connect, working closely with you to develop a bespoke solution.

Connecting your risk management information system (RMIS) with our global platforms using the Zurich Connector API Solution

The benefits of Zurich Connector API Solution

What data is available?

Policy administration

Life and non-life data

- Program

- Policies

- Premium payments

- Policy documents

- Property location exposure*

* supports also bidirectional exchange

Claims

Life and non-life data

- Claims

- Claim bookings

- Claim reserves

- Claim documents

Risk engineering

Non-life data

- Location

- Loss scenarios

- Risk improvement actions*

- Visit schedules

- Risk engineering documents

* supports also bidirectional exchange

Captive

Non-life data

- Captive premium

- Captive claims

- Captive documents

With API, almost all risk engineering data points are integrated into our risk management information system. I am now able to click a button and easily run a report with our most up-to-date risk engineering visits. We also track our claims within our RMIS, so we are able to easily cross reference risk engineering visits and improvement actions to claims activities.

My wish for collaborating with insurance carriers in future must include technically an automated data exchange… An API to the insurance data… would lead to efficiency gains and cost savings. Error prone manual data transfers or misinterpretations would be minimized.

In the past we have spent numerous hours gathering, sending and sorting data. With API we no longer need to clean the data. Instead, it automatically feeds into our risk management system in real time. We can then, without a time-consuming exercise, share accurate data with various stakeholders.

Putting you in control of your risk

When you care about your business, you need to be at the very center of efforts to protect it. My Zurich Portal allows you to quickly monitor and act on your risk and insurance management information, in all countries across all of your locations, in real time. Even out of office hours. Our digital solution puts you in control of your risk

Podcast

Listen to our podcast on the usage of API technology in the commercial insurance space